Fortescue delivers again – hard to watch! (FMG, SFR, JHG, GMA)

WHAT MATTERED TODAY

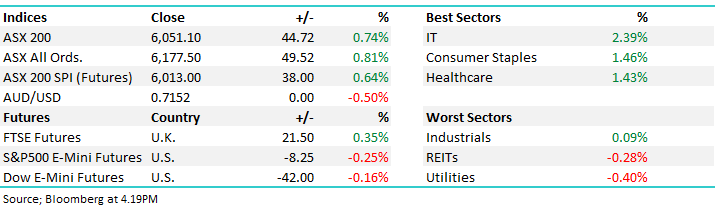

As one trader said to me today, what does it take for this market to fall? 723 new cases in Victoria not the answer as the ASX continues to climb the wall of worry on the back of strong updates from material stocks today – Fortescue Metals (FMG) the standout coming on the back of a decent report from RIO overnight. We also cover Sandfire (SFR) below along with a few other names that reported in one way or another today.

The IT stocks regained top spot today along with Staples and Healthcare, the typical COVID-19 roadmap that we saw during more widespread lockdowns, while the travel stocks and shopping centres lagged. Unibail-Rodamco-Westfield (URW) out with results today and while we don’t cover below, a few charts in the presentation pack on shopping centre foot traffic, rent collection and the like were very interesting – we’ll look more into this at some point.

Overall, the ASX 200 added +44pts / +0.74% to close at 6051. Dow Futures are trading down -42pts / -0.16%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

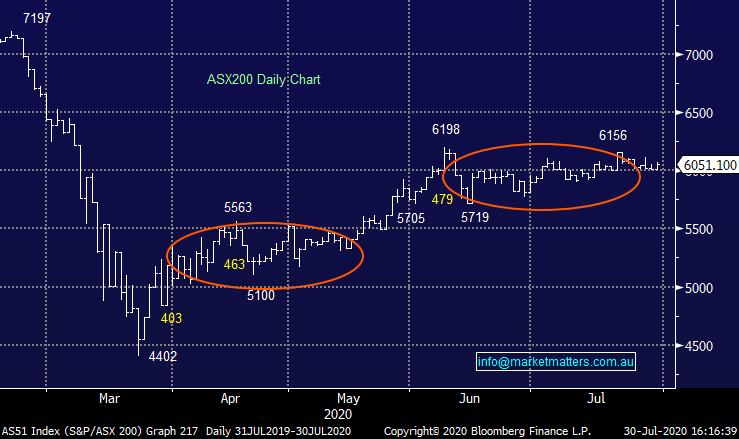

Fortescue Metals (FMG) +4.15%: Quarterly plus full year production numbers out today and they were strong across the board. They shipped 178.2Mt vs guidance 175-177Mt while they guided to FY21 shipments of 175-180Mt which is strong. Costs were well behaved with C1 costs a $12.94/wmt vs year-ago $13.11/wmt, inclusive of COVID-19 related costs of approximately $0.22/wmt. At at June 30, they have cash on hand of $4.9b and with the run rates and cost based, along with their outlook for spending in FY21 (total of $3-3.4bn of capex) the backdrop looks good for their upcoming full year results on the 24th August.

Fortescue Metals (FMG) Chart

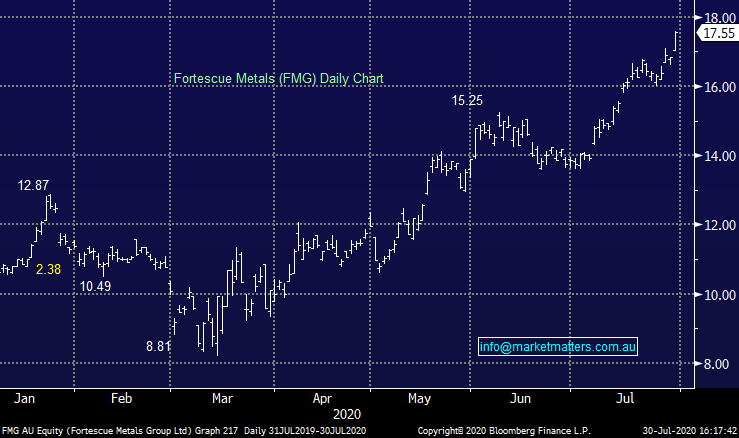

Sandfire (SFR) -5.76%: Q4 update today that looked good on first read through but like Independence Group yesterday, SFR fell short on guidance. The miner produced 72kt of copper and 42koz of gold in FY20, with June being the biggest quarter for both commodities. Despite the strong finish to the year, the company expects production of both metals to fall in FY21. Lower production = higher costs, clearly a negative when SFR has a short mine life in their DeGrussa operation. Focus for SFR is their ability to develop other projects in the next few years to fill the void. While we are bullish gold over the medium term, we are more neutral copper. We prefer & own OZL for Copper exposure, though have taken some profit off the table this week. In gold we like NCM.

Sandfire (SFR) Chart

Janus Henderson (JHG) -2.98%: Out with quarterly update overnight that had a weak underbelly. The actual earnings were strong mainly for reasons that are unlikely to be repeated, the main issue for JHG, and it’s the reason why the stock is cheap (9x) is the continuance of outflows, ~$8bn versus ~3$bn expected. We hold the stock in the international portfolio. One we may cut.

Janus Henderson (JHG) Chart

Genworth (GMA) -6.78%: The mortgage insurer was out with 1H20 results today and while the stock is cheap, it’s there for a reason which todays update highlighted. We have held GMA in the past for income and done well out of it however the story for GMA is all about dividends and excess capital. Today they suspended their dividend and said it was product to conserve capital, a real negative for the investment thesis on this stock.

Genworth (GMA) Chart

BROKER MOVES:

· Rio Tinto Cut to Hold at Morgans Financial Limited; PT A$107

· Paradigm Biopharma Cut to Reduce at Morgans Financial Limited

· Domino's Pizza Enterprises Cut to Sell at UBS; PT A$64

· Downer EDI Raised to Buy at Goldman; PT A$5.10

· IGO Cut to Neutral at JPMorgan; PT A$5.45

· St Barbara Cut to Neutral at JPMorgan; PT A$3.60

· IGO Cut to Hold at Shaw and Partners; PT A$6

OUR CALLS

No changes today

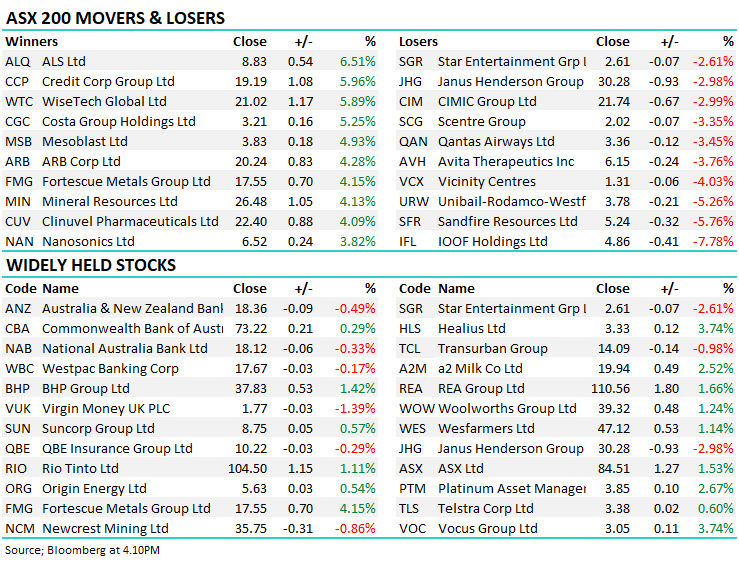

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.