Banks take ASX to 12 weeks low (HVN, DXS)

WHAT MATTERED TODAY

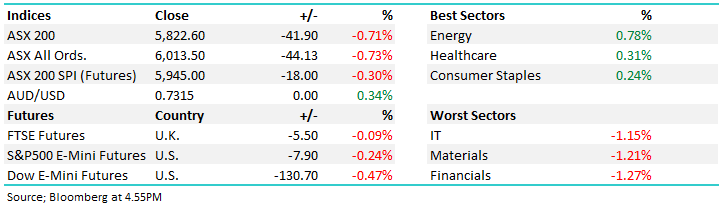

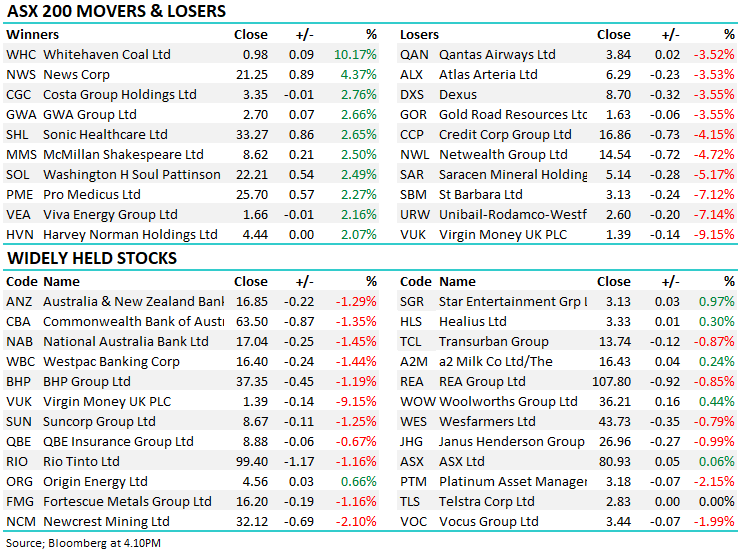

The local market struggled today with sustained selling seen in market heavy weights of the banks and materials weighing on the index. CBA & ANZ fell to their lowest levels in more than 3 months taking the ASX to its lowest point since the turn of the Financial year. Virgin Money (VUK) was the worst performer with the investors increasingly concerned around earnings for the UK bank as the country looks destined for a second lockdown. Property fell more than 1% with Morgan Stanley raising concerns about Dexus earnings and Macquarie painting Unibail-Rodamco-Westfield’s (URW) recent raise in a negative light. On the flipside, energy was the standout sector today though bouncing off a low base here. Whitehaven (WHC) caught a bid too with thermal coal rallying towards breakeven for the coal miner.

By the close, the ASX 200 was down -41pts / -0.71% to 5894. Dow Futures are trading down -130pts/-0.47%

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

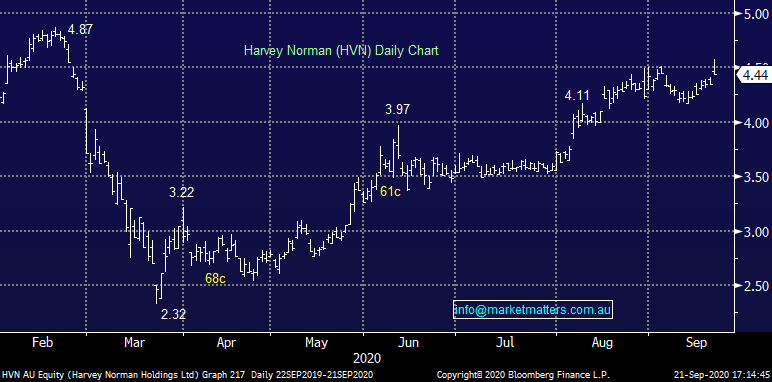

Harvey Norman (HVN) +2.07%: Consumer names were higher today, though Harvey Norman paced the pack on continued growth in sales numbers. For the period 1 July to 17 September comparable sales were up over 30% across the network, with the bulk of the work done by a 34.5% lift in Australian stores. While there was little commentary, they did note profit before tax had increased 185.8% on an unaudited basis for the period to 31 August. Clearly the work, and entertainment from home spend has continued into the new year and HVN has benefitted, though continues to lag JB Hi-Fi (JBH) which is currently trading above pre-COVID levels.

Harvey Norman (HVN) Chart

BROKER MOVES

Morgan Stanley dropped Dexus (DXS) to a hold today with concerns around the return to work plan of many of the property manager’s larger clientele. Workplaces continue to grapple with the return to the office plan, and while Dexus has been a leader in terms of getting works back into the office, plenty of their renters are showing less certainty. Clients are requesting shorter leases and while a robust industrial portfolio will soften the potential blow, it can’t offset falling occupancy in office. The recommendation has been pulled back to a hold with the uncertainty to play out over the next 6-12 months.

Dexus (DXS) Chart

· Virgin Money UK GDRs Cut to Hold at Bell Potter; PT A$1.80

· Costa Rated New Buy at Bell Potter; PT A$4.05

· Dexus Cut to Underweight at Morgan Stanley; PT A$8.15

· CSR Cut to Sell at Morningstar

OUR CALLS

No change to the portfolios today.

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.