Morning Report Monday 26 May 2014

I remain confident a decent pullback is coming for a buying opportunity but whose listening?

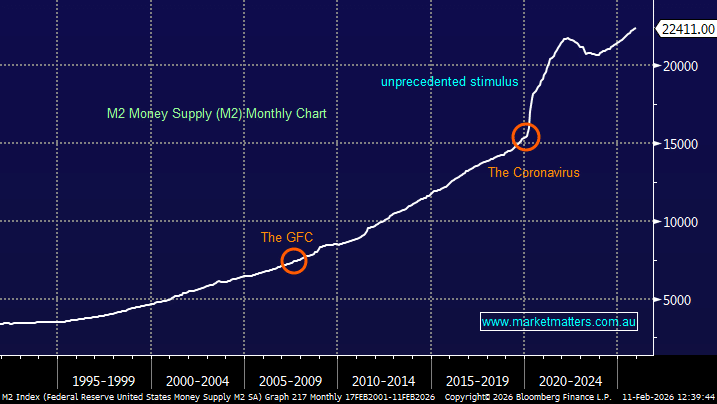

The S&P 500 closed at an all-time on Friday as traders would have squared up ahead of tonight’s Memorial Day holiday (markets are closed tonight). Unfortunately, I feel recent reports at times have been repetitive but tops are hard to predict and patience is required. I remain committed to holding a decent / large percentage of my investable funds in cash. Chart 1 below illustrates perfectly how complacent equity markets have become due in part to the “free money” being pumped into the system by world Central Banks attempting to stimulate growth. The volatility Index (fear gauge), the blue line, is now falling below GFC levels. After rallying 77% from October 2011 an 8-10% pullback will hardly register on the S&P500 chart (red below in chart 1) but it will almost definitely provide far better entry levels to stocks in the Australian market. Below are 5 stocks that I am watching carefully for different reasons into any decent weakness:

Show more...