Market Matters Morning Report 15th August 2016

Subscribers questions at an interesting time for markets

Stocks have become tricky over recent weeks and local reporting season has dominated intra-week swings of individual companies. Hence as we often say it's critical that subscribers understand both our views and reasoning for the path ahead. We are enjoying the feedback around our Monday mornings "Q & A" report format and urge all readers to keep the questions coming. Today questions were very interesting and hopefully the answers provided were both insightful and interesting to all.

Question 1: "Hi , just wondered if you had any view on Aristocrat (ALL) I'm up over 100% and thought that with Aus $ on the up whether or not I should take some profit ?" - Ian

Answer: Firstly a great pick Ian, the stock has soared this year with the Sydney-based gaming machine manufacturer rallying over 50% in just a few months. The company upgraded its earnings forecast back in May and the share price has not looked back since. They are enjoying the beautiful combination of increasing market share while growing margins - a rare combination. The recent growth was largely driven by the Lightning Link and Players Choice family of games which have been extremely popular – and will provide a good foundation for second half earnings. In addition to this, they have a very strong pipeline of new games that are being rolled out over the next few months while they’re also in the process of rolling out a subscription based model.

Obviously, ALL has a large amount of this excellent news built into its price but it should be remembered we are in a market where quality growth is hard to find - current P/E of 36X – however forward PE varies based on earnings expectations from different analysts – however, drops to mid 20’s.

The stock looks ready for some consolidation around the $16 area, our thoughts would be to take profit on 50% of your holding and run ½. Please note Ian, this does not take into account your personal circumstances and should be considered general advice only.

Aristocrat Leisure (ALL) Monthly Chart

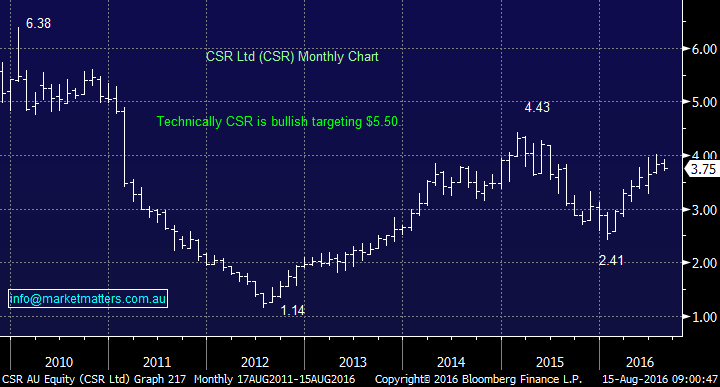

Question 2: "Good Morning, I followed your recommendation and purchased a few CSRbut since that time I have not seen any updates from Market Matters on CSR. You said at the time it was a "stand out chart". Is that still the case? Is it tracking as you expected?" - Regards, John

Answer: Morning John, we have to say CSR has been a little frustrating over the last few weeks failing to break over the $4 resistance area while some other stocks rallied strongly. We would have thought that CSR – which is trading at a steep discount to peers (11 times v the sector on 16 times) may have been more keenly watched. That said, they do operate on a March year end so don’t report now. Half year numbers are not released until the 2nd November.

We are happy to hold for now but would stress that scratching this position has crossed our minds and important to remember that allocating capital is a relative game - if perceived better opportunities arise elsewhere ahead of the November numbers this position may be sold.

CSR Ltd (CSR) Monthly Chart

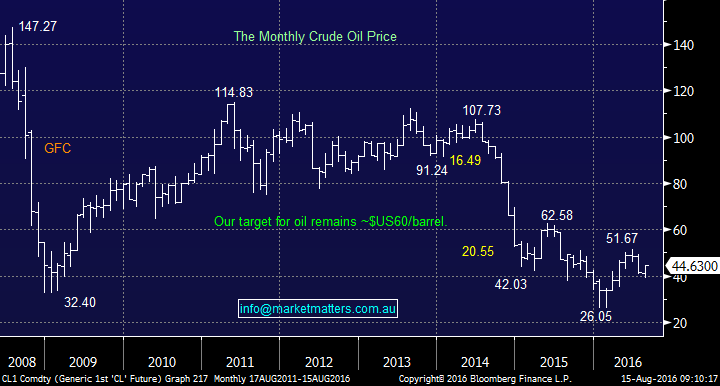

Question 3: "Why are MM bullish on oil and what's currently your favourite stock to buy for exposure" - Len

Answer: A very topical question Len after our look at Woodside Petroleum (WPL) in the Weekend Report. Oil suffered a massive decline in prices in 2014-5 leading to panic in the oil sector with companies going into administration, or literally collapsing in price e.g. Santos (STO) fell ~75%.

Saudi Arabia attempted to halt the major competition coming from shale gas in the US by simply pumping more oil which brought down global energy prices. Many OPEC members have been decimated by the decline in prices, losing money on every barrel produced. The price war appears to have abated for now and the market is going through a period of rebalancing.

We are simply looking for oil to retest its best levels of last year ~$US60/barrel, not a particularly aggressive call considering price movements over the last 2 years. Looking shorter term, characteristics of sell-offs can be very telling – with a test below ~$US40/barrel being rejected.

We like the oil sector at current levels for further 8-10% appreciation. We hold Origin Energy (ORG) in the portfolio with a target of $6.20 and can buy Woodside Petroleum (WPL) for a shorter term trade

Crude Oil Monthly Chart

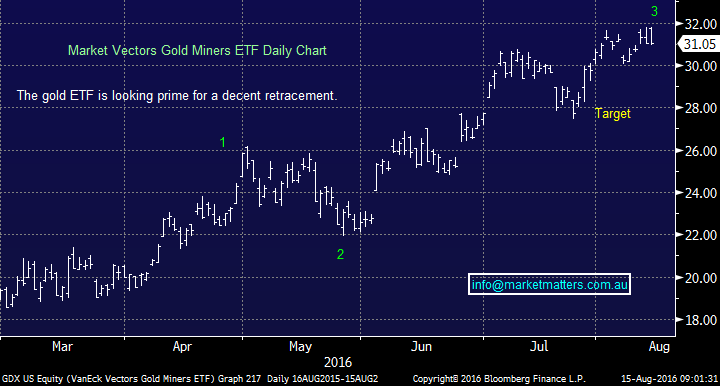

Question 4: "I keep watching your gold thoughts, looking to buy but it never pulls back, should we not simply buy now?" - Stephen

Answer: Hi Stephen, we share your frustrations but our philosophy revolves around the combination of risk, reward plus of an overlay of value. The gold sector has enjoyed a wonderful 2016 but there have been a number of 10-15% retracements and it’s currently our opinion that another one is likely to be close at hand.

We watch the gold ETF's as a large percentage of investment in the sector now enters via these vehicles. Technically we see a strong possibility of a retracement of around 10% from current levels hence our patience, which is being tested liken yours - we still like RRL, NCM and NST in the sector.

**Newcrest (NCM) full year numbers mid-morning today. This is a ‘deleveraging story’ - at last update, they still had $2.1bn in debt. Commentary / progress here will be the major talking point**

Gold Market Vectors ETF Daily Chart

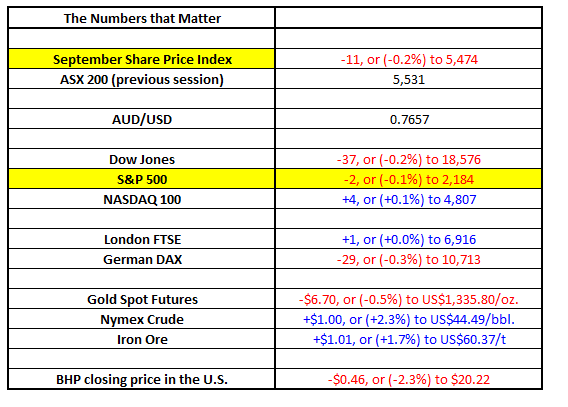

Overnight Market Matters Wrap

- The US markets closed mostly weaker after poor economic data was released. The Dow finished down 37 points (-0.2%) to 18,576, however, the broader S&P 500 finished basically square, down just under 2 points to 2,184.

- US Retail sales figures were less than expected, coming in unchanged when analysts were expecting an increase of 0.4%. Others were not surprised, noting that Macy’s announced the closure of 100 stores, indicating sales are not improving.

- We had better news on the oil front, with crude finishing up US$1.00 (+2.3%) to US$44.49/bbl, its biggest gains in a month.

- Iron Ore continues to improve with the price finishing the week up US$1.01 (+1.7%) to $60.37/t.

- The ASX 200 is expected to open with little change, still testing the 5,530 level as indicated by the September SPI Futures. Earnings and trading updates will dominate and dictate the market direction.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here