Market Matters Morning Report Wednesday 17th August 2016

Can the BHP result reignite the ASX200?

Stock markets have almost moved into hibernation around the world e.g. the US market has not experienced a daily move up, or down, over 1% in 5 weeks, this degree of stagnation has only occurred 5 times since 2010. The ASX200 has now traded sideways for 9 days, ignoring some gains in other markets. It feels to us that if the local market is going to make another assault on the 5600 area BHP and the resources are likely to be the catalyst.

Although the headline numbers from BHP yesterday painted a weak picture, markets and share prices are all about the future and there was some extremely positive undertones to the result – more on that below.

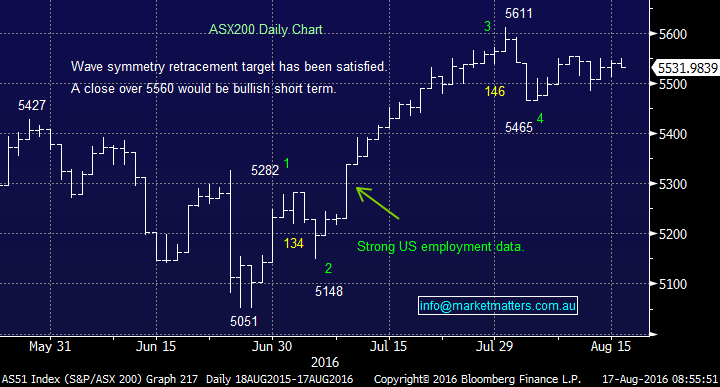

The technical picture for the ASX200 still points to a test of the 5625-5650 area before further consolidation but a close over 5560 is required to trigger a bullish signal.

ASX200 Daily Chart

As we touched on in the afternoon report, BHP Billiton (BHP) announced their profit numbers after market yesterday to produce some very negative tabloid style headlines - " BHP loses $US6.38 billion!" but importantly they forecast $US7 billion free cash flow for 2017 at current consensus commodity prices. The term ‘consensus’ is key here as that number across most of BHP’s commodity complex is substantially below current spot prices. Should commodities remain firm (or even stable) then we’ll see upgrades to consensus commodity price forecasts which will drop directly into upgrades for BHP earnings.

Simply BHP has experienced an awful year , with some big one off painful hits but the clear feeling is that FY16 was the low point for BHP earnings. The toughest of periods is now behind them and some clear skies andoutperformanceis likely.

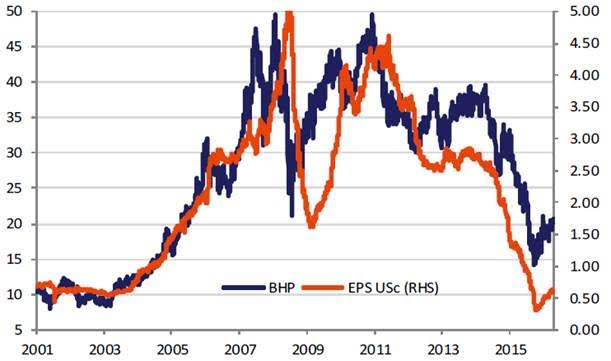

This chart looks at BHP share price versus earnings per share. Not rocket science, however, it clearly shows that share prices will track earnings. If conditions are ripe for a period of EPS upgrades then the share price will follow.

Source; Shaw and Partners Research

A relief rally similar to last weeks by ANZ Bank (ANZ) would not surprise.

Resource-based businesses are clearly cyclical being dependent on commodity prices and we have just witnessed a once in a decade correction from the resources sector from which the recovery historically is likely to last at least another 3 months.

BHP, along with a number of other key producers have shown a strong ability to cut hard, and reduce the overall cost of production, making us confident of some very healthy profits on the horizon, for 2017: Oil ~ $US10/barrel and Iron Ore ~ $US14/tonne.

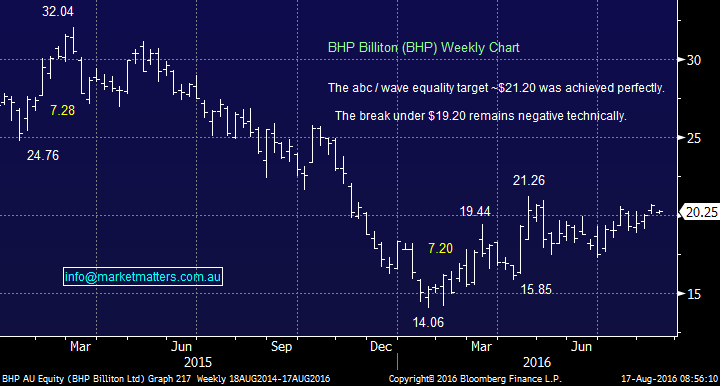

Technically we got a sell signal when BHP broke $19.20 but the lack of follow-through has switched us neutral to positive, we strongly feel the next 10% for BHP is more likely to be up.

BHP Billiton (BHP) Weekly Chart $20.25

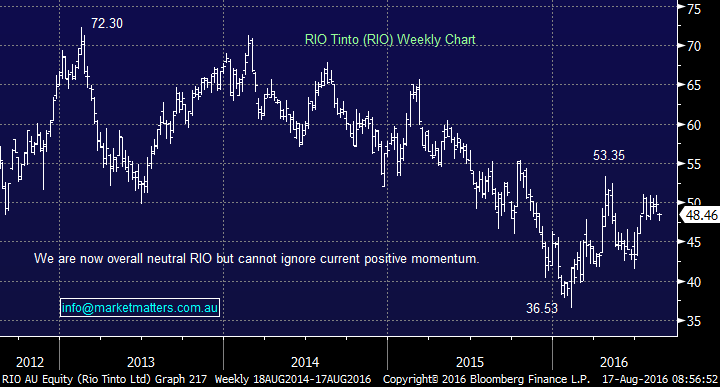

RIO Tinto (RIO) is a world class iron ore producer which has rallied around 30% in 2016 compared to FMG which is up around 300%. We believe the relative value has now moved too far and RIO is a buy in the sector.

While RIO is not overly clear from a technical perspective, our preferred scenario is a move up towards the $56 area.

RIO Tinto Ltd (RIO) Weekly Chart $48.46

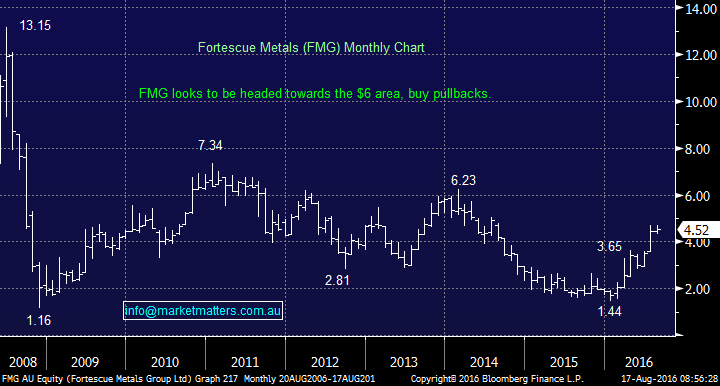

Fortescue Metals (FMG) has surged over 300% in 2016 as the iron price has increased and the company has performed extraordinarily well paying down large chunks of debt. The market was negative Fortescue (FMG) until they started to effectivelyexecuteof their strategy. BHP now seems to be in a similar boat.

While we feel on a comparative basis FMG has rallied too far technically it remains bullish targeting the $6 area.

Fortescue Metals (FMG) Monthly Chart

Summary

- We remain bullish stocks short term and continue to believe that the best returns over the next 3-6 months will be generated by a more active approach.

- Following on from the above we believe it is catch up time for BHP and RIO and favour these two heavyweights in the currently positive resources space.

Watch out for Live Market Matters Alerts

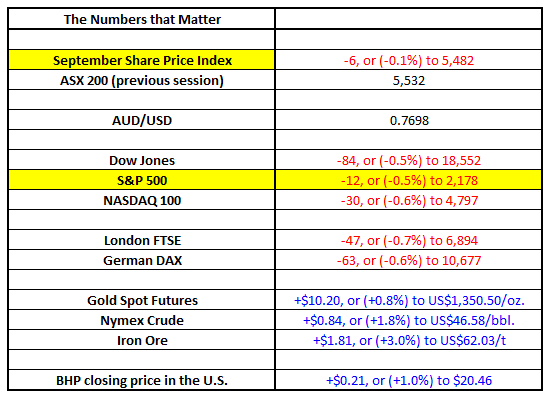

Overnight Market Matters Wrap

- The US markets finished weaker ahead of the release of the Fed minutes due tomorrow in the US. The Dow closed down 84 points (-0.5%) to 18,552 whilst the S&P500 closed down 12 points (-0.6%) to 2,178.

- Oil pared gains from earlier in the day after a report showed a surprisingly strong build up in US gasoline stocks. Crude oil finished up 84c (+1.8%) to US$46.58/bbl

- Gold had a strong night, rising US$10.20 (+0.8%) to US$1,350.50/oz which was US$5 off its high of the day after mixed economic data during the day.

- Another strong night in Iron Ore saw the metal rise US$1.81 (+3%) to US$62.02/t

- Last night BHP Billiton (BHP) reported a weak FY16 result, but although it had some bad headline numbers, most of the bad news was already in the market. BHP closed 1% higher in the US to an equivalent $20.46.

- The ASX 200 is expected to open 11 points lower, near the 5,520 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here