Market Matters Morning Report Tuesday 23rd August 2016

Is it time for Woolworths to regain its "mojo"?

Market action remains very stock specific at present, while global equities continue to tread water, awaiting any indications from the Fed on interest rates from this weekend's meeting at Jackson Hole. The standout characteristic of 2016 has been buying the previously unloved has led to the best performance – historically the signs of a bull market approaching completion.

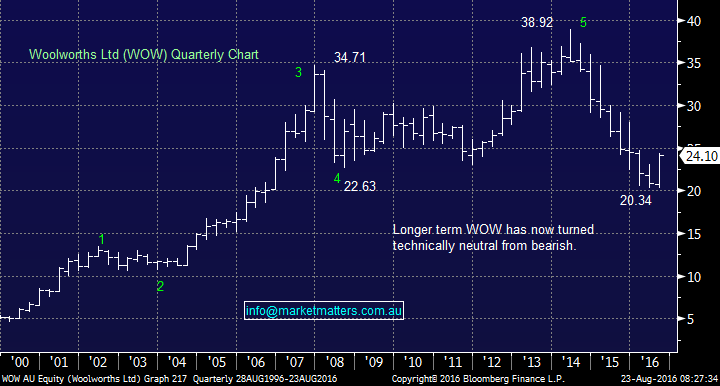

Woolworths (WOW) definitely fits into this category, haven fallen almost 50% from its 2014 high and only managing a relatively minor correction of this collapse to-date. Even Myer has bounced over 70% and its stores still feel empty! With both Woolworths and Wesfarmers reporting this week, we thought it was an ideal time to revisit the supermarkets.

In early 2015, we wrote a very bearish piece on WOW when the stock was ~$34, targeting a drop under $25 which unfolded as we foreshadowed. The fundamental basis of the view was the inevitable contractions to its huge margins with the arrival of global discounters like ALDI and COSTCO.

We looked at simple comparisons to see how competition had impacted UK supermarkets, Tesco and Sainsbury's. Today, we will again cast our eyes to the UK and see if we should be considering jumping back into WOW - have they turned the ship around and if so, how long did it take them to do it?

Technically, WOW looks likely to now range trade between $20 and $27 for a year, or two – and we’ll be conscious of trading this range.

Woolworths (WOW) Quarterly Chart

WOW's major competitor in Australia, Wesfarmers (WES) has enjoyed an excellent few years in comparison, including the success of Bunning's, compared to the disastrous, Masters.

Technically, WES looks destined to make fresh highs ~$48, interestingly a very similar percentage gain to WOW rallying towards the $27 area.

Wesfarmers (WES) Weekly Chart

Looking at two of their UK counterparts, Tesco and Sainsbury’s, which helped us to become very negative WOW 2 years ago.

1. Tesco's remains very weak and while a decent bounce looks possible, there is no bullish lead for WOW / WES from here.

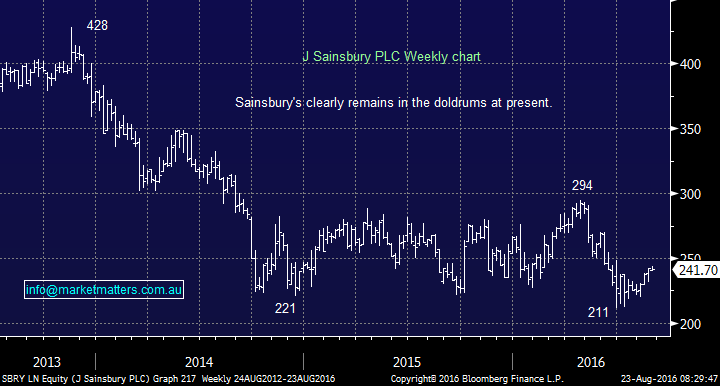

2. Sainsbury's also remains close to multi-year lows and again, while a reasonable bounce may be unfolding, there is currently no bullish lead for our supermarkets.

Tesco PLC Quarterly Chart

Sainsbury PLC Weekly Chart

Summary

- The UK supermarkets are still struggling to put their respective ships in order, trading close to multi-year lows, strongly suggesting that it's not time to jump back into Australian supermarkets for an investment - perhaps only a short-term trade.

- However, if we are correct and global stocks top out in the next 6 months, WOW may be a safe place to hide given their defensive earnings (people still need to eat!) - something to consider at the time.

Overnight Market Matters Wrap

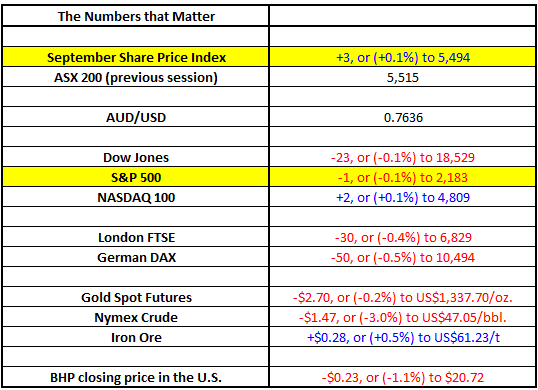

- The US share market closed mixed on very low volume overnight, with the Dow falling 23 points to 18,529 and the S&P500 closed down 1 point to 2,182, while the Nasdaq 100 ended 2 points higher (+0.1%) to 4,808.

- Oil yet again was a catalyst, with Crude Oil dropping US$1.47 (-3%) to US$47.05/bbl. News that China ramped up its exports of refined products, together with further news that US producers added rigs for an eighth consecutive week and prospects that Iraq and Nigeria were increasing exports; all of which sent the market lower.

- Janet Yellen the Chairperson of the Fed is due to deliver a speech on the US economy on Friday and market watchers are wondering if she will follow the line of Fed Vice Chairman Fischer and N Y President Dudley with their belief that the economy is on track to meet requirements for a rate increase.

- On the back of this, Gold took a step backwards, dropping US$2.70 (-0.2%) to US$1,337.70/oz.

- Domestically, corporate earnings continue, with the following today: Aconex Ltd (ACX), Bradken (BKN), Caltex (CTX), Greencross Ltd (GXL), Healthscope (HSO), Monadelphous (MND), Nextdc (NXT), OilSearch (OSH), Scentre Group (SCG), Spark Infrastructure (SKI), Senex Energy (SXY), Vocus (VOC)

- The ASX 200 is expected to open weaker this morning, down 16 points testing the 5,531 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here