Market Matters Morning Report 24th August 2016

3 things today we are watching very closely

While US stocks continue to test all-time highs day-day activity remains extremely muted with the combination of US holiday season and Janet Yellen's weekend speech enough to continue the current run of low lacklustre moves – last night saw the 32nd straight session where US markets moved less than 1%. Many commentators believe this is the calm before the storm but we think the likelihood is that the calm may extend far longer than many think. Historically the Volatility / Fear Index (VIX) Index usually spends a lot longer at depressed levels than a few weeks as we’re currently seeing.

However, it’s during these relatively quiet times that it's important to remain focused and ready to act to achieve the best portfolio returns. Today we are going to look at 3 things we continue to watch closely.

VIX Weekly Chart

Short-term ASX200 target

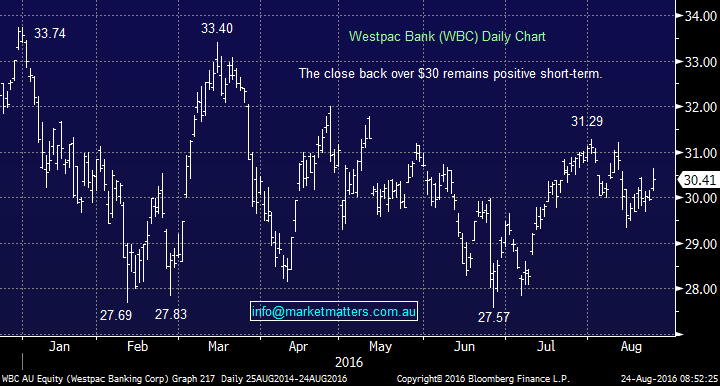

Yesterday the ASX200 broke out of its recent extremely tight trading range led by a satisfying +1% rally by the banking sector. Our view that banks outperform over the next 3-6 months has clearly been challenged but yesterday’s strength and Westpac's (WBC) technical set up is very encouraging.

We continue to believe that investors who continue to scour the market for any value will soon switch their attention to the oversold banking sector, especially with chunky fully franked dividends looming in November.

Technically, WBC's recent close over $30 is bullish, initially targeting a move towards $31.50-32, ~4% higher.

Westpac (WBC) Daily Chart

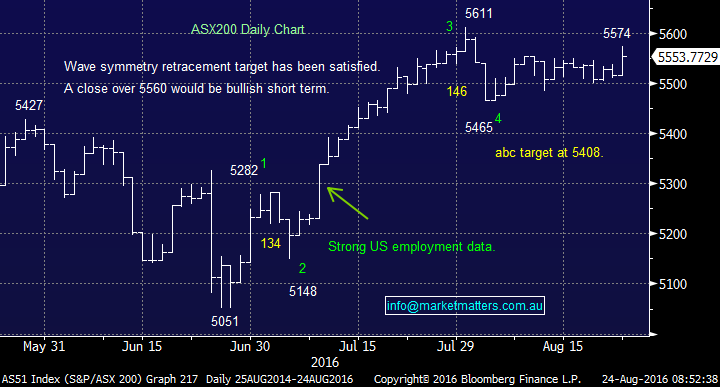

Our view is yesterday’s strength will eventually follow through and take the ASX200 towards the 5625 area. Assuming this move unfolds as anticipated we envisage increasing our cash position back over ~20% into this strength.

Watch out for text / email alerts.

ASX200 Daily Chart

Investors are becoming more confident

While the market is trading "rich" on most measurements, aided by expectations for further economic stimulus, investors are becoming increasingly comfortable hence slowly raising the possibility of disappointment. Simply, people are not as bearish as they were back in January:

1. Active managers have the highest exposure to "Beta" since 2008.

2. Investment managers have the highest cyclical v defensive exposure since 2012.

3. Long - short managers have the highest long exposure in the last 12 months.

NB "Beta" is a measurement of a stocks volatility compared to the market, so if people are long beta, in relative terms they are aggressively long the market.

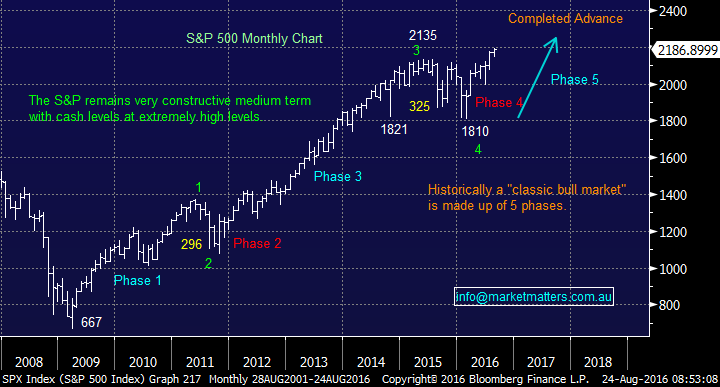

The S&P500 has rallied over 20% from the lows of 2016 so it's no surprise that people are becoming more comfortable with equities. We intend to fade this relaxed mood and slowly start reducing our significant exposure to stocks into short-term strength.

NB We remain short-term bullish equities looking for a further ~6% upside prior to a +20% decline in stocks, this improvement in sentiment towards the market is gradually making the projected aggressive correction more plausible - markets do not fall when people are bearish.

S&P500 Monthly Chart

Two sectors we like in the US

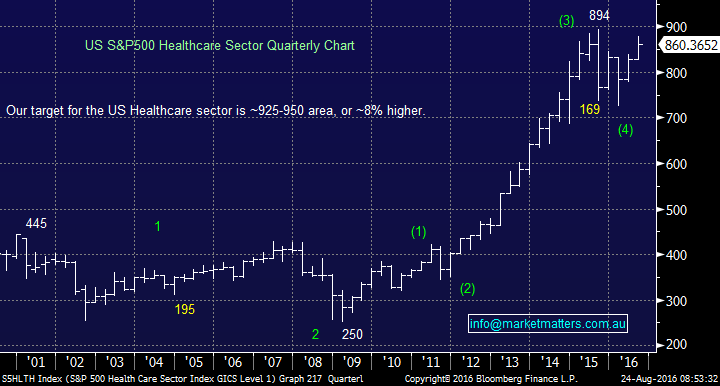

The tech. NASDAQ has led US equities higher in 2016 but we now see two sectors within the market that may enjoy some strength through to the US election, and into Christmas.

Healthcare remains cheap in the US and as certainty unfolds around the US election - (Clinton is a long way ahead now), we still see further 8% upside from here which should impact positively on the Australian sector – and thus our holding in CSL.

Similar to the Australian market we like the energy sector in the US short-term but we will be sticking to our targeted levels in both Woodside and Origin if they eventuate. ORG ~ 6.20, WPL over $30

S&P500 Healthcare Quarterly Chart

Summary

- Be patient short-term but "start taking some money off the table" if the ASX200 rallies towards 5625 in coming days / weeks.

Overnight Market Matters Wrap

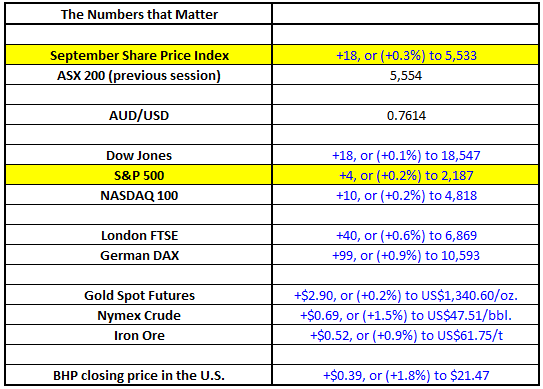

- The US markets finished in positive territory this morning, with the Dow finishing up 19 points (+0.1%) to 18,547, after being up 100 points earlier in the day, whilst the S&P500 closed slightly better, up 4 points (+0.2%) at 2,187.

- With the Fed reserve Chair speaking on Friday expect some volatility towards the end of the week!

- Oil helped with investor sentiment, with Crude finishing up 69c (1.5%) to US$48.10/bbl after reports from Reuters, that Iran was sending positive signals that it may support a joint action to prop up the oil price.

- Gold also improved, rising US $2.90 (+0.2%) to $1,340.60/oz.

- Helping our miners today, Iron Ore rose 52c (+0.9%) to US$61.75/t. BHP in the US closed an equivalent of +1.8% to $21.47 from Australia’s previous close.

- We have the the following companies reporting today: APA Group (APA), Alumina (AWC), Boral (BLD), McMillan Shakespeare (MMS), Paladin (PDN), QANTAS (QAN), Steadfast (SDF), Webster (WBA), Wesfarmers (WES), Westfield (WFD), Worley Parsons (WOR)

- The September SPI Futures is indicating the ASX 200 to open marginally higher this morning, testing the 5,560 level, with Telstra (TLS) trading ex-dividend.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here