Market Matters Morning Report Tuesday 30th August 2016

Do we remain bullish as the ASX200 struggles on the global stage?

At the start of 2016, one of our forecasts was that the ASX200 would outperform its US equivalent, the S&P500 for the first time in a decade. The foundation of this view was our predicted rebound for the resources sector which has materialised, but alas, the rest of our market has not yet come to the party. To-date for this calendar year, the ASX200 is +3.2%, while the S&P500 is +6.6%.

There are times when our market feels even worse than this simple comparison e.g. the ASX200 has corrected 2.5% from its recent high while the S&P500 is only 0.4% below its all-time high. Unfortunately, we currently seem to be adopting the cliché "if in doubt, sell" to a far greater extent than our American friends - a stronger economy may be the simple explanation.

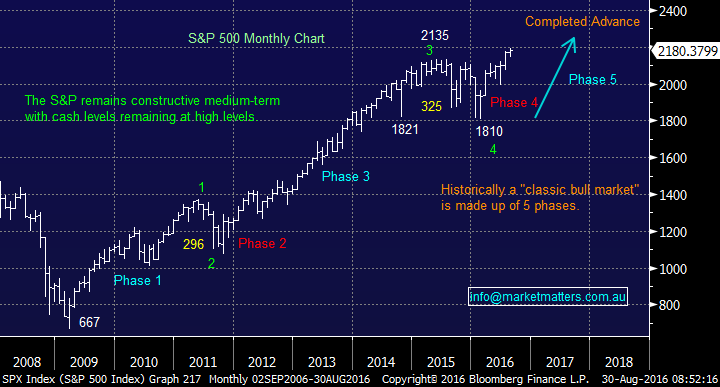

The doomsday merchants have been more vocal this year than we can ever remember, often telling people to sell all their shares and switch to cash. We continue to believe that these bears are simply too early and US stocks still have another +6% upside. The volatility index may be under 15% for the longest period in over the last 2 years, but that is no indication of an imminent collapse. Valuations are rich, but not excessive, especially when we consider the incredibly low-interest rates environment.

The S&P is currently trading on 16.9x forward earnings, while the average of the last 20 years is 16.5x, hence implying only a 2-3% correction on value. Earnings need to disappoint going forward to make valuations a huge negative.

US S&P500 Monthly Chart

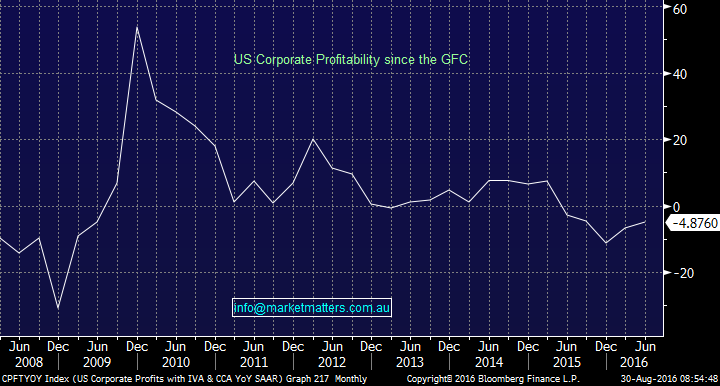

US corporate profitability is certainly a risk to the US stock market, with the most recent quarters showing corporate profitability has been declining, if this continues and interest rates are raised stocks should come under pressure. Over recent years, companies have been a binge of cost reduction as opposed to CAPEX (capital expenditure), hence they need to change gears fast to increase profits in a meaningful manner. The rhetoric from most companies at present is things are getting tougher, not easier, hence we believe this is a very important area to watch moving forward.

US Corporate Profitability Monthly Chart

Last night, the US banking Index made fresh 7-month highs and as we have been discussing, we remain bullish banks short-term, looking for them to outperform for the balance of 2016 – theoretically, a solid sign for the ASX200 which is highly correlated to the banking index.

S&P500 Banking Index Monthly Chart

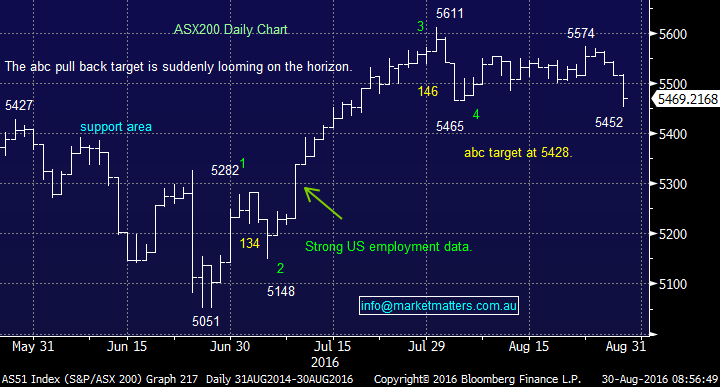

Yesterday, the ASX200 was thumped 46-points, but it felt more through as lack of buying than aggressive selling - this would make sense after the large placements of Crown (CWN) and Evolution Mining (EVN).

We remain short-term positive the local market, while the 5400 area holds.

ASX 200 Daily Chart

Summary

No change to our overall short-term bullish view, but a few important points to highlight:

1. Many US Indices like the S&P500, have made the fresh all-time highs we were predicting for 2016, but ideally the other will play catch-up e.g. NYSE Composite Index.

2. While we still see ~6% upside in US stocks, our bigger picture view is negative, hence we will continue to be looking to reduce equity exposure into strength.

3. On current relative performance numbers, if the US can rally another 6% we may be lucky to seed the ASX200 reach 5650.

4. Short-term we feel the banking sector should perform well following the US.

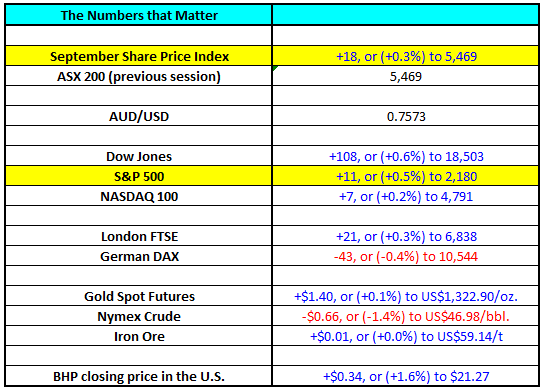

Overnight Market Matters Wrap

- The US Share markets started the week in the green, as the reported consumer spending reignited investors’ anticipation for an interest rate rise by the end of this year.

- The Dow closed 108 points higher (+0.6%) at 18,503, while the broader S&P 500 closed 11 points higher (+0.5%) at 2,180.

- Oil continues to play snakes and ladders, falling 1.4% overnight to US$46.98/bbl. while Gold futures brought some of its lustre back, up $1.40 to US$1,322.90/oz.

- The September SPI Futures is indicating the ASX 200 to rise this morning and test the 5,490 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here