Market Matters Morning Report Wednesday 31st August 2016

Five stocks that we do not like at today's prices

Today, we see August come to an end and it's been a very quiet month from an index perspective, with a range only ~30% that of July's. All the action this month has been on the stock-specific level, with reporting season assisting some big moves in both directions.

Below are a few that have caught our eye:

Winners - Perpetual (PPT) +8.2%, Woodside (WPL) +8.9%, Treasury Wine (TWE) +16.2%, Computershare (CPU) +11.3%, JB HiFi (JBH) +15.1% and Ansell (ANN) +16.9%

Losers - Medibank (MPL) -11%, Newcrest (NCM) -8.1%, Northern Star (NST) -21.4%, Realestate.com (REA) -9.9%, QBE Insurance (QBE) -10% and Vocus (VOC) -15.2%.

We have been talking the short- term positive equities story at Market Matters all year, with the ASX200 up 3.5% plus dividends since January 1st. We are relatively pleased to-date. However, being mildly bullish stocks for the next 6-months does not mean that we currently like all stocks / sectors. Today we have focused on 5 stocks we do not want to own today, but in some cases perhaps in the future.

ASX200 Monthly Chart

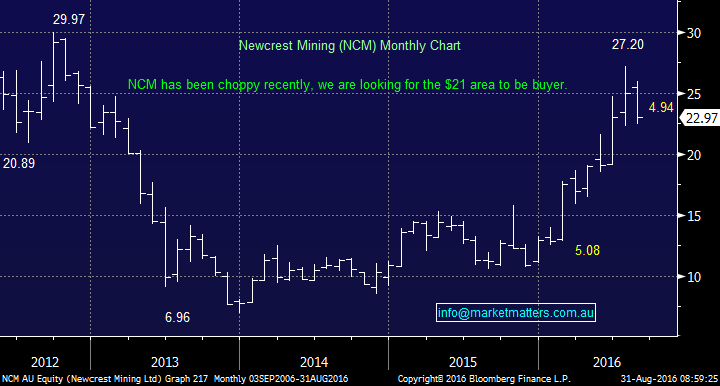

Newcrest Mining (NCM) $22.97

For the first time in seven years, gold has fallen in an August, around 3% with one US session left to trade. Even over the last 5-years when gold was in a bear market, the precious metal rallied in August. Simply, gold is losing momentum after the best first 6-months in almost 40 years.

The pending interest rate increases in the US is creating renewed strength for the $US and subsequently, suppressing the gold price. While we believe a large part of this should be built into the price, it feels highly likely to continue short-term.

Local gold stocks have been hit by some meaningful profit taking of late with NCM falling 15.5% and Regis Resources 12%.

We remain a buyer of NCM ~$21 but this is a further 8-9% lower.

Newcrest Mining (NCM) Monthly Chart

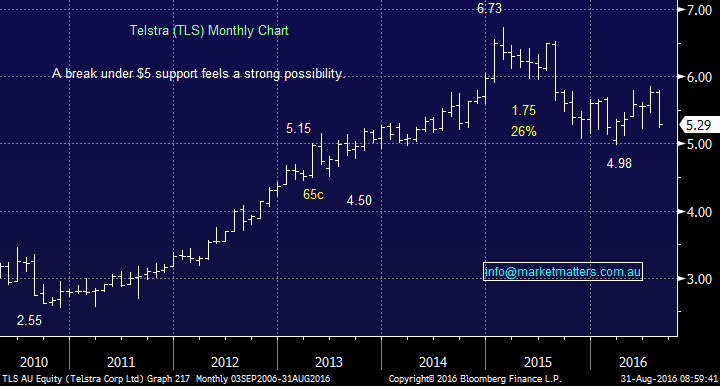

Telstra (TLS) $5.29

TLS is a great example of how both stocks and markets move in cycles. In early 2015, everybody was chasing yield with TLS along with the banks the prime candidate for retail investors. Here we are 18-months later, the ASX200 is 8% lower, but poor TLS is down a significant 21.4%. Markets look ahead and interest rates are primed to rise in the US and TLSascompany, shows little / no growth prospects, hence why own it?

Technically, TLS looks destined to break its $5 support area, with a target somewhere around $4.70. Its 5.86% fully franked dividend is not supporting the stock. However, down towards $4.70, TLS may outperform the market if we see a sizeable correction for stocks - this would be a fall of 11% from today's levels.

Telstra Monthly Chart

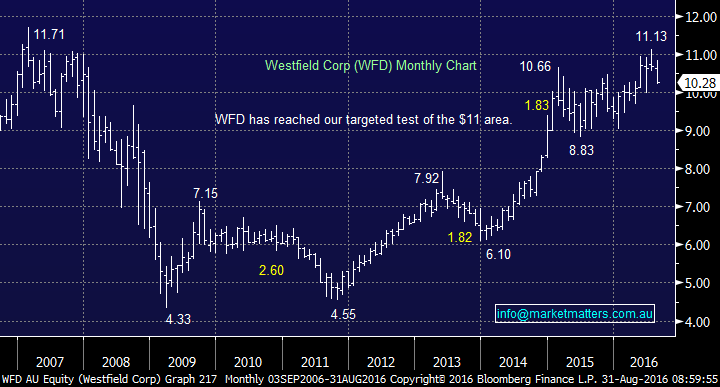

Westfield Corp. (WFD) $10.28

We have been bearish WFD since it hit $11 and so far this has proved accurate with the stock retreating 6.6% from its July highs.

We remain bearish WFD, targeting a further ~15% downside.

Westfield Corp. (WFD) Monthly Chart

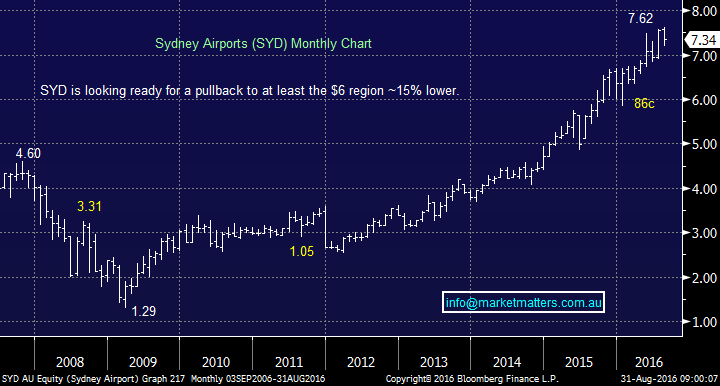

Sydney Airports (SYD) $7.34

We have recently discussed our view that global interest rates have basically bottomed and are set to rise with the potential for a "bond bubble" to pop and rates spike. Central Bank’s biggest job of the next few years may not be creating growth, but letting the bond bubble down slowly.

We believe top performing stocks like SYD that have acted like a quasi-bond are set for a pullback, we are targeting the $6-6.50 region for SYD i.e. ~13%.

Sydney Airports (SYD) Monthly Chart

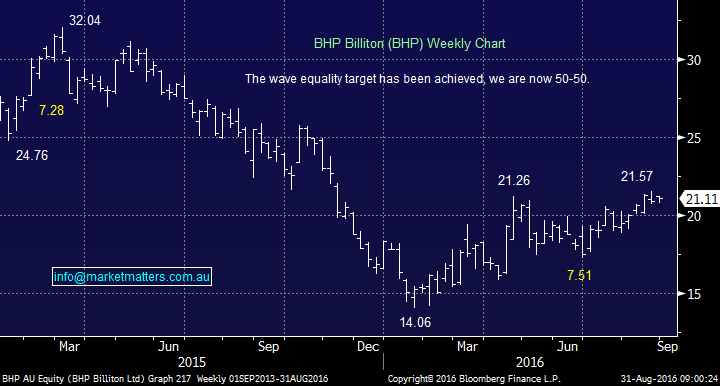

BHP Billiton (BHP) $21.11

This is more of wildcard entry to our 5 stocks, as we like BHP and believe the resources sector has the ability to rally for another ~6 months, led by BHP and RIO. However, BHP has now rallied over 50% since the panic lows last December and the risk / reward is far from compelling at today's prices.

BHP has been edging higher over recent months, with no decent momentum and noticeably it has bounced in a very similar manner to early 2014. We would be taking $$ on any long position and wait for further development.

BHP Billiton (BHP) Weekly Chart

Summary

Our simple view on the 5 stocks that we are currently negative:

1. Buy NCM ~$21, or 8-9% lower.

2. We will consider TLS in the $4.70 region if we are bearish the overall market, as it is likely to outperform during a significant correction.

3. We remain bearish WFD, targeting a further 15% downside.

4. SYD looks set for a 10-15% retracement.

5. BHP, the stock would be far more exciting under $18. Over $21, the risk / reward is not compelling.

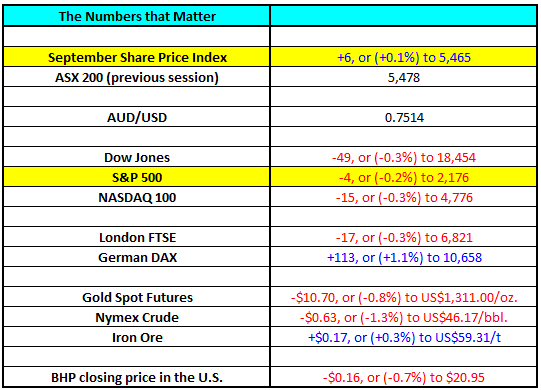

Overnight Market Matters Wrap

- In the US the Dow once again closed less than one-half of a percent down. The Dow closed down just 49 points (-0.3%) to 18,454, whilst the S&P500 closed down just 4 points (-0.2%) to 2,176.

- All eyes, this time, are looking at the impending jobs report, due on Friday night our time. The consensus of analysts are expecting to see 180,000 jobs added on the report.

- Oil was weaker on the strength in the US$ and a continual concern of oversupply. Crude finished down 63c (-1.3%) to US$46.35/bbl. Analysts are expecting a build in stockpiles of 1.3 billion barrels for last week, a second week of rises.

- Gold also fell for mostly the same reasons, i.e. stronger US$, unemployment figures expected to be lower and sentiment for a rate rise soon. Gold finished down US$10.70 (-0.8%) to US$1,313.00/oz.

- Iron ore at least finished in the black, rising just 17c (+0.3%) to US$59.31/t. BHP is expected to open higher, after finishing an equivalent of 0.7% higher in the US, to $20.95 from Australia’s previous close.

- The ASX 200 is expected to open flat this morning around the 5,480 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here