Market Matters Morning Report Friday 2nd September 2016

When to hold'em and when to fold'em?

Please excuse the Poker sounding title today, but we were actually thinking of the Kenny Rodgers old country song, which admittedly is titled "The Gambler"!

"You got to know when to hold'em, know when to fold'em, know when to walk away and know when to run....." - Kenny Rodgers.

At Market Matters, we regard ourselves as active investors who put our own money to work in exactly the same manner that we advocate. We look for opportunities to make money, as opposed to just writing reports. One important aspect of our philosophy is to constantly evaluate previous decisions, constantly looking to improve our performance.

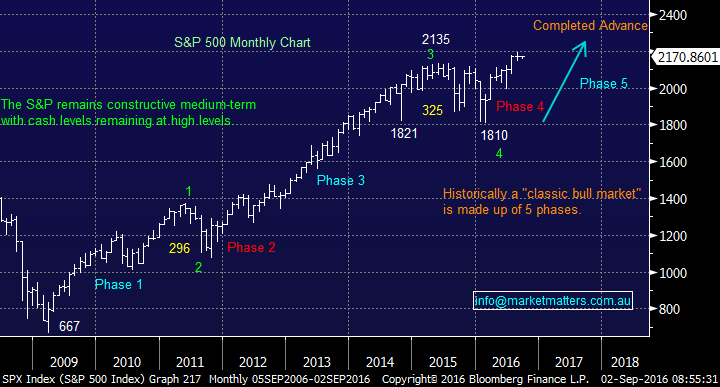

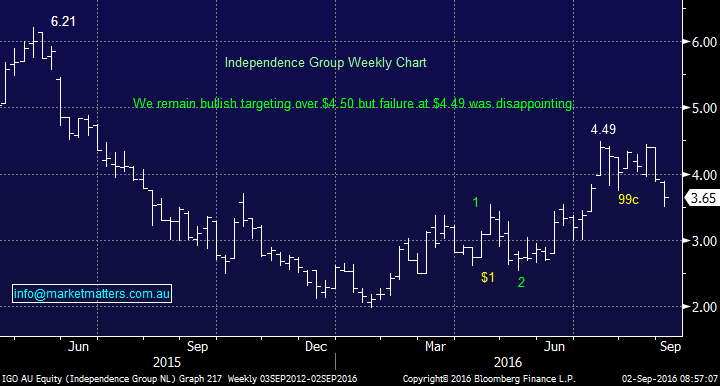

It remains our belief that equities are in the mature "Phase 5" of a bull market, that commenced back in early 2009. A common characteristic of this final stage is the stocks that have underperformed during the previous 4 phases play some catch-up and we have witnessed this locally with the resources sector. However, the final phase should be the one where the market runs out of puff and we also have experienced this with a number of our holdings, swinging from good profits to losses in the blink of an eye e.g. Origin (ORG) and Independence Group (IGO).

In this market, selling strength and buying weakness is paying all the dividends, or in other words, go against how the market feels at the time because it's not following through in either direction!

Today we are going to evaluate our portfolio by stock / sector to ensure subscribers fully understand our current thinking. Current portfolio:

https://www.marketmatters.com.au/blog/post/market-matters-stock-positions-30th-august-2016

US S&P500 Monthly Chart

We currently hold 3.5% in cash, ideally, this would be slightly higher so we could buy gold stocks into further weakness without liquidating any holdings. Note, we are also considering an option play in Newcrest Mining (NCM) around $21.10, meaning we would not have to sell any of our existing positions.

Our largest sector holding at present is the banks, where we have 40% of our funds in CBA, BEN, ANZ and WBC and also have exposure to Suncorp which has a banking division. With the US banking sector breaking to the upside and our local banks cheap compared to the overall market, we like this holding but will have no hesitation taking some profit if decent strength unfolds over coming weeks.

The banking sector remains our favourite place to be at present.

US S&P500 Banking Index Monthly Chart

We have 10% of our portfolio in CSL, a position that has swung from profit to loss on more than one occasion over recent times. Although its recent earnings report was good, it was not as great as the market was hoping for with their growth profile marginally downgraded, leading to +10% pullback in the stock. While we like the company after many years of outperformance, a period of consolidation looks likely. We will now consider liquidating this position over $110.

CSL Ltd (CSL) Weekly Chart

Gold stocks have been hammered recently, as the prospect of higher rates in the US weighs on the sector. Gold has fallen just over 5% from its highs in July, but the gold stocks have fallen around 4x times this amount e.g. Newcrest (NCM) -20% and Regis Resources (RRL) -16%.

With both NCM and RRL now extremely close to our targeted buy areas, we are not panicking with our IGO position. Importantly, IGO reported a solid result last week which was all about the progress of their Nova Nickel mine (given that financial results were pre-released). They also announced a 2c dividend which is a bit strange given they just raised capital to pay down debt. Importantly, IGO have built good projects in depressed environments that are about to start producing and we can be reasonably comfortable there are no skeletons in this closet.

*watch for alerts*

Independence Group (IGO) Weekly Chart

Vocus Communications (VOC) has recently come under pressure, as shares came out of escrow from the MTU and Nextgen deals. It's not surprising that some money has been taken off the table. We see significant revenue and margin improvements ahead for the company and believe the stock is cheap at current levels - the recent sell-off enabled us to increase our position to 10%.

Vocus (VOC) Weekly Chart

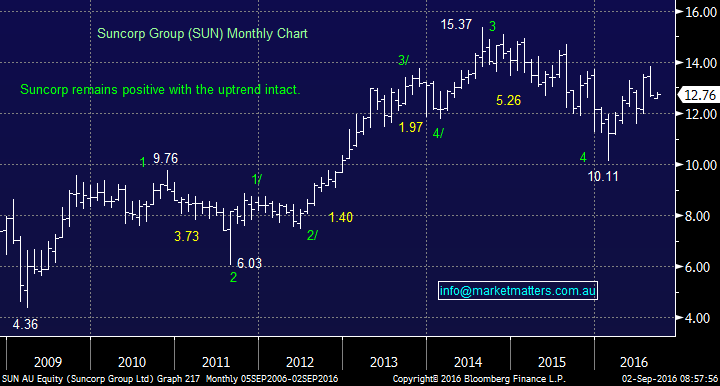

Suncorp (SUN) remains our favourite stock in the market technically, hence our 12% weighting. We are still targeting ~$15.50 for the stock and are enjoying a 5.3% fully franked yield on the journey.

Suncorp (SUN) Monthly Chart

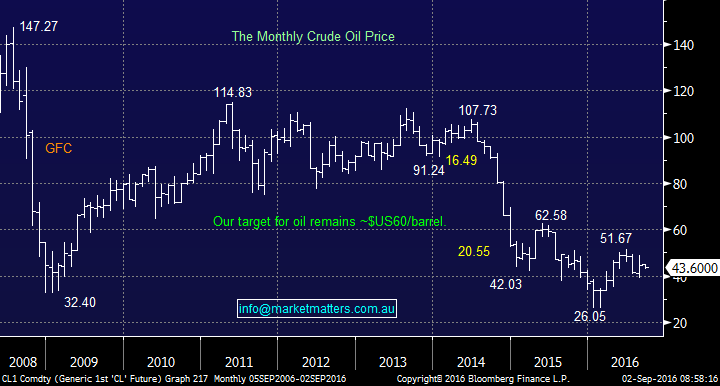

Lastly and importantly, we now hold 2 energy stocks, Woodside (WPL) and Origin Energy (ORG), which over recent weeks have been causing us some discomfort. Last month, crude oil rallied strongly as expected and we maintain our $US60/barrel target area.

WPL has behaved as expected and is currently showing a 2.3% profit, plus we’ve picked up a 34c dividend.

However, ORG had a disappointing report and is languishing closer to $5 than the +$6 target we have for the stock. Overall, due to our view on oil, we believe that the ORG position will play out ok, but it's very frustrating after the stock traded within 10c of our profit target! Clearly, ORG is a play on Oil and if we believe (as we do) that Oil trades higher, then we should continue to hold ORG.

Crude Oil Monthly Chart

Summary

- We remain short-term positive local equities, but the 5400 area needs to hold for this view to be maintained.

- If 5400 holds, we remain comfortable with our current holdings, with basic thoughts outlined in today's reports.

- Overall, our analysis tells us we need to be more active in the market until further notice.

Overnight Market Matters Wrap

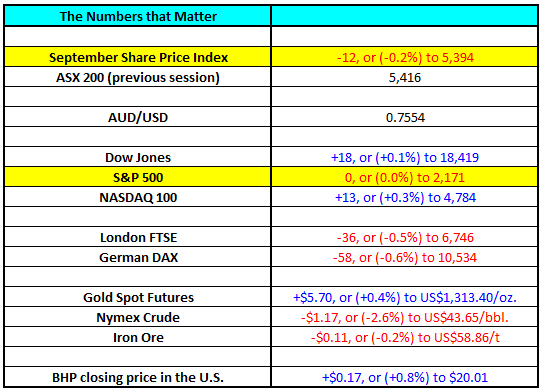

- The Dow managed to turn around a 100 point loss during the day, to finish up 18 points (+0.1%) to 18,419. The S&P500 however, managed to just keep its head above water with a less than one point gain to close at 2,171.

- Oil continued its slippery slope down, with traders dismissing now the (hope) that the OPEC meeting would put a freeze on supply but focussed again on the dismal report of the stockpile figures released yesterday. Crude finished down US$1.17 (-2.6%) to US$43.53/bbl, marking a three-week low.

- Gold put in a better performance, rising US$5.70 (+0.4%) to US$1,313.00/oz.

- The ASX 200 is expected to open down this morning just 9 points, testing the 5,407 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 2/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here