Market Matters Morning Report Tuesday 6th September 2016

We like the signals from the Oil Market

Last night European stocks closed at their highest level since early January led by the oil & gas sector which rallied 1.2%. The local energy stocks should have the ability to add to Mondays modest gains but nothing is certain in this choppy market. As most readers will know Saudi Arabia made a decision in 2014 to pump more oil in an attempt to depress energy prices and subsequently damage the growing US shale gas industry. They did manage to smash the oil price but not the shale industry - again market manipulation fails.

Yesterday Russia and Saudi Arabia met to discuss ways of stabilising / increasing the current oil price. They are two of the world’s largest global oil producers, making up around ~40% of supply, which implies strongly that they can influence the short-term price of oil. While the most recent meeting fell short of producing a freeze on output their intentions feel clear - oil closed up 1.6% after surging 4.7% at one stage.

We believe the simple implication of Russia and Saudi sitting down with the intention to get oil prices higher is bullish – think back to how far Saudi smashed oil when they wanted it down back in 2014. OPEC have not been a functional Cartel over recent years but the combination of Saudi Arabia, the drivers of OPEC and Russia is a very powerful combination in today's oil pricing framework.

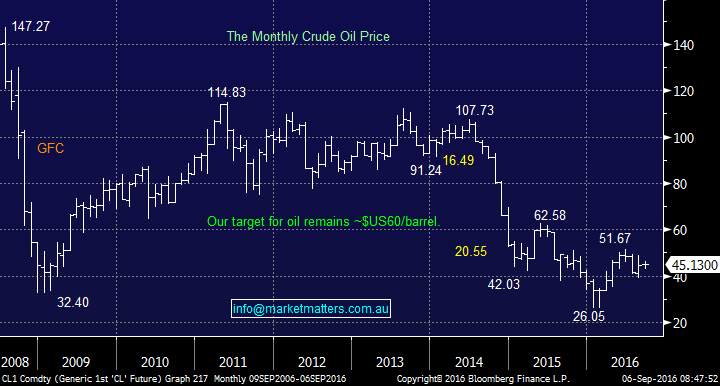

Short-term supply may be outstripping demand but we remain bullish oil from the current $US45/barrel area targeting a move back over $US60/barrel.

Furthermore, the added potential of M&A will increase if the Oil prices tracks this path given the very low cost of capital – this would further support a sector that has had a very tough couple of years.

Crude Oil Monthly Chart

A very important issue for future prices is the lack of current exploration relative to history with new oil discoveries at a 70-year low. Obviously, the demand profile for Oil is also changing, and the self-sufficiency of the US along with new energy technology obviously has an impact on demand, however probably not to the extent currently being factored in.

Depressed prices provide little incentive to bring on new production (other than the stuff that is already being developed) so the likelihood is that today's supply / demand dynamic will change dramatically as lower supply in the next 12-18 months becomes supportive of price.

Crude oil is currently trading in a significant Contango with crude oil December 2017 at $US45.17 but 2018 at $US51.49 - a 14% premium.

NB. Contango is when the forward / future price of a commodity is trading at a premium to the spot (today's) price. The reverse is called backwardation.

Importantly stocks look 1-2 years ahead hence while this Contango is in place we remain optimistic the energy sector over coming months.

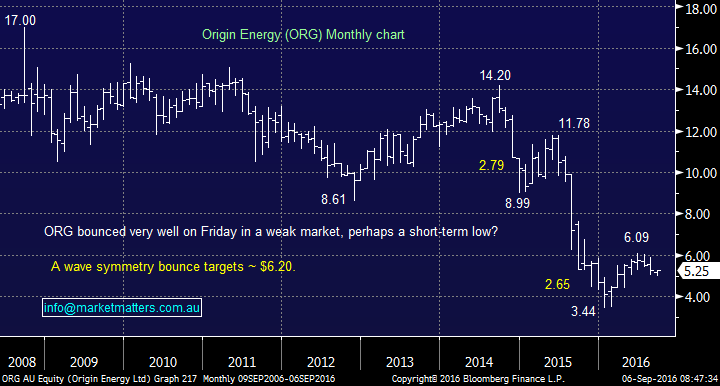

Origin (ORG) - Our first holding in the sector has been weak over the last month since a poor report. While it's clearly frustrating to see a stock drop over 10% after being so close to our profit target we still believe that ORG will reach our $6.20 target area if oil follows our anticipated path.

Origin Energy (ORG) Monthly Chart

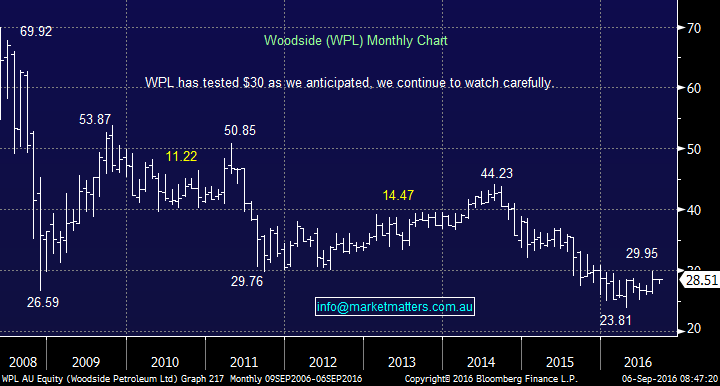

Woodside (WPL) - Our second stock in the sector has performed nicely since our purchase and is showing an 80c profit plus its traded ex-dividend while we held the stock. Our initial target is a retest of $30 from where we will review our exposure.

Woodside Petroleum (WPL) Monthly Chart

And finally, further M&A cannot be ruled out in the sector with prices still at depressed levels and cash extremely cheap.

This week we saw WPL purchase some BHP assets but it was not that long ago that they had an unsuccessful tilt at Oil Search (OSH).

Summary

We remain comfortable with our energy sector exposure via Origin (ORG) and Woodside (WPL).

Overnight Market Matters Wrap

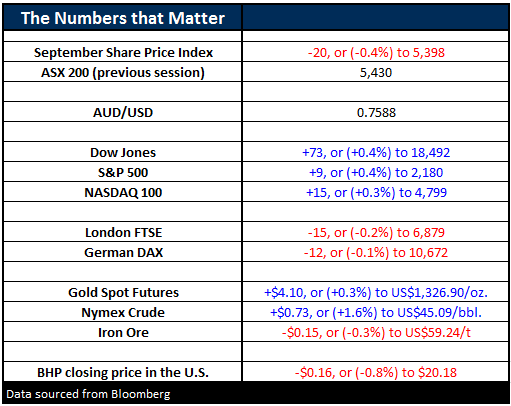

- With the US market closed last night for a Labor Day holiday, the only lead we had this morning is from Europe. The London FTSE however, closed down 15 points (-0.2%) at 6,879 and the German Dax finished just 11 points lower to 10,672.

- Oil, yet again was the feature, with the price rallying strongly on the expectation that the Saudi’s and Russians would be signing a joint statement saying they will both set up a working group to monitor the oil market and its stability. However, once the statement was made, the price pared gains with Crude finishing up 73c (+1.6%) to US$45.17/bbl after being up nearly 5%

- The ASX 200 is expected to open down this morning 29 points, testing the 5,405 level as indicated by the September SPI Futures this morning. Note, volatility is expected, as investors wait for the RBA interest rate meet. Current consensus is no change.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 6/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here