Market Matters Morning Report Wednesday 7th September 2016

Resource stocks or Mining Services?

The US stock market again looks set to make fresh all-time highs in coming days but the it's the Emerging Markets (EM) that are again catching our eye, with the emerging markets ETF closing at fresh 2016 highs last night. The ASX200 and especially resource stocks are usually correlated to the EM's so hopefully we can enjoy some optimism returning to our domestic market; although we do want to qualify that our initial target for the EM ETF is only 3% higher. Yesterday’s strength from overseas equities was aided by the renewed belief that US rates will stay lower for longer, likely to be good locally today for resources, energy and gold's but not necessarily for banks.

One important statistic that came from yesterday's energy based report was that oil discoveries are at a 70-year low. This is a theme across many commodities given depressed prices and massive reduction in capital expenditure as miners / energy companies look to dramatically reduce costs. At some point, this will change and resource companies will need to start increasing CAPEX.

Similarly, the overall market can only continue the last 7-years of cost cutting to increase performance to a point before reinvestment in future growth will be required. Interestingly, a comparison can be drawn with the transition of economic direction between countries who have quantitative easing policies which are drawing to a close while we’re starting to see increased discussion around fiscal policy; i.e the increasing role of Government in supporting growth rather than central banks.

As subscribers know we are bullish global equities for the next 3-6 months hence we find ourselves thinking, should we be looking at resource stocks, or mining services, for potential trading opportunities?

Emerging Markets ETF Weekly Chart

Resource Stocks

Using history as a guide, this once in a decade recovery in resource stocks should last another 3-6 months, interestingly just as we are forecasting for the overall market.

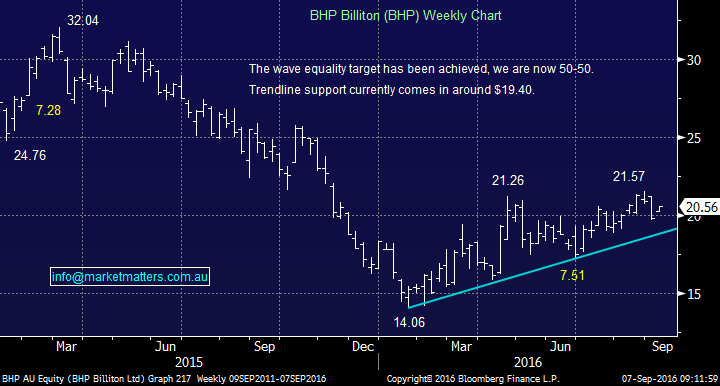

Today we have just reflected on 2 stocks because our views have not changed significantly over recent times. BHP has recovered over 50% from its panic lows but we would be now taking profit into strength, ideally towards $22. Buy weakness, sell strength has been a very obvious thematic in recent times. Interestingly, Deutshce Bank ran a heading on their BHP Note yesterday similar to one we used recently in our morning report; YOU GOTTA KNOW WHEN TO HOLD EM’. The next part of the quote is FOLD EM which we think is relevant at this juncture for BHP. DB have a $21 price target.

Source;Deutshce Bank Markets Research

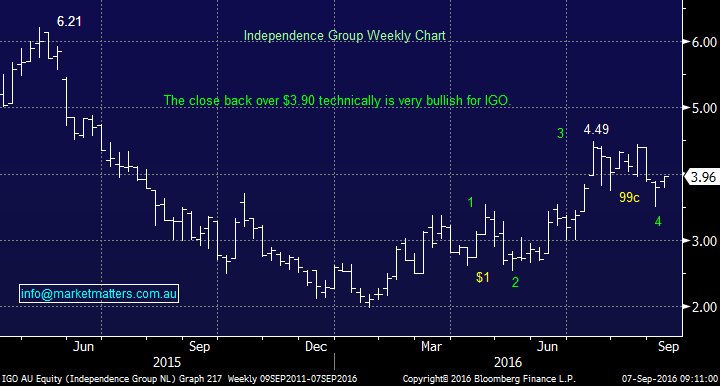

IGO which we own has rallied harder than BHP and similarly we are looking to take profit over $4.50. Yesterday IGO generated an excellent buy signal closing over $3.90. We decided not to increase our gold exposure as the risk / reward was not exciting and happily IGO was actually showing the best strength in the sector - gold stocks should be strong today.

BHP Billiton (BHP) Weekly Chart

Independence Group (IGO) Weekly Chart

Mining Services

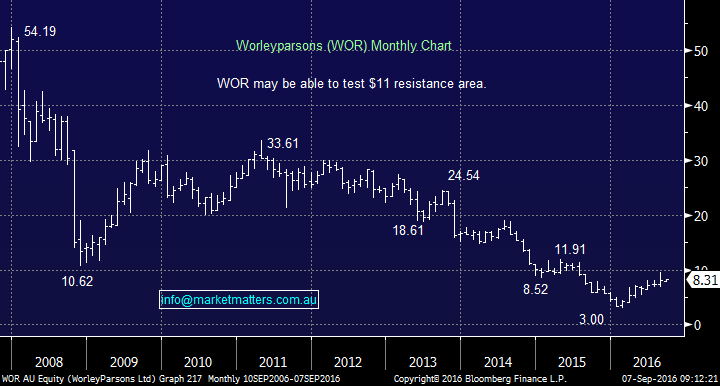

The mining services sector has also run hard as the market accepts that most of these higher end players will survive the commodities downturn but the damage has been enormous e.g. WOR fell over 94% from its 2008 highs. Today we have looked at 4 of the major players in the space from a technical perspective to see if anything looks appealing.

WOR -May reach the ~$11 resistance area but not exciting just here at $8.31.

MND - We are neutral in the mid $8 region.

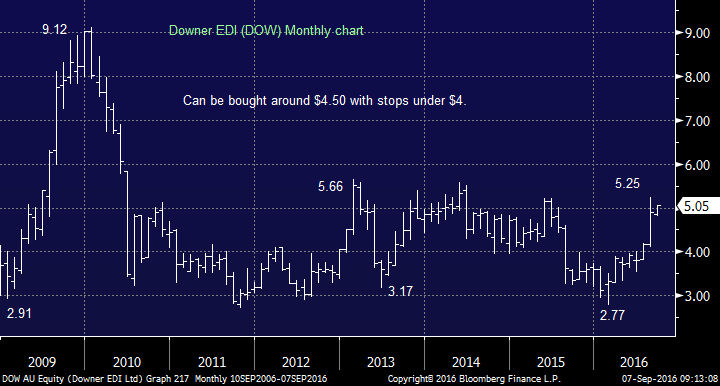

DOW - We can buy a pullback to around $4.50 with stops under $4.

BKN - We can buy around $1.70 with stops under $1.30.

Mining Services plummeted much further than the resources sector hence it is not surprisingly has bounced harder but WOR for example remains 85% below its 2008 high. We believe with the exception of a few aggressive trading opportunities the ship has sailed for mining services and the space no longer presents exciting risk / reward opportunities.

Worley Parsons (WOR) Monthly Chart

Monadelphous (MND) Monthly Chart

Downer EDI (DOW) Monthly Chart

Bradken (BKN) Weekly Chart

Summary

We prefer resource stock's over mining services for the remainder of 2016.

Overnight Market Matters Wrap

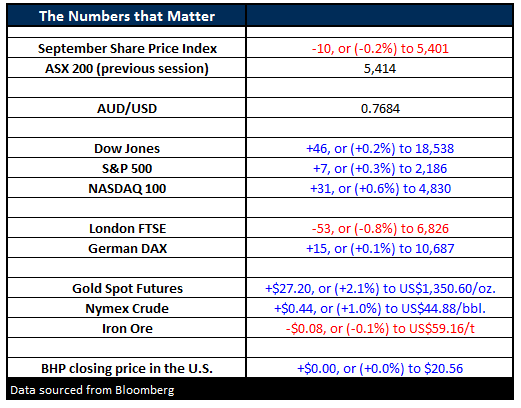

- The US markets started their week after a Labor Day holiday in the black, with the Dow ending its session up 46 points (+0.2%) to 18,538, whilst the S&P500 closed up 7 points (+0.3%) at 2,186.

- The share markets were stronger on the back of positive energy numbers, despite poor economic numbers. The ISM non-manufacturing PMI index came in at 51.4 - the lowest it’s been since 2010.

- Oil was stronger, even though there seems to be confusion after the meeting between Saudi and Russian Ministers. Crude finished up 44c (+1.0%) to US$44.88/bbl

- Gold was stronger, up US$27.20 (+2.1%) to US$1,350.60/oz on the back of a weaker US$

- The ASX 200 is expected to open down this morning 6 points, around the 5,407 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 7/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here