Market Matters Morning Report Friday 9th September 2016

Three speculative investments that could have legs

We typically focus on the larger, more blue chip style investments at Market Matters and look to be active around positioning in these better known, more liquid stocks. Going down the food chain into the smaller areas of the market, where information typically comes direct from the companies, liquidity can prove problematic and at times, major setbacks can occur as companies bring to market emerging technology, new medical products or focus on exploration or commercialisation of a mining asset. In today’s report, we’re going to focus on three stocks, all of which are higher risk, more speculative investments that will not be added to our portfolio, but look interesting none-the-less. We’ve met with management from all three companies to help form our views.

FirstWave Cloud Technology (FCT) 50c

FirstWave has a market capitalisation of ~$60m – so it’s small,however it’s pipeline of growth looks substantial. Where in the past, corporations would run applications or programs from software downloaded onto a physical computer or server in their building, cloud computing allows access to the same kinds of applications through the internet. For instance, if you update Facebook, you’re using the cloud, checking your bank balance, you’re in the cloud again. In short, most businesses are starting to use cloud computing and the scope of usage is expanding dramatically. It’s easier to be in the cloud because it’s more flexible, it’s typically cheaper, allows for remote access to applications, more collaboration, automatic updates and the list goes on. One of the main concerns however comes from security. How do businesses ensure the data, the application, the IP stored in the cloud is safe? They need a cloud based security solution, and this is what FCT has. For a business like FCT however, the biggest hurdle, once the solution is developed is selling it.

FCT’s solution was developed in partnership with Telstra Research Laboratories and this in turn, has meant that FirstWave has been able to integrate its security application into the Telstra Network. This partnership generates revenue now, however, is expected to generate significantly more into the future as the Telstra sales force is incentivised to roll out Telstra’s cloud applications. FCTs security solution is embedded in these applications and they earn a fee per user. Yesterday, FCT announced strong revenue growth from this partnership with the company well ahead of milestones they articulated to us when we met.

This is a small growth company, that is on track to be cash flow positive towards the end of this financial year – if not sooner. We can buy FCT ~50c with stops under 44c.

FirstWave Cloud Technology (FCT) daily chart

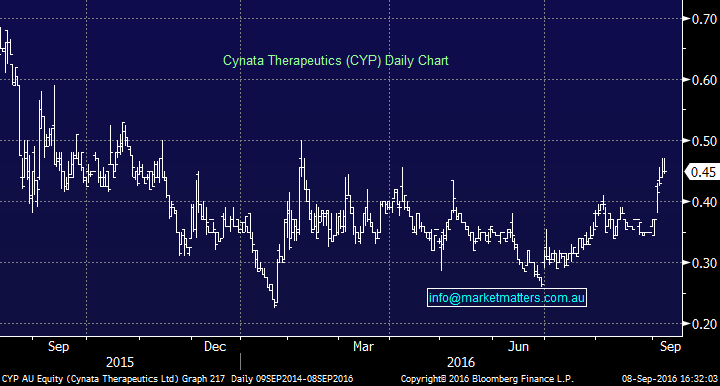

Cynata Therapies (CYP) 45c

Cynata has a market capitalisation of ~$32m and is a small cap stem cell company operating in the highly risky, highly speculative and at times highly rewarding biotech sector. The platform they have developed is a very complex one and the detail can be quite labour some, so we’ll do our best to simplify it for us all! Stem Cells have a wide variety of medical applications, and many researchers believe they will dramatically change the future of medicine. They are currently being used to treat more than 80 diseases and are being studied in clinical trials as treatments for countless other conditions. The main issue around Stem Cells is the ability to produce them on a significant scale given stem cells are harvested from a donor, typically from their bone marrow then reproduced.

CYP has developed a platform for manufacturing stem cells that don’t lose potency with expansion over successive generations and are infinitely expandable. FijiFilm, which is no longer a photo company , but one that invests a lot in up and coming medical treatments this week signed a non-binding agreement with CYP. The term sheet anticipates that, under a definitive agreement, Cynata will grant FUJIFILM various options to distribute their Stem Cell platform. In short, this is validation of CYP’s platform, with Fuji set to acquire Cynata shares to the value of US$3 million at a 35% premium to the 6 month VWAP as at 2 September 2016 – so, somewhere around the 50c mark. This is validation of what CYP has and it should provide support for the share price over the coming months.

We can buy CYP ~$45c with stops under 40c

Cynata Therapies (CYP) Daily Chart

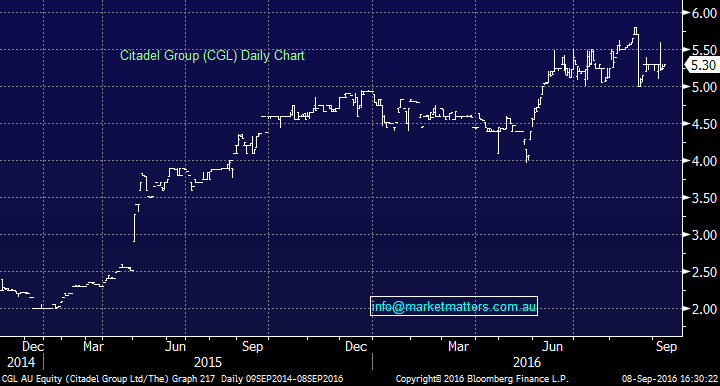

Citadel Group (CGL) $5.30

Citadel has a market capitalisation of ~$250m, so is larger than the two companies covered above. It’s also a technology company,however they target a more complex / trusted / high value market than FCT otherwise would. It’s all about managing knowledge in very complex, secure environments using technology. The Department of Defence uses them, as do other Government agencies. The Prime Minister visiting Afghanistan requiring a secure line into a G20 summit for example would use them. Highly complex tasks that require a bespoke solution is the market CGL operates within, and they do it well.

Along with the tech side of the business which generates around 75% of their earnings, they also have an education business which only accounts for about 5% of their earnings, but is still reasonably important. The company is profitable and tradeson 18x earnings, however on a cash adjusted basis this number drops to 15 times. The company is likely to have double digit earnings growth for each of the next 3 years and is on a multiple, lower than that of the ASX 200 – which has very little growth. The downside to this stock is it’s very tightly held with management owning the bulk of the shares, which means liquidity is now. We can buy around ~$5.30 with stops under $5.00

Citadel Group (CGL) Daily Chart

Summary

- Three smaller, interesting growth stocks that can be purchased around current levels

- Importantly, these are higher risk investments and should be considered within that context

- Liquidity in CGL can be limiting on entry as well as potentially on exit

***Watch out for the Weekend Report on Sunday to see our bigger picture views, including our exposures to Banks & Energy stocks***

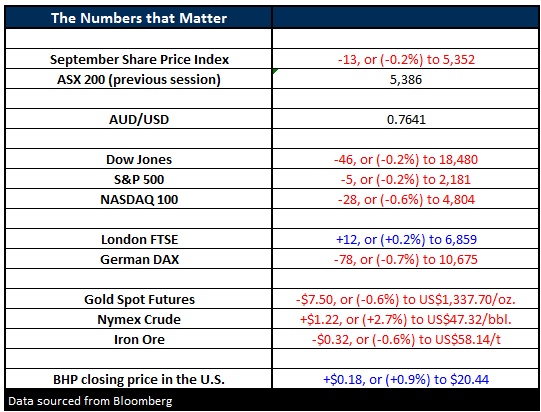

Overnight Market Matters Wrap

- The Dow closed 46 points lower (-0.3%) at 18,480, while the S&P 500 ended 5 points lower (-0.2.%) to 2,181.

- Interestingly, Banks continued to outperform the broader market as did the energy sector

- Volatility lifted slightly with on market weakness, up 4.8% overnight.

- The snakes and ladders game continues with oil, climbing 2.7% to US$47.32/bbl. after a lower than expected inventory number was reported in the US.

- The September SPI Futures is indicating the ASX 200 to open 30 points weaker, testing the 5,350 level this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here