Market Matters Morning Report Monday 12th September 2016

The questions - should we panic?

Good morning everybody, on what is likely to be a tough day for local stocks with the futures pointing to at least a 1.5% fall in early trading. Today, we have changed our usual question style report due to the large nature of emails received over the weekend on the same subject, following Friday’s savage decline by US stocks – basically, is it time to be scared?

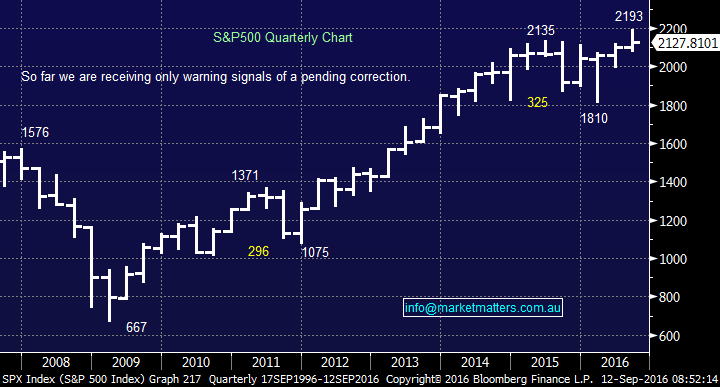

We have to ask ourselves, "is the bull market advance since early 2009 complete for US stocks?" If the answer is yes, then the likelihood is that the S&P500 will correct ~600-points minimum or a whopping 25%.

At this stage, as can be seen on the longer-term chart, Friday’s fall is hardly noticeable at this point in time. However, we have to reiterate we can see only a maximum of 10% upside from current levels, compared to at least 25% downside = clearly of concern.

US S&P500 Quarterly Chart

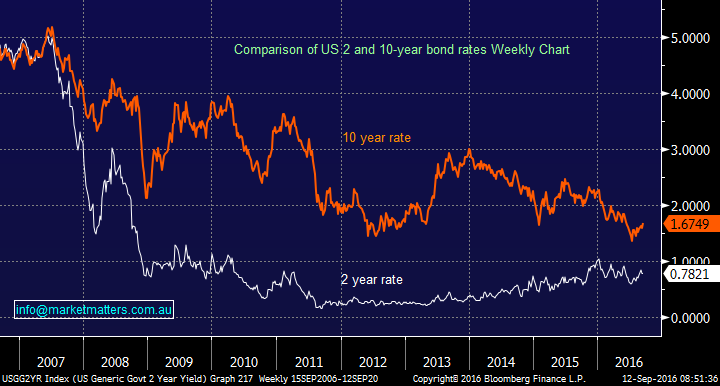

Friday’s decline in equities was not surprisingly, led by the bond market - a looming problem we have been flagging for many weeks. The ECB disappointed markets by not extending quantitative easing last week, lighting the fuse for a pullback in global bonds = higher interest rates. Rumours are now in overdrive around what Japan will do later in the month, as well as the whether the Fed will raise rates in September, December or even both.

As we have covered a number of times recently, investors should be prepared for rising interest rates, increased volatility and higher inflation - exciting times ahead!

The main characteristic of Friday’s shakeout in the bond markets, was the longer-dated interest rates rising faster than at the shorter dated, referred to as a "Bear Steepener". In simple terms, markets are pricing in more inflation and potentially some fiscal stimulus - scenarios we have discussed recently.

If central banks do engineer this rumoured steepening of the yield curve the likely motivation is to improve the economy by aiding the banks, which in turn will lead to more lending, hence helping the economy to grow.

Comparing US 2-year and 10-year interest rates

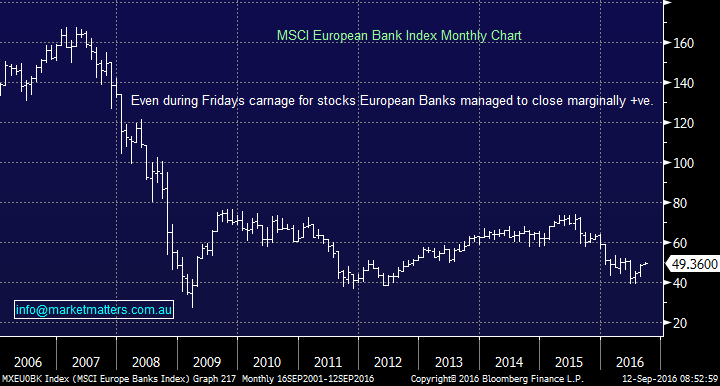

This "steepening" move in the yield curve is good news for banks margins / profitability. On Friday night during the carnage for stocks, European banks impressively managed to close positive, plus they actually closed over their 200-day moving average for the first time in a year. In the US where the sell -off became more aggressive, the banks closed down only 1.2%, around half of the fall across the broader market.

We remain relatively bullish banks at this stage in the cycle and for sophisticated investors "Buy-Writes" in the banks look very attractive into the anticipated weakness today plus increased option volatility.

NB We are relatively positive, but if markets get hammered, they are still likely to fall but by just a smaller degree e.g. US banks on Friday night.

MSCI European Banks Index Monthly Chart

We feel that Friday’s deep correction by US equities owes a large part to the recent history breaking period of sideways movement. Rate rises in the US is likely nothing new and a move to steepen the yield curve should be positive for the banking sector. At this point in time, we do not see this as a "Black Swan" style news that should send stocks into a tailspin, but major follow through tonight will technically be very concerning.

At this point in time of writing this morning's report, the US S&P500 futures have opened basically unchanged which is some short-term comfort.

Summary

We are not bearish US stocks at this point in time, but the risk / reward profile at this point in time is NOT compelling to aggressively buy the broader market. Unfortunately, the ASX200 does now feel to have peaked at 5611 for 2016, hence we will be looking for countertrend rallies to lighten our overall equity exposure.

We remain relatively bullish banks and negative quasi-bond style stocks. For sophisticated investors, we like buy / writes in the banks into current weakness and high volatility. We will explain this in more detail in tomorrow morning’s report.

Overnight Market Matters Wrap

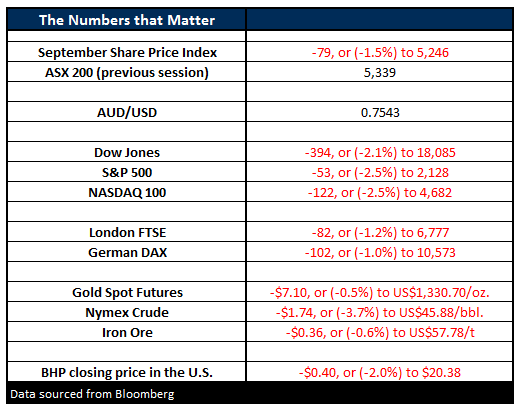

- The US markets closed down with a thud on Friday, with the Dow having its worst day since 24th June. All three markets suffered a similar drop of >2.5%, with the Dow down 394 points (-2.13%) to 18,085, the S&P 500 was down 53 points (-2.45%), whilst the NASDAQ had a similar drop, down 122 points (-2.55%) to 4,681.

- Uncertainty gripped the markets on Friday, with traders unsure whether the Fed will raise rates this month or December.

- Oil dipped lower even though there were reports that Saudi Arabia and Russia would work together to rebalance markets. Crude Oil finished down US$1.74 (-3.7%) to US$45.88/bbl. Oil still managed to finish up for the week +3.4%.

- Gold suffered on a stronger US$ after Fed governors continued to make more hawkish comments that rates should rise very soon. Gold finished down US$7.10 (-0.5%) to US$1,330.70/oz.

- The ASX 200 is expected to open down aggressively this morning by 90 points, around the 5,250 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here