Market Matters Morning Report 23rd September 2016

Australian Tourism Looks Exciting Going Forward

Currently, one of the hardest factors when investing in the Australian stock market is to find companies / sectors with decent growth potential moving forward that are on reasonable valuations. In a lot of instances, companies that have demonstrated strong growth over recent years are priced expensively, primarily due to the scarcity of such stocks. These high valuations lead to significantly increased investment risks when the companies hit a plateau, or worse. This month clearly illustrates these risks with the worst two performing stocks fitting that description. They have been priced expensively after excellent growth but failed to produce e.g. Blackmore's -27% and TPG Telecom -29%.

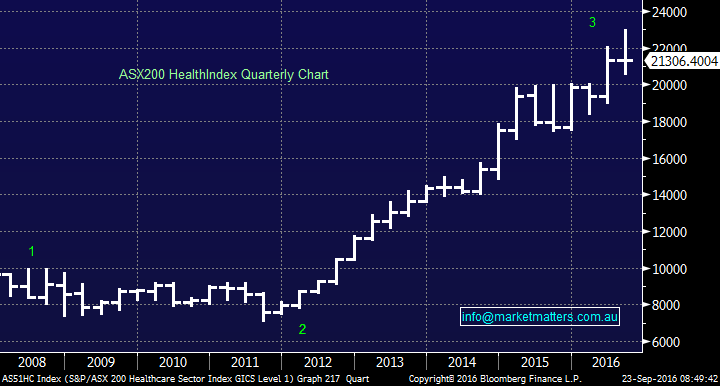

One sector we are very bullish on is tourism, primarily due to the huge increasing volume of travellers coming from China. This theme is in its infancy and is a longer-term thematic however being positioned early on in the piece makes sense. While this may be a sector theme that we have mentioned over recent months and one which will come as no surprise to many, striking a comparison with the healthcare sector can be illuminating. Investors were well aware of the aging population 10-years ago, which should make the healthcare sector be a strong performer, which it was! The Australian Healthcare Index has rallied over 250% over the last decade i.e. if the sector view is correct, returns will follow.

Australian Health Index Quarterly Chart

Sydney Airport (SYD) recently released another set of excellent traffic numbers. SYD has seen an increase of international tourists by around 9.5% over the last 12-months. This increase is strongly supported firstly by the growing Chinese middle class and secondly, by a dollar under 80c, as supposed to being over parity. Currently, only 4% of Chinese hold a passport, compared to ~35% of Americans. Brace yourselves, the Chinese are coming, think of the impact on property prices. Inbound tourism to Australia is accelerating, we believe this is just the beginning and tourism is a sector where investors should have some decent exposure going forward. Today we are going to focus on 4 stocks in the sector, which will benefit directly from the Chinese phenomenon, looking for the ideal investment candidates.

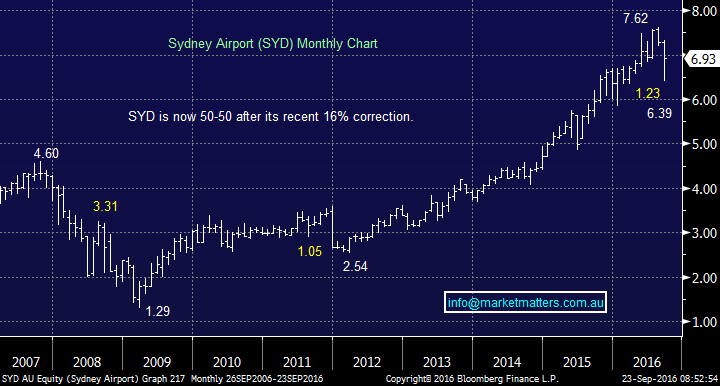

Sydney Airport (SYD) $6.93

Sydney Airport (SYD) has been the go-to travel stock in recent years, which makes perfect sense as it’s a great business with sensational long life assets and high levels of free cash flow. However, the backdrop of rising interest rates globally means we’re ideally looking elsewhere for our travel exposures, as SYD has been treated as quasi-bond / safe stock investment over recent years.

We went negative on the stock when it was trading close to $7.50, but after its 16% correction as the "yield play" stocks were down, we are now neutral. The company is clearly positioned to benefit from the Chinese influx, but it remains expensive and will suffer as their cost of debt increases.

Sydney Airport (SYD) Monthly Chart

Mantra Group (MTR) $3.20

Mantra (MTR) $3.20 operates Australia’s second largest network of accommodation properties, with more than 20,000 rooms in Australia, New Zealand, Indonesia and Hawaii. Since listing in 2014, Mantra shares have gone from ~$1.70 to $5.26 and are now back at $3.20. The most recent weakness is a result of three main concerns. Change in Management, concern about Airbnb and perception that the recent acquisition in Hawaii increases the company risk profile and implies they have fewer growth opportunities domestically.

We believe these concerns are overblown and the hotel operator looks appealing in the low $3.00 region, running stops below $2.80. We continue to believe a run up into the $4 region is a strong possibility. A current forward P/E of 16x is not a challenging valuation.

We are buyers of MTR at current prices.

Mantra Group (MTR) Daily Chart

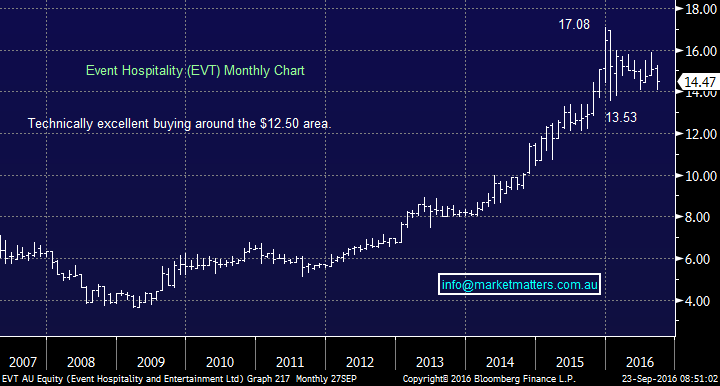

Event Hospitality (EVT) $14.47

Event Hospitality (EVT) is the former Amalgamated Holdings and operates a diverse group of businesses from cinemas, Thredbo Ski Resort to standard style hotels / resorts. Clearly, it's the hotels and resorts that will benefit from the swelling numbers of international travellers.

The stock has recently corrected 15% from the $17 region. The current P/E of 16x forward earnings is not too demanding.

We could be buyers at current levels with the plan to add to holdings under $13.

Event Hospitality (EVT) Monthly Chart

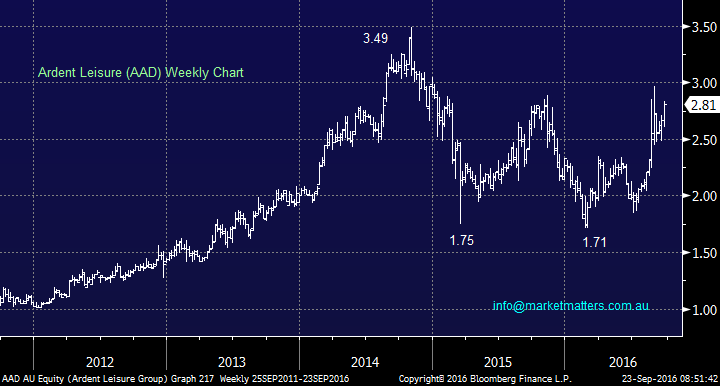

Ardent Leisure (AAD) $2.81

Ardent Leisure (AAD) has brands like Dreamworld and White Water World, Good Life Health Clubs & AMF bowling in Australia, however, their focus recently has turned more towards the US with their Main Event entertainment business – which is showing good growth. This business offers exposure to both Australian and US tourism which we think is appealing.

AAD is again trading on a reasonable valuation of 17x. Technically, we can buy AAD targeting a test of $3.50 with stops under $2.25.

Ardent Leisure (AAD) Weekly Chart

Summary

We are very keen in the tourism sector on a longer term basis, our view of the 4 stocks covered are:

1. SYD - A great company, but not trading on an attractive valuation. We would be keen buyers ~$6 over 10% lower.

2. MTR - We like MTR at the current $3.20 price, with stops under $2.80.

3. We like EVT at current prices, but would only buy ‘half size’, leaving flexibility to add to the position under $13.

4. AAD - We like AAD at current $2.80 level, with stops under $2.25.

*Watch for alerts.

Overnight Market Matters Wrap

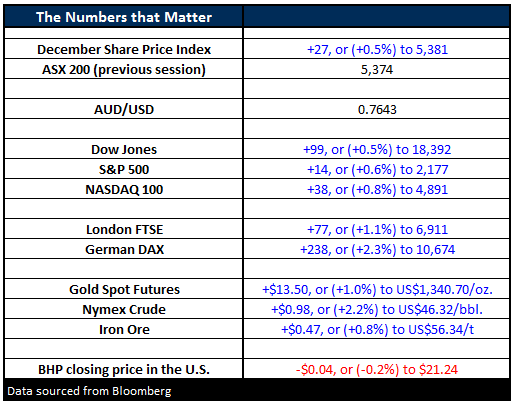

- The US share markets resumed its post interest rate decision rally overnight, with the NASDAQ ending its session at a record high.

- The Dow closed 99 points higher (+0.5%) at 18,392, while the broader S&P 500 was up 14 points (+0.6%) to 2,177.

- The commodities sector pushed higher overnight, with Crude oil settling up 2.2% to US$46.32/bbl. and Gold up 1% to US$1,340.70/oz.

- The December SPI Futures is indicating the ASX 200 to test the 5,400 resistance this morning, up 26 points from the previous close.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here