Market Matters Morning Report Wednesday 28th September 2016

Investigating the Financial Sector

Over recent weeks, we have covered in detail our short-term bullish stance on the banking sector which seasonally kicks off on Monday (start of October). Today with equities swinging up and down on the popularity of Donald Trump, we thought it would be an ideal opportunity to look at 4-stocks within the related Diversified Financial Sector.

The ongoing bank bashing has probably got most readers feeling that the banks have been an awful investment over recent times, but they are down only 0.8% as a sector over the last year, while paying some excellent fully franked dividends - better than a term deposit. The Diversified Financials are actually just positive over the last year, but there have been some extreme individual stock moves within the sector, including two where we have been invested - Henderson Group (HGG) -32% and Challenger Group (CGF) +34%. Today we have deliberately focused on 4-stocks that often receive less coverage.

The wealth management company, IOOF Holdings (IFL) was smashed in June 2015 after allegations from Fairfax around potential wrongdoing. This was later disproven, however, the share price has struggled to recover over the last 12-months and remains around the $9 level.

In August, the company announced a weaker than expected result with a $173.4m profit, and we saw some downgrades on the back of it. Most concern centres around the obvious pressure on margins and it seems the business is struggling to grow organically. They’ve shown their willingness to make acquisitions in the past and it seems likely that they’ll continue to sniff around for deals in an attempt to grow earnings, particularly if the big banks look to offload their wealth management divisions, which seems likely.

The shares trade on an est. 2017 P/E of 15.9x, with an attractive 5.7% fully franked yield - they trade ex-div. 26c fully franked tomorrow.

IFL looks fair value here and can be bought with tight stops at $8.60.

IOOF Holdings (IFL) Monthly Chart

Magellan Financial (MFG) enjoyed a great run since 2014, but early in 2016 the stock was rerated as its growth plateaued. The stocks now trades on an est. P/E of 19.2x 2017 earnings which is more realistic relative to its likely growth, however, the share price has failed to deliver on the company’s exposure to the strong US market and we see no compelling reason to be a buyer at present.

We are neutral MFG, with a negative bias.

Magellan Financial Group (MFG) Weekly Chart

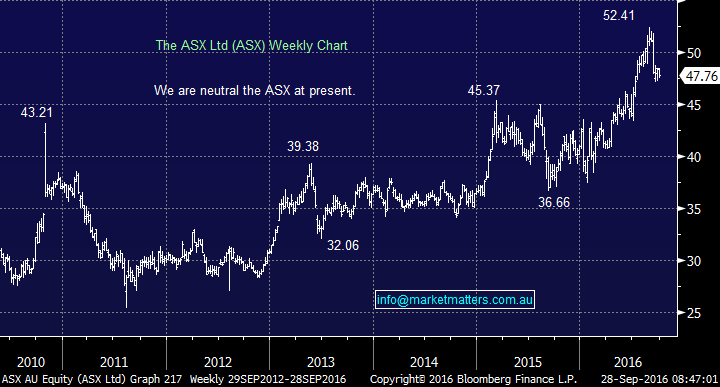

We all know the function of the ASX (ASX) and they owe a significant proportion of their success to having such a dominant market position (89% market share) – a monopoly until very recently which has led to sublime margins of around 77% . Chi-X has now entered Australia but has yet to impact the ASX in any meaningful manner.

For the ASX to reach its full potential, we believe it should merge with a major Asian exchange, but its perplexing why this has not yet occurred. The stock trades on an Est. 21x P/E for 2017 and pays a 4.15% fully franked dividend. Earnings are stable and reasonably predictable, meaning this is a low-risk stock. It’s expensive relative to its historical multiple (but so is the overall market) however when compared to global peers which trade on 21.7x, it’s slightly cheap - if we price of that multiple we get a price nearer to $50.

We are neutral the ASX at present with no clear view at current levels.

ASX Ltd (ASX) Weekly Chart

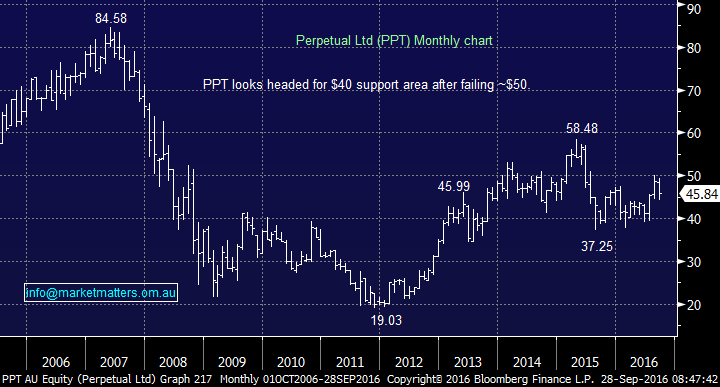

Perpetual (PPT) has endured a tough time since mid-2015, with the stock down over 20%. In April of this year, they announced net fund outflows of $400 million for the quarter ending March31 2016.

Overall funds under management (FUM) were down $1.1 billion for the quarter, as market falls shaved another $700 million off total FUM, which stood at $29.8 billion.

PPT trades on an Est. P/E of 16.4x 2017 earnings while paying a 5.6% fully franked yield. It seems there is a growing preference for smaller, more nimble players in the funds management game, and bigger is no longer naturally better.

We are neutral PPT here, but with a definite negative bias with a retest of $40 looking a strong possibility.

Perpetual Ltd (PPT) Monthly Chart

Summary

Unfortunately not a particularly exciting group of stocks upon closer inspection:

1. We are positive IFL, with stops under $8.60 or $8.30 after they trade ex-dividend tomorrow.

2. We are neutral the ASX.

3. We are neutral / negative PPT and MFG.

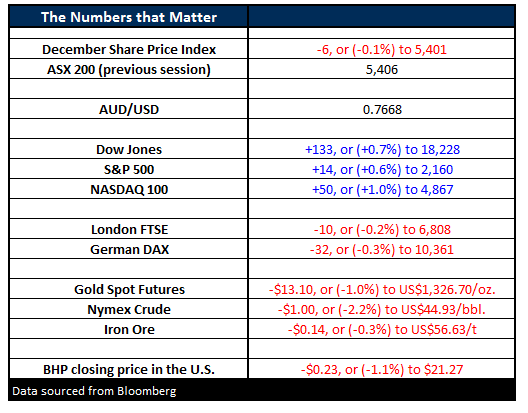

Overnight Market Matters Wrap

- US stocks closed higher on Tuesday, with the Dow up 133 points (+0.7%) to 18,228, while the broader S&P500 finishing on par, up 14 points (+0.6%) to 2,160.

- The energy market was again weaker overnight, with Crude dropping US$1.00 (-2.2%) to US$44.93/bbl. Reports from the Saudi Arabian Energy Minister mentioning he didn’t expect there would be an agreement on output cuts in the Algerian meeting, however, a production freeze deal was possible later in the year.

- BHP finished square in both London and the US, however, with the currency move overnight, BHP closed an equivalent of $21.27 in the US, down 1.1% from Australia’s previous close.

- Gold lost a little ground on a strengthening US$ after the market gave a pass mark to Hillary Clinton in her debate with Donald Trump. Gold was down US$13.10 (-1%) to US$1,326.70/oz.

- The ASX 200 is expected to open stronger this morning around the 5,420 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here