Market Matters Morning Report Wednesday 5th October 2016

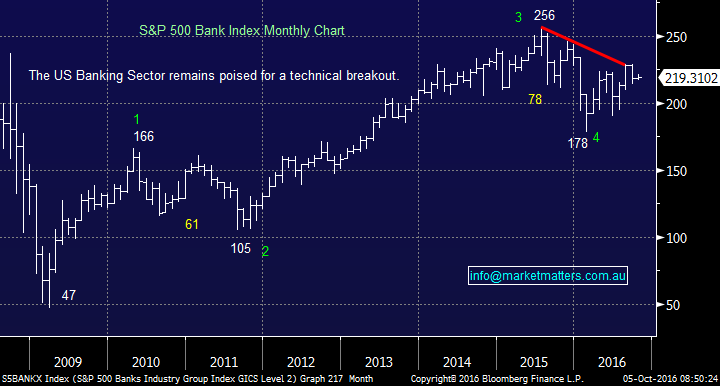

The interest rate story is not going away.

Markets felt like they had shaken off concerns around looming interest rate rises over the last 2-weeks but they came back with a vengeance last night. Bloomberg News reported that the European Central Bank (ECB) will likely reduce bond purchases as it slowly ends quantitative easing and this was enough to send shock waves through some markets.

It clearly tells us that investors are not prepared for the inevitable higher interest rate environment on the horizon. Although this morning’s report does cover some old ground, the topic is an extremely important one for investors, and in our view will be the most important macro theme in 2016/17.

Overnight, the most noticeable move was gold which plummeted over $US40/oz, the most in 3-years, as a combination of potential rate hikes and minimal inflation is a simply awful underlying environment for the precious metal. Our expectation of rising interest rates has restrained us from taking a few shorter term buy signals in gold stocks recently and that is likely to look prudent today.

That said, one of the major elements capping inflation has been the price of energy, specifically Oil which we believe goes higher towards ~$60 following the move by OPEC to cut production last week. The $US dollar was higher last night and we believe this trend will continue. A higher $US is a negative for commodities generally and the trends overnight indicate that some commodities such as met coal have peaked short-term.

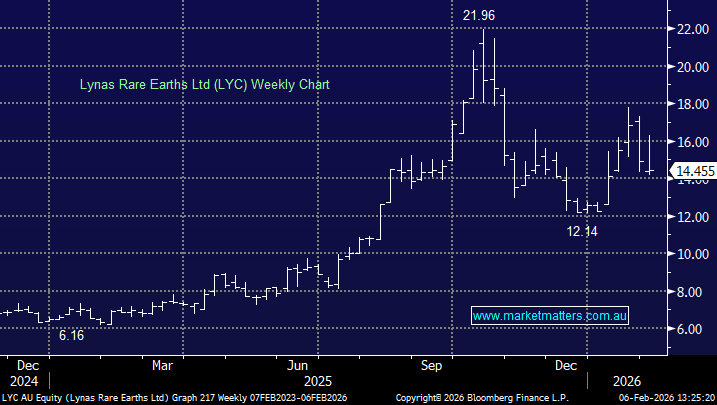

BHP is once again at the top of the range and we think it’s a SELL

BHP Billiton (BHP) Daily Chart

We’ve been looking for an entry into gold targeting Newcrest (NCM) or Regis Resources (RRL). Our first target on the downside for RRL is $3.40, over 10% below yesterday's close and +20% below the high for 2016. This may be achieved today. Failing that, and assuming the US Dollar Index can push towards our 105target, the next level sits ~$3.

This is another clear indication that investors should be more active in today's market and be prepared to take decent profits when they present themselves.

Regis Resources (RRL) Weekly Chart

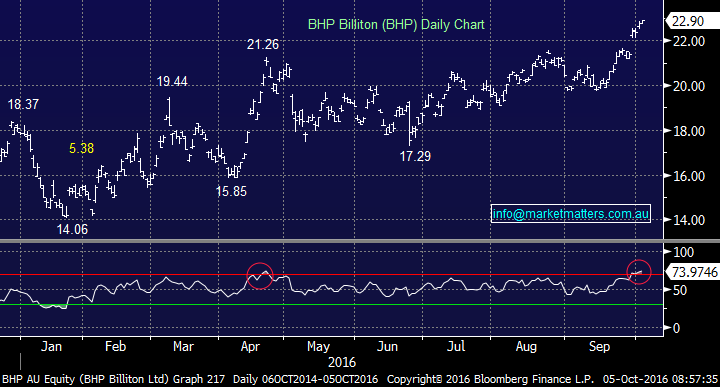

In yesterday afternoon report we said it was again time to sell Sydney Airports (SYD) after it had bounced 50c from the recent September lows, this is likely to look a very good call today. The stock was a major underperformer yesterday falling over 2% on a positive day and our strong feeling is it will be down more today.

Simply for the foreseablefuture the "yield-play" is an extremely dangerous game and one that is likely to result in a capital loss.

Sydney Airports (SYD) Monthly Chart

Considering that we saw an almost market backflip on its thoughts around interest rises over the last 24-hours the performance from stocks generally was very encouraging with the Dow falling less than 0.5%. As we discussed before its hard for a market to fall when investors are holding some of their highest cash reserves in history - looking to buy weakness.

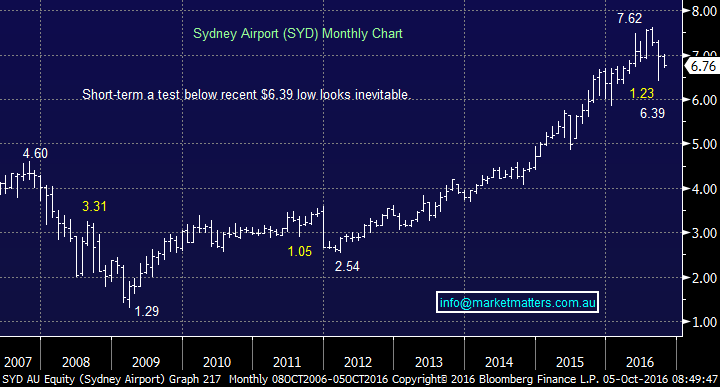

Also, It comes as no surprise amongst the selling on Wall Street last night only one sector closed positve - the financial sector which closed up 0.32%.

We stick with our relatively unpopular view that banks are the place to be at least for the short term. A gradual rise in interest rates are a positive for bank earnings

S&P500 Banking Index Monthly Chart

Summary

- Our belief is we have seen an inflection point and the bottom for this unprecedented low-

interest rate environment is in e.g. German 10-year bonds may still have a negative yield but it feels a matter of time until they swing back to normality. - Expectations for higher global rates will likely push up the $US and put pressure on commodities in the short term

- A pick up in interest rates is good for banks profitability but very bad for the "yield play" in stocks.

- Stay long banks, take profits in commodities short term, and avoid the yield trade for now

German 10-year yield

Overnight Market Matters Wrap

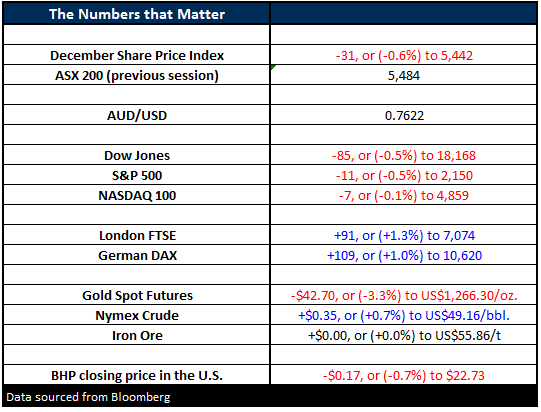

- The Dow fell last night as much as 138 points, before rallying slightly to close down 85 points (-0.5%) to 18,168. The broader S&P500 fell a similar amount, down 11 points (-0.5%) to 2,150.

- The US$ went to two months highs against the six major currencies in the US Dollar Index, finishing up 0.5% to 96.17.

- With the US$ higher, gold was sold off last night. The psychological support since August of US$1,300 was broken with the price settling down US$42.40 (-3%) to US$1,266.60/oz.

- Oil finished stronger however with Crude closing up 35c (+0.7%) to US$49.16/bbl.

- The ASX 200 is expected to open flat this morning, around the 5,484 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 5/10/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here