The Alcoa result is a poor sign short-term

Last night Alcoa shares tumbled over 10% after the US metals companies quarterly profit missed estimates, and perhaps more importantly lowered its future revenue forecast. The numbers were weak with nearly all divisions missing expectations and it’s not surprising to see shares hit hard. This is the last time we’ll see Alcoa report in its current form, with the company splitting in two.

Alcoa kicks of US reporting season and during more industrial times it was regarded as the sign of things to come from the market. That probably doesn’t hold as much weight now given the changing composition of the market, however, US investors are looking (hoping) for corporate earnings to improve after 4 quarters of declines. The good news is the market has low expectations (which is usual) with overall earnings expected to fall 0.7% - so if things can just come in ok / not too bad it should be overall market positive. Typically we see about 70% of companies beat expectations by a margin that would actually translate into earnings growth!

However, with US stocks trading on high valuations any misses by individual companies are likely to be treated ruthlessly and that was clearly evident overnight. The next 2-weeks will undoubtedly throw up some significant individual stock volatility in the US and it will be interesting to see its overall impact the market. Historically in an election year the stock market is fairly quiet into the vote - November 8th.

Technically Alcoa looks set to test close to $US25 but if this area holds the stock will look good on a risk / reward basis.

US Alcoa Weekly Chart

Last night was evidently a profit taking night in US stocks with the NASDAQ , which hit fresh all-time highs the previous session, underperforming other indices yet the specific stocks that were under the most pressure are not in the high-flying tech sector. This grab for profits while they are still available, may be around locally for a few days / weeks given our strong bounce from the 5200 level. As we wrote in the afternoon report yesterday, 5400/5375 is the logical target if we are to pullback – which we think is likely. Markets rally, pullback then go again. It’s the typical flow!

Australian resource stocks have enjoyed a stellar 2016 after 5-years of massive underperformance and we are now in the middle of the "once in a decade" mining recovery which as we have discussed previously should flow into 2017. However, these resource stocks have surged since January just like Alcoa leaving them vulnerable to sharp short-term corrections as investors lock in profits.

Our preference remains to energy stocks among resources hence BHP, WPL, and ORG but we will also consider trading opportunities, into weakness, for RIO and S32. Notably, Fortescue has run very hard and is currently showing no clear risk / reward opportunities.

BHP is not presenting any clear trading levels but it remains bullish while over $21.50 – it’s expected to open today around $23.20 i.e. down 2.5%.

BHP Billiton (BHP) Weekly Chart

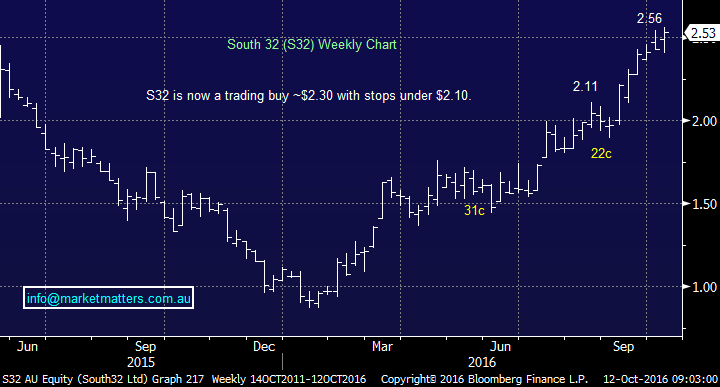

S32 has enjoyed a great run since September as the business has become a cash generating machine with coking coal and manganese prices high. Technically we are a trading buyer in the low $2.30 region with stops under $2.11-i.e. a 8% pullback.

S32 Weekly Chart

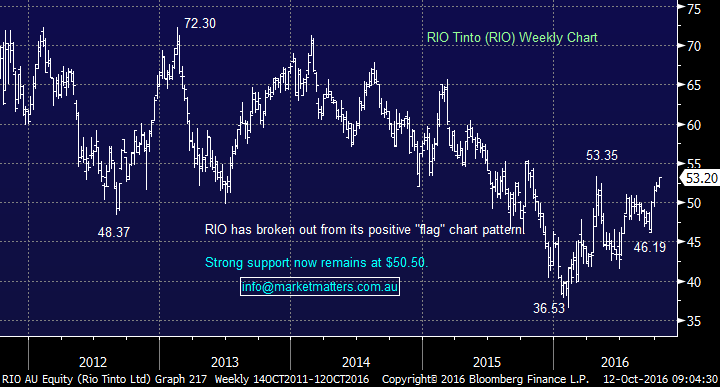

The RIO chart pattern is similar to that of BHP, but with alas no clear risk / reward opportunities - RIO remains positive while over $50.50 but there is strong technical resistance ~$53.

RIO Tinto Ltd (RIO) Weekly Chart

Summary

- We can see a short-term correction to the high performing resource sector with our favorite trading opportunity to buy S32 in the low $2.30 region with stops under $2.10.

- BHP remains tricky here and our preference recently was to sell into strength, with the view of coming back in at lower levels – BHP will open down ~2.5% today

Overnight Market Matters Wrap

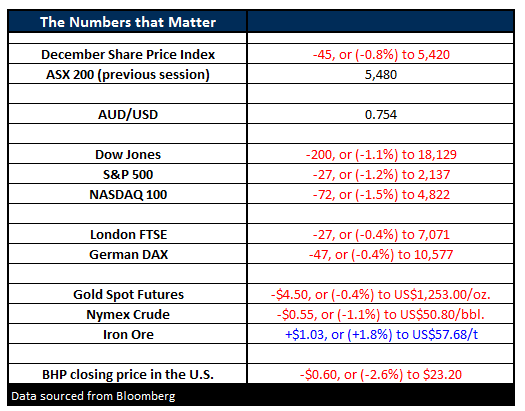

- The US markets finished down with the Dow closing off -200 points (-1.1%) to 18,128, whilst the S&P finished down 27 points (-1.2%) to 2,136.

- Health Care stocks led the markets weaker after the last Presidential debate had both candidates talking health care costs down.

- Crude down 55c (-0.6%) to US$50.80/bbl, after Russia came out on Monday saying they were prepared to cut production along with members of OPEC, although the timing remains unknown

- Iron Ore continued to improve overnight, with the metal climbing another US$1.03 (+1.08%) to US$57.68/t

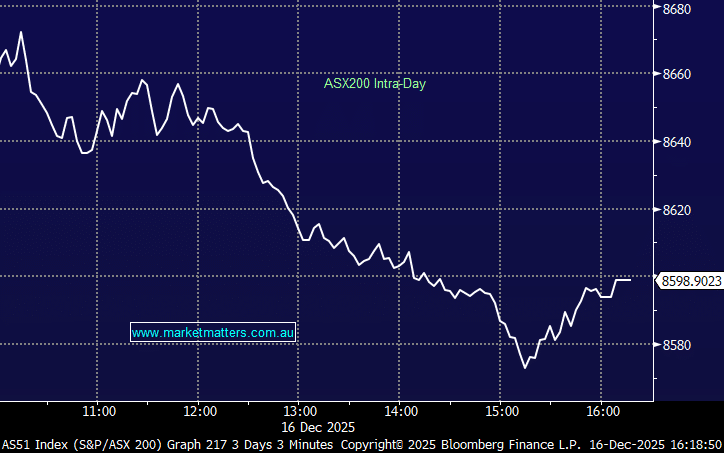

- The December SPI Futures is indicating the ASX 200 to open down 37 points this morning, testing the 5,442 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/10/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here