The Telco’s are not back in town – yet

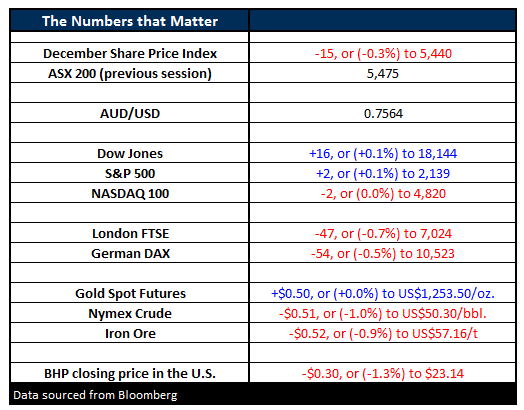

**Firstly, the ‘Numbers that Matter’ table in yesterday afternoons note was incorrect – we apologise for the inaccuracy. Alex, our resident spreadsheet jockey is travelling in the US for the next few weeks and we’re blooding new talent**

As you all now know October has seasonally been the best time for local stocks in recent times even with its scary reputation. We saw a great example of this October strength yesterday with the Dow falling 200-points but the ASX200 closed down only an impressive 5-points. Some more comparative numbers illustrating Octobers seasonal backbone:

- Banks have gained on average 4.01% in October since the Olympics in 2000.

- The best October was in 2001 with a gain of 14.29%

- The worst October was in 2008 with the loss of -4.40%

- 12 of the last 16 October’s has been positive for the Banks

- CBA has gained on average 6.6% in October over the last 5-years.

- October has been the best month for the ASX200 since the Olympics with an average return of +1.7%.

Around a third of our way into October 2016 the Banking Index is up 2.9%, CBA is up 3.6% and the ASX200 is up 0.7% - everything is on track for the month with more gains feeling likely. However, beware November is traditionally a poor month so we will very likely switch our positive bias over coming weeks i.e. Banks have their best month of the year in October followed by their worst month in November.

We strongly believe that the "yield trade" is over and probably so are the local rate cuts with the most likely next move by the RBA actually a rate increase.

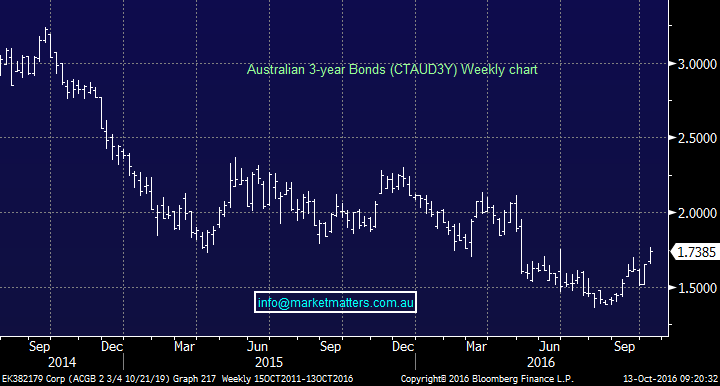

Bond markets are following our view and over the last few months, local 3-year bonds have seen their rate rise from 1.3% to 1.71% which actually represents an increase of over 30% in the interest rate.

Technically we are targeting a test of 97.60, or 2.4% which is where rates were at the end of 2015.

Australian 3-year bond yields Weekly Chart

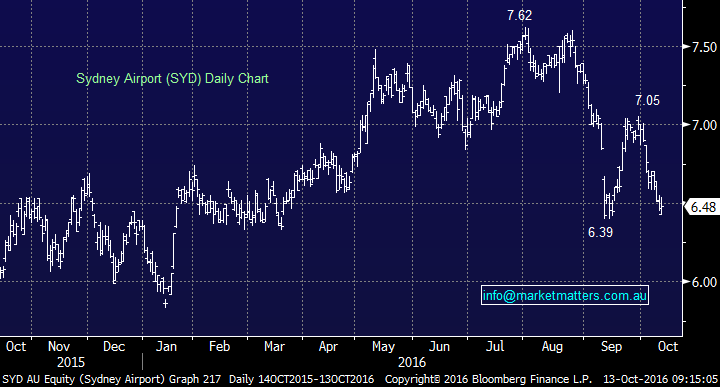

So far we have not mentioned the Telco's except perhaps explaining the main reason they have been hammered i.e. our belief that the interest rate cycle has come to its end. When we originally came to this conclusion we became bearish the "yield play" and in particular identified SYD as a sell, the stock has since corrected 16%. During this decline the stock managed to actually recover 66c (10.3%) from its September lows illustrating perfectly that stocks / markets rarely travel in one direction without dips / bounces.

While we have zero intention of going long SYD another 10% bounce feels close at hand.

Sydney Airports (SYD) Daily Chart

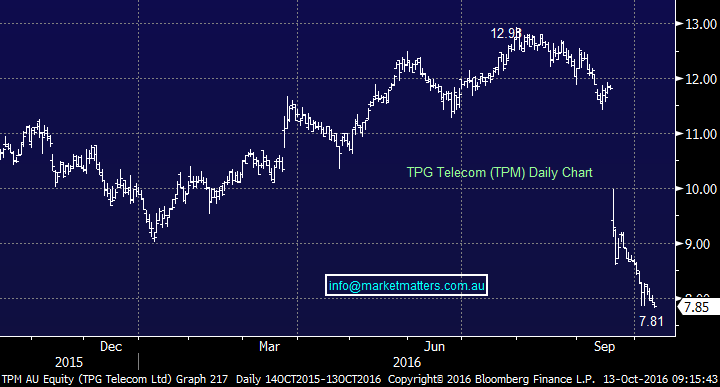

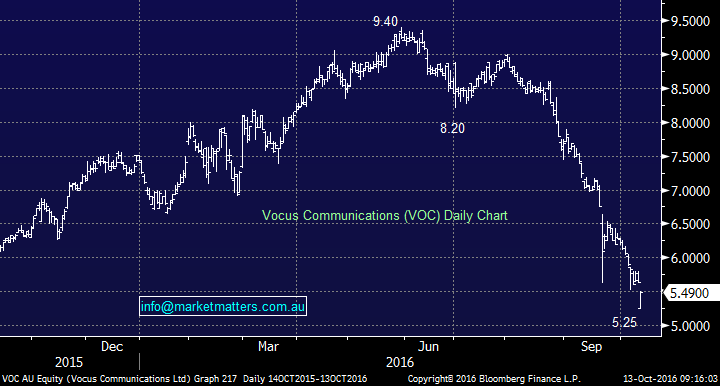

The Telco sector has been smacked 15% over the last year with obviously TPG falling 32% and Vocus 22% in the last month gaining the most attention. It should be noted that while we have seen the NASDAQ make fresh all-time highs in recent days the US Telco sector is also down 9.6% over the last 3-months as US investors adjusted their portfolios for a higher interest rate environment.

Our short-term view is the local Telco's are ready for a decent bounce but we note this would only be a trade for the extremely aggressive as our core view is rates move higher which is a definite negative influence on the Telco Sector.

After plummeting almost 40% technically TPM looks poised for a rally back towards $9 i.e. ~15%. Stops would be at $7.45.

TPG Telecom (TPM) Daily Chart

Similarly, Vocus who has fallen to the same degree looks ready for a bounce back towards the $6.50 area ~18% higher. Stops would be at 5.19. Yesterday’s relatively benign reaction to board upheaval is a good sign that a low is close at hand. We discussed VOC in yesterday afternoon note – available here.

Vocus Communications (VOC) Daily Chart

Summary

We will not be taking long trades in the Telco sector but we are using this view of a short-term bounce as some comfort for our exit plan from our poor long exposure to Vocus.

Overnight

- The US markets finished flat after the minutes were released from September Fed meeting affirmed the previous expectations of a December rate rise. The Dow finished up 16 points to 18,144.20 whilst the S&P500 finished just above the line, up 2 points to 2,139.

- Oil lost ground after it was reported that OPEC announced its September oil output was at eight year highs, which offset optimism over its expected cut to production in November. Crude finished down 51c (-1%) to US$50.30/bbl.

- Iron Ore took a step back after two days of strength since returning from a week long holiday. It closed down 52c (-0.9%) to US57.16/t.

- The December SPI Futures is indicating the ASX 200 to open down ~12 points this morning, testing the 5,462 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/10/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here