Time to lighten our banks?

Yesterday we experienced a relatively volatile session for local stocks with the combination of disappointing Chinese trade data and the sad news of the Thai Kings passing leading to selling across the board in global equity futures, which in turn dragged the ASX200 almost 40-points lower. Unsurprisingly the weakness was led by the resources stocks due to the significant negative Chinese influence with Fortescue -2.6%, RIO -2.7%, S32 -2.8% and BHP -2.9%.

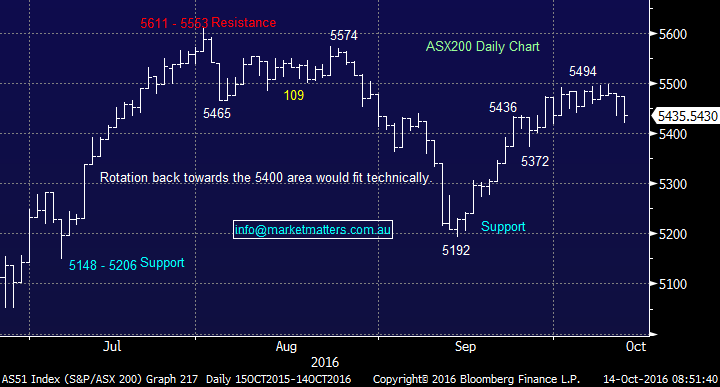

US stocks yet again recovered well last night after an initial poor start with the Dow rallying ~140-points from its lows. The local ASX200 appears to be slowly rotating back towards the 5400 area that we have flagged over recent weeks hence on the index level there is no change to our current thoughts.

ASX200 Daily Chart

The question we ask ourselves this morning is can we "add value" on the stock level within our portfolio. In the US last night the banking sector had a poor session as nerves set in ahead of JP Morgan and Citigroup's results which are likely to have a significant impact on the sector short-term.

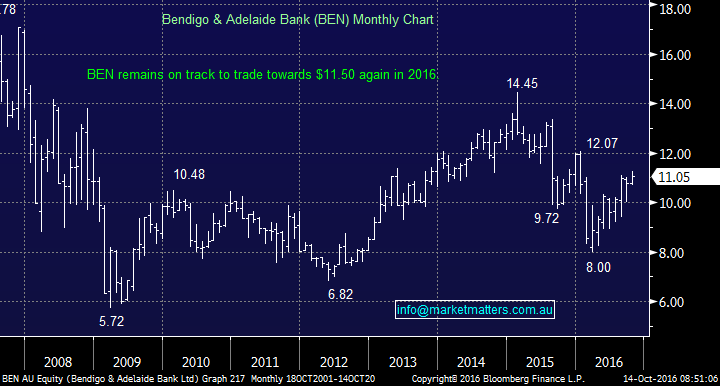

Whilst we remain positive the local banking sector for the next few weeks we are clearly overweight and Bendigo Bank has satisfied our objective - we have 8% of our portfolio in BEN which is showing a profit of almost 5% including a 34c fully franked dividend. The question is do we switch this BEN position into a resource stock that may come under pressure today, into another more industrial stock, into cash or simply do nothing ?

Bendigo Bank (BEN) Monthly Chart

The market sentiment has been swinging fairly markedly between expectations of improving global growth which would be supportive of stocks versus higher interest rates and lumpy growth which seems to cast a shadow over stocks. This volatility in sentiment is normal, particularly in times of significant policy change as it seems we’re about to experience. For that reason, we intend to take a more active approach towards our portfolio over the coming months.

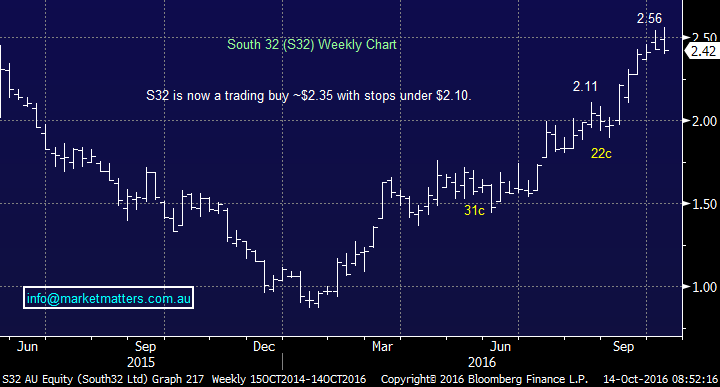

BHP is set to open down about 25c this morning, even after a strong night by crude oil implying the resources sector overall will start the day in the red. We identified S32 as a short term buy ~$2.35 with stops under $2.10 targeting fresh 2016 highs, ok risk/reward but a solid chart pattern for a company currently performing well. If taken, this would be a short term trading opportunity.

S32 Weekly Chart

Another company we have looked at recently as it's generated excellent technical signals is QBE Insurance. Technically QBE looks set for a rally towards $12 with the tailwind of higher US interest rates but the problem remains that it's been a serial disappointment as a company since the GFC and earnings continue to remain under pressure from weakening commercial insurance premiums. Certainly a trading stock at best.

QBE Insurance Weekly Chart

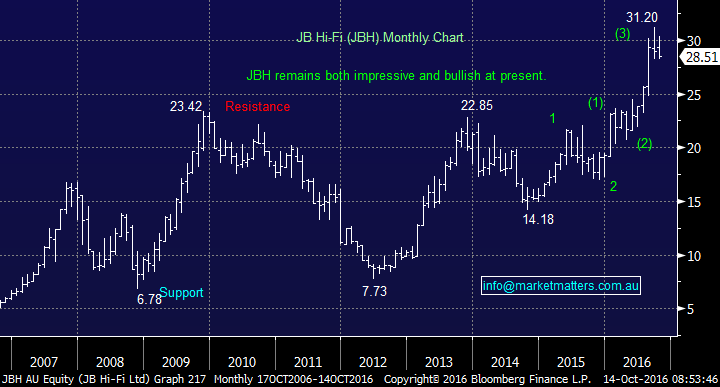

Thirdly a stock we have been bullish over recent times in the Weekend Report is JB HI-FI which traded at all-time highs last month. Again, the valuation here looks reasonably high making it a shorter term opportunity however it is a high quality business. We believe that JBH is a buy under $28.50 targeting the $33 area.

JB HI-FI (JBH) Monthly Chart

Summary

We will consider switching / selling our BEN position, potentially today, depending on the performance of some other stocks.

* Watch for alerts**.

Overnight Market Matters Wrap

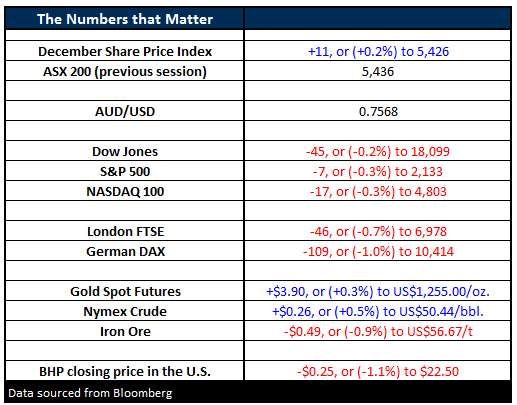

- The US markets had a volatile night with the Dow dropping early in the session over 184 points, before recovering to be down 45 points (-0.2)% to 18,099. The S&P500 followed suit, dropping below a technical support of 2,120 intraday, before finishing down 7 points (-0.3%) to 2,132.

- A mixture of weakness on Chinese figures released yesterday and stronger oil kept the market on the move.

- Oil prices initially weakened on the release of inventories numbers which showed an increase of 4.9m barrels, with analysts expecting only a 700,000 increase. However, traders then took note of the drop of distillates, which includes diesel and heating oil, which declined over 3.1m barrels, together with a decline of 1.9m barrels in gasoline.

- Gold managed a small increase on the back of weakness in the US$, finishing up US$3.90 (+0.3%) to US$1,255/oz.

- The December SPI Futures is indicating the ASX 200 to open up ~12 points this morning, testing the 5,462 area

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/10/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here