Are gaming stocks worth a punt?

Are gaming stocks worth a punt?

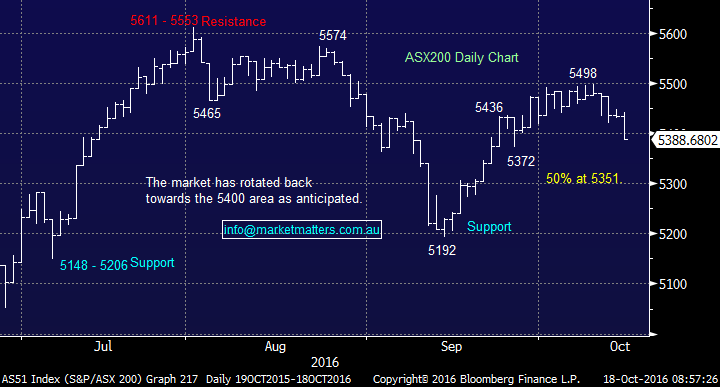

The local market got belted yesterday from late in the morning onwards led by signs of pending weakness from the US futures. The selling was pretty much across the board with the standouts real estate -2.5% and Telco's -2.4% while banks remained firm only falling -0.15%. We have been looking for a pullback to the 5400 area following the 300-point advance since mid-September, a strong market will now hold this area and commence a recovery back towards 5500 - time will obviously tell however this remains our stance.

The standout story yesterday was the arrest of 18 employees of Crown Resorts (CWN) in a huge crackdown on foreign casino operators. Today we ask ourselves, especially as we are sitting on a 14% cash holding, is this an opportunity for bargain hunting in the gaming sector?

ASX200 Daily Chart

The arrests are a very clear signal that China is focusing on overseas casino operators using their marketing operations to entice Chinese nationals to their casinos to gamble. They have been operating in a very "grey area" at best as it’s illegal to promote gambling directly in mainland China, however, you can market a ‘tourism destination’.

This also fits with the wider clampdown on capital leaving China, given that gambling is a major way that capital can be exported internationally. Put simply, it cannot be underestimated the impact of the Chinese government on any industry when they decide to act - there is no senate in China to appease! When China clamped down on junkets back in early 2015 CWN shares were smacked and they are still currently trading almost 40% below their 2014 highs.

CWN was punished 13.9% yesterday with no obvious technical support coming in until ~$10, or another 10% lower. The key issue for Crown at this point stems from the development of the impressive Barangaroo casino in Sydney, which is a VIP casino, aimed directly at Chinese high rollers. At this point, VIP high rollers account for about 25% of Crown’s revenues, however, in terms of actual earnings, the number is closer to 10%. Still, that number would increase post the Barangaroo development and this is clearly the concern from a markets perspective. Crown could easily come under further pressure short-term as a result.

Interestingly a similar story unfolded about a year ago with a number of Korean gaming companies being targeted. Perhaps the lesson to be learned here is the stocks have not yet recovered, Paradise is down a painful 50% since the arrests and Grand Korea Leisure 40%. Very importantly for Crown, VIP revenues are down ~40% for the two casinos.

Given the Chinese Government seem to be focussing their attention on Australia, it would be very plausible to think that Chinese VIP gamblers would look elsewhere in the short term. Why put yourself in the firing line of an agitated Chinese Government?

Crown (CWN) Monthly Chart

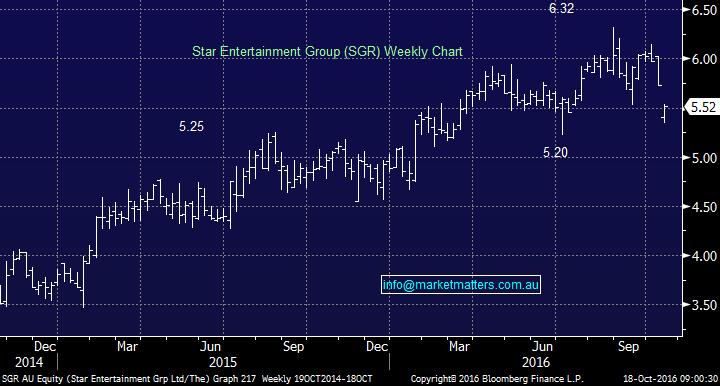

Star City (SGR) announced excellent growth numbers in February driven by the domestic market and in fact the VIP's had a negative impact on actual earnings after 6 large high-rollers went on a "freaky" winning streak. SGR operates Star City in Sydney, Jupiter's on the Gold Coast and the Treasury in Brisbane with ~30% of Chinese visitors to Sydney walking through the front doors of their Sydney casino.

SGR ran a similar marketing operation in China, with staff on the ground. These staff have subsequently been brought out of the country as the CWN news unfolded. In terms of revenue, International VIP which is primarily sourced from the wider Asian region including China, accounts for almost 28% of revenue and about 13% in terms of earnings – so, more than Crown.

We have a preference for SGR over Crown given the added uncertainties created from Barangaroo but the hard question is, what is good value? The stock is trading on a 17.98x P/E for forecasted 2017 earnings and pays a 2.36% fully franked yield, not particularly cheap on market terms and with heightened uncertainty to earnings, we would get more positive on SGR under $5 i.e. ~10% lower.

Star Entertainment Group (SGR) Weekly Chart

Sky City (SKC) operates in Adelaide and throughout New Zealand hence no significant exposure to the Australian tourism theme we like. Technically SKC is neutral around this $4 region and we see no compelling reason to be a buyer technically or fundamentally.

Sky City Entertainment (SKC) Monthly Chart

Summary

- The actual impact of this news is uncertain making it hard to make a call, however, our experience suggests these types of events linger, and create weakness for longer than most expect. ·

- While SGR was sold 3.7% yesterday as the whole sector was dragged down by the CWN news we do not believe it's cheap enough to take on the short-term trade.

- CWN is simply too hard here and we see more downside risks than upside potential.

- We have no significant view on SKC here and prefer SGR if we are going to dip our toe in the gaming sectors hot water – but at lower levels

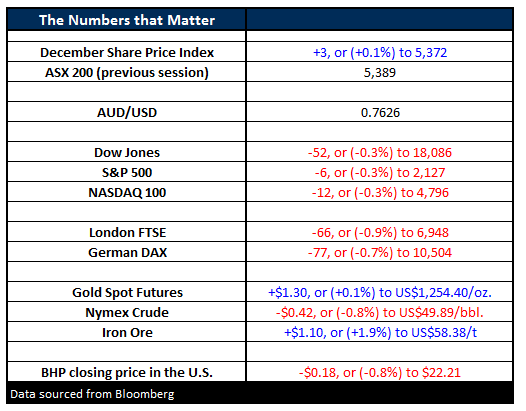

Overnight Market Matters Wrap ·

- The US markets took a backward step last night with the Dow finishing down 52 points (-0.3%) to 18,086. The broader S&P500 followed suit and dropped 6 points (-0.3%) to 2,126. ·

- Oil dropped on concerns about oversupply and the upcoming expiry of the commodities futures market. Crude dropped 42c (-0.8%) to US$49.89/bbl. ·

- Gold, however, rose on the back of a weaker US$, with the price rising US$1.30 to US$1,254.40/oz. ·

- Iron ore continued to improve, with the price up US$1.10 to US$58.38/t, up 1.9% ·

- The ASX 200 is expected to open up ~7 points this morning, around the 5,395 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/10/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.