China is not a licence to print money!

Yesterday Bega Cheese (BGA) was hammered 16.8% after writing down the value of its infant formula joint venture with Blackmores saying that since they launched the venture early this year, changes to Chinese regulation have resulted in an oversupplied market for baby formula which has forced a decent drop in prices. The company now saying that the ‘change in market circumstances has seen our expected sales not materialise at levels that were initially forecasted’ or in other words, we’ve gotten it wrong and now need to back pedal.

Bega was the dominant partner in the deal and have the most to lose. It seems they were too late to the party, enticed by ‘surging demand’ which lifted prices. It reminds us of the Iron Ore space. At the peak it was trading above $190 but then a wave of new production came online – enticed by the high prices, supply then exceeds demand and prices drop sharply. Throw in the added swing factor of the flippant Chinese regulatory environment and we suddenly get a fairly risky environment.

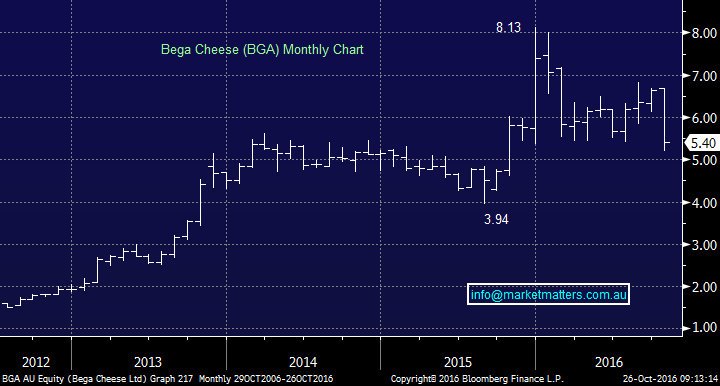

In terms of Bega, it’s yet another example of a stock not delivering when it's trading on a demanding valuation and hence suffering a painful retracing in price. BGA closed on an est. P/E of 22.2x 2017 earnings so we feel further weakness is highly likely. The company is forecasting flat earnings in the year ahead which is not an exciting short-term outlook.

Suddenly BGA is facing major headwinds not considered by many investors during most of 2016 with the below 3 looming large:

1. The ongoing risks of regulation changes in China.

2. Supply increases more than capable of meeting changing demand.

3. Fresh supply avenues leading to oversupply and hence discounting.

We see no reason to catch the BGA falling knife with a test of 2015 lows ~$4 feeling a strong possibility i.e. over 20% lower.

Bega Cheese (BGA) Monthly Chart

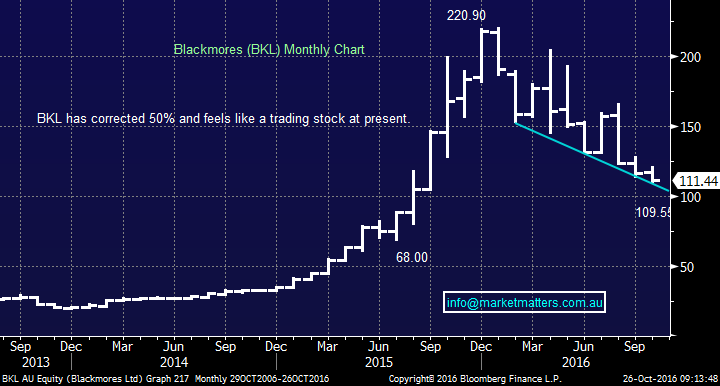

Blackmores also fell over 1% yesterday and Bellamys (BAL) almost 3% on a strong day for stocks. As we have discussed previously stocks that "crack" China should reward investors handsomely but pitfalls exist as many will fail. The key issue for the ones that fail it that they’re typically priced for success, and therefore you get big re-rates in share prices on any slip-up. BKL has now corrected over 50% from its highs in January and finally with the stock trading on a valuation of 18.5x 2017 earnings the downside risks have clearly improved. However, the current volatility and regulatory risks around China make this a high-risk investment to us.

We see better risk / reward elsewhere - a more conservative stance than we were adopting a few weeks ago.

Blackmore's (BKL) Monthly Chart

Bellamy’s is looking far more appealing than BKL at present but the est. 2017 P/E of 20.4 is a little richer but not overly scary for a growth stock. BAL has a better position from a regulatory perspective in China and does seem to be positioned nicely for the increasing demand for Australian organic products locally as well as in China / Asia. It’s not just aa one trick pony.

We are bullish BAL targeting fresh highs over $16.50.

Bellamys (BAL) Weekly Chart

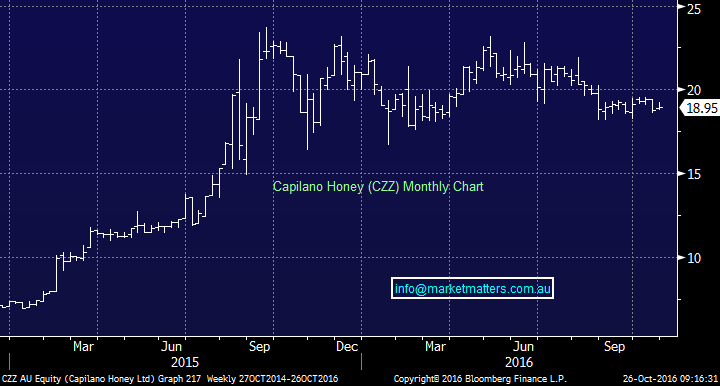

On the smaller-cap space that is China facing we still like Capilano Honey (CZZ) but technically under $18, and ideally under $17. CZZ is currently trading on an est. 2017 P/E of 15.8x which is at the cheaper end of town.

Capilano Honey (CZZ) Monthly Chart

Summary

- Within the China, theme BAL is by far our preferred investment under $13 with stops under $11.70.

- We still like CZZ in the smaller-cap space but want to buy weakness ideally under $17.

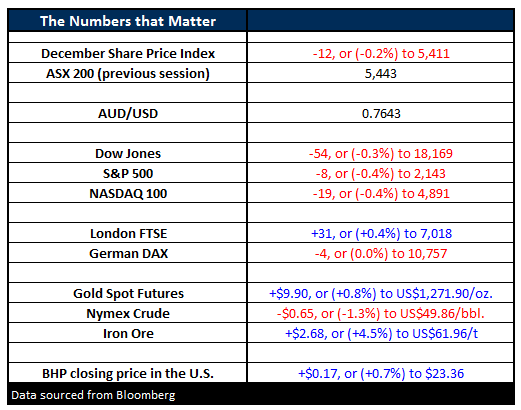

Overnight Market Matters Wrap

- The Dow closed lower last night after a mixed night of news and lower oil prices. The market closed down 54 points (-0.3%) to 18,169.27 whilst the S&P500 closed down 8 points to 2,143.

- Crude oil was weaker ahead of weekly data that could show that domestic inventories have increased. Analysts polled by Reuters expect the data to show an increase of 800,000 barrels; we’ll see in tomorrow mornings report how close they are. Crude finished the day down 65c (-1.3%) to US$49.86/bbl.

- Iron Ore managed to follow on from a very strong market during our time yesterday when it was trading in Singapore close to 6% higher. Last night it finished up US$2.68 (+4.5%) to US$61.96/t

- The ASX 200 is expected to open flat this morning, around the 5,437 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/10/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here