Ouch that hurt!

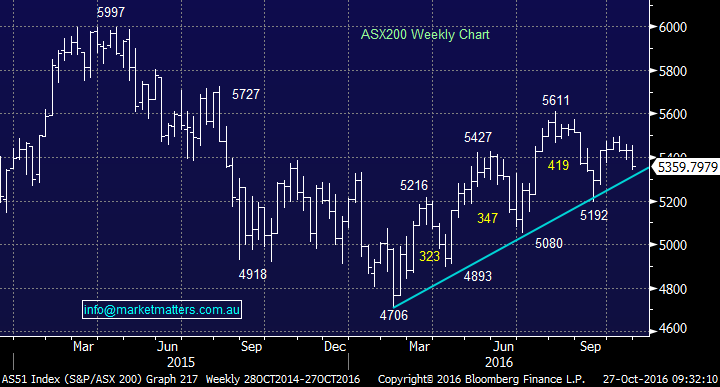

Yesterday our market was hammered 83-points / 1.5% with selling across the board locally and most of the region. The New Zealand market also fell 1.5% while Hong Kong was down 1.4% but there was no major negative influence from the US or Europe. The local market has now corrected 2.5% from its October high and 4.5% from the 2016 high, while the Dow Jones is only 2.5% below its all-time high - we are a painful 21.8% below that distant equivalent milestone. The volume of selling that hit our market yesterday is likely to have broken its short-term resolve unless NAB can report well today.

Overall it's not surprising that investors finally through their hands up with our market yesterday considering some of the stock movements during this current reporting season. Basically, if a stock reported well it rallied a few percent BUT when it was poor the outcome was bad & often very ugly, especially with follow through to the downside usually occurring e.g.

Good - Independence Group +2.4% and Ramsay Healthcare +1.5%.

Bad - Wesfarmers -5.7%, Resmed -3.8% and Coca-Cola Amatil -6.4%.

Ugly - Healthscope -18.8% and TPG Telecom -21%.

Importantly if our market fails to hold the 5350 area we will move from a bullish to a neutral stance, at best. Considering our medium-term view for US stocks is a +20% correction, ideally, after making fresh all-time highs as we have written about often, caution is warranted for local investors. We continue to be in overall sell mode looking to increase our 9% cash position at optimum opportunities, however, for now, the US market remains constructive even if our market is less so.

ASX200 Daily Chart

We anticipate that the stocks that we are likely to invest in moving forward will have a low correlation to the ASX200 index itself e.g. The Healthcare Sector and "situation stocks" (technically called low beta stocks).

A story on Bloomberg caught our eye today where a Chinese businessman is about to commence flying fresh milk directly from Hobart to Ningbo, China on a weekly basis. He is marketing Tasmania's air as the cleanest in the world ahead of rivals like the Czech Republic and Chile. While the Crown casino arrests are putting Australia's relationship with China under the microscope in a negative way it is assisting opportunities elsewhere in non-related businesses. As we all know Australia is an enormous "clean" food bowl that China has been eyeing closely which is illustrated by its purchase of a number of large properties / farms.

The Tasmanian-based Bellamys combination of organic foods for babies and children remains perfect for the Chinese who value children / family above all else. All of BAL’s products are Australian-made and 100% certified organic - a trend that is only just starting in China. Recent weakness as investors sold the China story has brought the valuation back to a more compelling 19.2x 2017 est. earnings.

We remain bullish BAL on a fundamental basis and like its lack of correlation to the index. We can buy BAL into current weakness with stops now under $11.30 - please note this is a volatile stock and hence we would not be allocating more than 5% of our portfolio to this investment. Watch for alerts

Bellamys (BAL) Weekly Chart

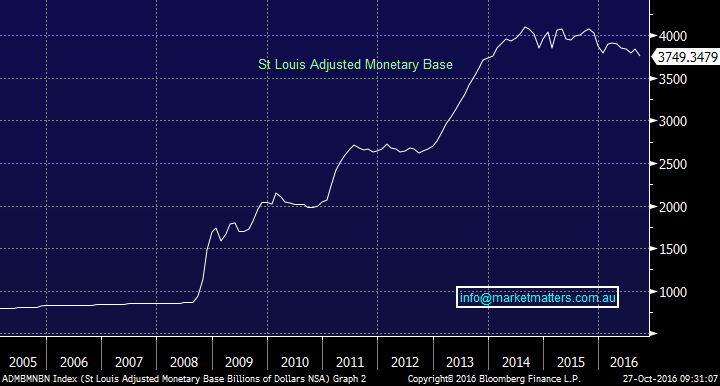

One chart we watch carefully from a macro perspective is the St Louis Adjusted Monetary Base which, as can be seen from the following chart is rolling over. This implies that the $$ with the St Louis Fed is about to find its way into people's pockets and hence inflation will gather pace. The bond market has already been forecasting this to a degree by falling and hence pushing up rates. Currently, central banks want inflation higher BUT if it gathers momentum they will be caught out yet again - history tells us this, not an uncommon occurrence. If inflation expectations increase faster than the market expect we are likely to have our catalyst for an over 20% correction from US stocks.

We will shortly write a report on what stocks / sectors to own and of course avoid when inflation kicks in.

St Louis Adjusted Monetary Base Monthly Chart

Summary

- We remain positive the ASX200 while it can hold over 5350 and like Bellamys at current levels.

- We are concerned about rising inflation moving forward.

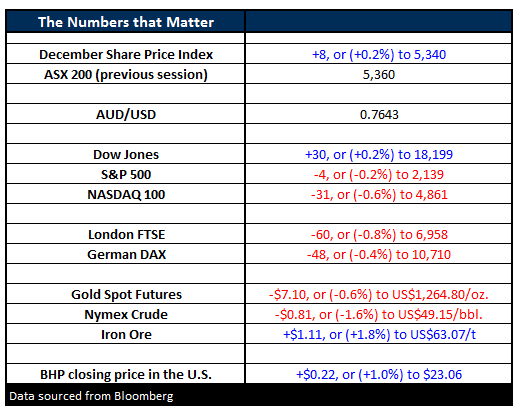

Overnight Market Matters Wrap

- The US markets finished their session mostly down, however the Dow managed to poke its head above water, finishing up 30 points to 18,199. The broader S&P500, however, weakened off, finishing down just 4 points to 2,139.

- Oil continued its run of weakness despite figures from the Energy Information Administration (EIA) showing a further decline in stockpiles. Inventories showed a fall of 553,000 barrels last week, compared to an expected 800,000 increase suggested by analysts in a poll. Oil fell according to traders, because of fears that OPEC will not go ahead with their cut in production. Crude finished down 81c (-1.6%) to US$49.15/bbl.

- Iron ore continued its positive moves higher last night with an increase of US$1.11 (1.8%) to US$63.07.

- The ASX 200 is expected to open flat to slightly higher this morning, around the 5,366 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/10/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here