Subscribers questions on the last trading day of the month!

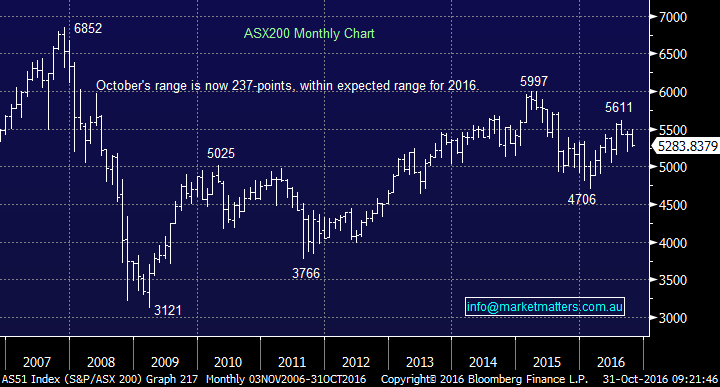

Last week the local ASX200 had an awful time underperforming pretty much all of its global counterparts. This was unfortunately another great example that having a finger on the pulse of US stocks regularly has little impact on forecasting our market on a week to week basis. While we remain a healthy 12.3% above last Decembers lows it does demonstrate how quickly the ASX200 can decline under its own steam.

Today's questions have a healthy mix of subjects but all our topical.

ASX200 Weekly Chart

Question 1

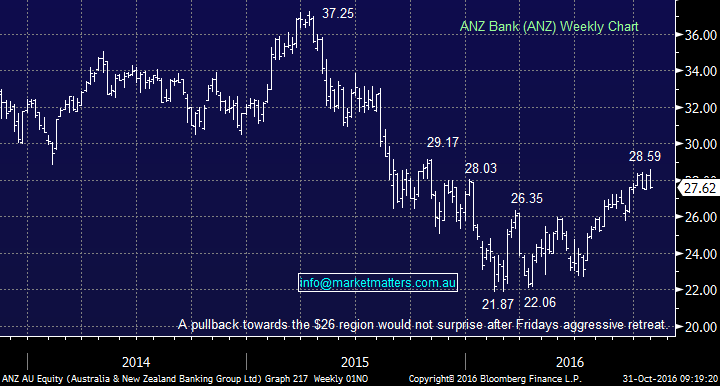

"Hi Team, Can you please tell me how to find out the date ANZ will go ex-dividend or do we have to assume it will be 6th or 7th November as is has previously. How much notice do we normally get? If it drops significantly in the next couple of days, it may be worth buying back in to get the dividend". Cheers Peter

Good Morning Peter, Thanks for the question, it's always good to expand on our thoughts around a recent sale / purchase of a stock. ANZ Bank reports this Thursday when they are anticipated to announce a dividend ~90c to be paid on the 11th of November. These are estimations only compiled by Bloomberg. The actual dates of the dividend (and obviously the amount) are confirmed when the company reports. Most investors are unlikely to have access to a Bloomberg Professional terminal as we do. The easiest / cheapest way is to look at past dividend dates as future dividends usually fall around roughly the same time.

Last week ANZ announced $360m of "specified charges" against its pending full year profit. Fortunately we sold our holding the day before avoiding the 48c / 1.7% drop that occurred on Friday - a nice touch of fortune as you would normally expect the bank to be tight lipped ahead of Thursday.

ANZ Bank is usually the worst performing of the "Big Four" banks in November falling on average just over 4% i.e. around 1% more than the dividend. If the ANZ Bank shares spike down towards $26 after it reports we will consider reinitiating our position but of course depending on the reason behind the move. Also if we did buyback ANZ we are highly likely to reduce / sell one of our CBA, or Westpac positions.

ANZ Bank (ANZ) Weekly Chart

Question 2

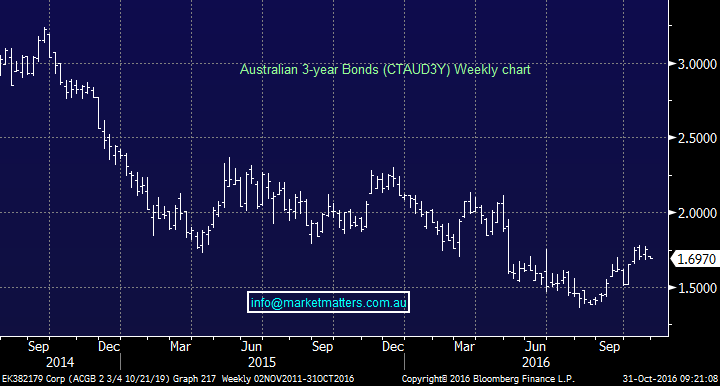

"MM, do you think local interest rates will go higher from here when people are still taking a potential cut tomorrow?" - Nigel A simple answer from us is yes, not this year but potentially late next year. Importantly stock markets look at bond yields as a comparison investment vehicle to stocks i.e. if bond yields go up it has a negative impact for stocks.

Since early August the Australian 3-year bond yield has risen from 1.3% to 1.71%, a huge relative difference while obviously the RBA have made no changes. During this rally by the 3-year yield the "yield play" stocks like Sydney Airports have been smacked ~20%.

Now consider that our medium-term target for the 3-year yield is 2.4% the implications for a large part of our market is poor.

Australian 3-year Bonds Weekly Chart

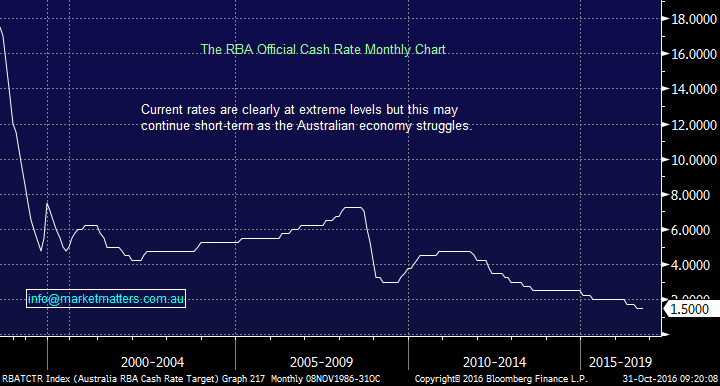

If you now consider that we believe interest rates have completed a massive bear market which lasted close to 30-years and are now heading higher it’s again bad news for stocks. Interest rates were well over 15% in 1990 and over 7% before the GFC, we are only initially targeting ~4%, back to the levels of 2012. However this is interest rates doubling from the levels of today!

Australian RBA Cash Rate Monthly Chart

Question 3

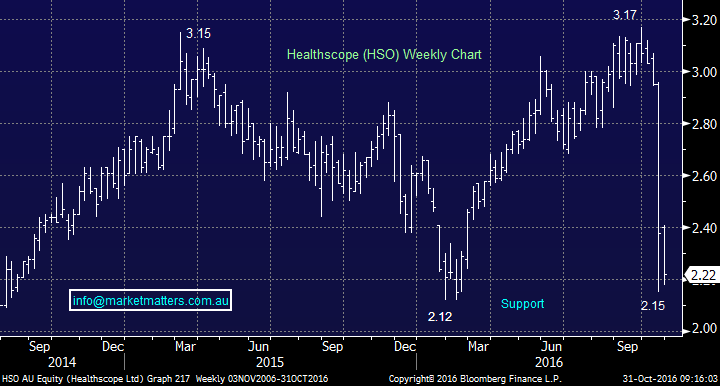

" Good morning MM. Just a question for the Monday Report. I purchased HSO on 21/10 (at the high of the day) as I was conflicted about whether to follow "The 3 Day Rule", (wait 3 days before buying the share after a big drop in order for broker downgrades and residual selling to filter through). In hindsight it would have worked in this case. Also, it was reported that the MD of HSO sold 77% of his shares on the 31 Aug, before reporting. I think this should have been a red flag to either not hold the stock into reporting or an opportunity to short a stock on a high multiple. What are MM thoughts on the above? Keep up the good work MM." - Mark.

Hi Mark, Firstly we obviously all prefer to see directors buying their own stock as opposed to selling it and we watch this closely for our own trading. In this instance, HSO closed that day in August at $3.06 and it was in a window where Directors could sell. In terms of the connection with the latest poor update from HSO, the company has blamed a weak trading period in September as the main reason for a change in guidance – obviously the sale came before that time. It still ‘smells’ a little to us though and from an investor standpoint, we don’t like it.

The "3 day rule" is something that we are obviously aware of and have in the past implemented but also we have a number of times when a stock spikes lower on a poor number but recovers significantly the same day. However the recent theme of smacking "expensive" stocks that do not perform was also at play for HSO. A lot to consider in 5 minutes, our logic was as below:

1. We had flagged HSO as a stock we wanted to buy and the result was giving us the opportunity - we remain very comfortable with the fundamentals of HSO.

2. We allocated only 5% of our portfolio encase the stock fell further - it did actually bounce over 18% after the initial knee jerk fall prior to drifting lower.

3. We are now considering adding to our position ~$2.10.

Healthcsope (HSO) Weekly Chart

Question 4

"Team, is the current falls in the supermarkets time to start buying, they cannot fall forever". Steve.

Both Woolworths and Wesfarmers (Coles) were sold hard last week falling 4.2% and 8.6% respectively when their respective reports fell short of market expectations. Our simple answer to this Steve is it remains too hard at this point. The stock remain very challenged by evolving market conditions e.g. ALDI.

1. Technically if we see Woolworths back under $20 it would be very interesting.

2. WES feels like it is / has completed a major advance from ~$14. We would be taking our $$ here over $40.

There is a lot that could be written about the sector, the evolution of supermarkets over recent years, and we’ll take some time to do this if either stock becomes appealing from a price perspective.

Woolworths (WOW) Weekly Chart

Wesfarmers (WES) Weekly Chart

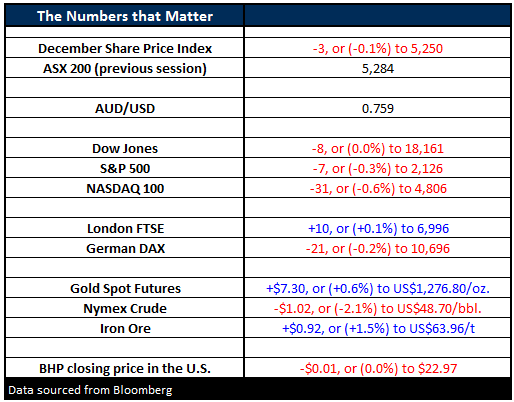

Overnight Market Matters Wrap

- A reasonably volatile session in the US on Friday night following news that the FBI were once again digging into the Clinton email saga – with the Director of the FBI recommending further investigative action.

- The US markets finished slightly lower, but the DOW JONES did drop around ~140pts following the Clinton news, plus Treasury Yields rose and the chance of the December rate cut drifted back to 70%. The market is still very concerned about the possibility of a Trump win – and rightly so

- The Dow finished down -8 points to 18,161 whilst the S&P500 finished off -7 points to 2,126.

- Oil was pretty much the only commodity to lose ground on Friday with the ebbs and flows of OPEC still weighing on short term sentiment. Crude finished down 1.02c (-2.1%) to US$48.70/bbl.

- Iron Ore was up, as were other base metals finishing +1.5% to US$63.93/t – a very good week for Iron Ore which punch through US$60 dragging the likes of RIO and FMG with it

- The December SPI Futures is indicating the ASX 200 to open down ~3 points this morning, testing the 5,280 area – however, if commodities struggle, which is where the support is coming from, then this expectation will prove too optimistic `

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/10/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here