3 aggressive plays for November

Most focus will be on the Melbourne Cup today ("The race that stops the nation") at 3pm only 30 minutes after the RBA announces their decision on interest rates at 230pm. For the record we believe interest rates will remain unchanged and our "punt" for the Cup is "Big Orange”! We actually believe rates are likely to remain on hold for the next 6-months while the local economy shows its hand and the RBA get to see how aggressively the US will recommence with its rate hiking cycle.

Interest rates have essentially been falling for the last 35-years and as most of us hopefully realise all good things come to an end. The following chart illustrates that US 5-year bonds interest rate have fallen from over 16% to well under 2% today. Our belief is this bear market for interest rates has run its course and while it may not turn up quickly we are confident they will. When we consider the crazy situation that much of the world's bonds yield negative interest rates it gives us the confidence to believe in this inflection point i.e. a panic extreme.

US 5-year bond interest rate

Today we are going to look at 3 aggressive plays / trades that we are considering in November. Unfortunately we have been fairly quiet in this department recently which is a shame since we have a great strike rate in the short-term arena. If interest rates are heading higher and stock markets are likely to have a tougher few years ahead more active situation style trading / investing will be important. An aggressive play can also be within a portfolio as opposed to simply a short term trade, perceived safety is often not the case e.g. CBA is 23.8% and BHP 50.4% below the highs of the last few year BUT they would have been a must have in most portfolio managers holdings.

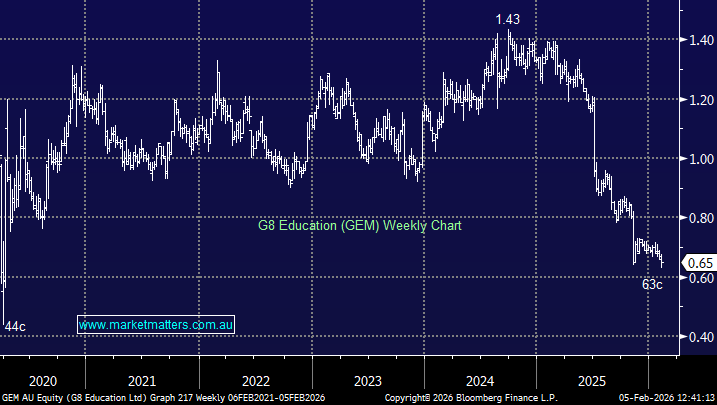

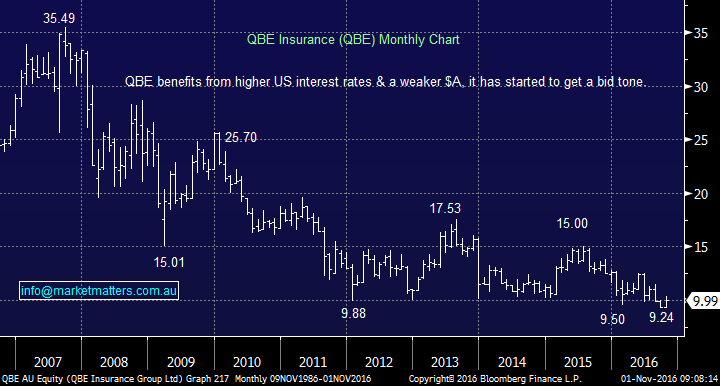

1 QBE Insurance $9.99

A story we have discussed for a while but now we are a little more cashed up we are watching this one closely. Simply QBE benefits significantly from higher US interest rates and a lower $A, both of which we foresee in years ahead.

QBE is a turnaround story at best having dropped the ball on too many occasions since the GFC, it's trading 30% below its panic GFC low while the ASX200 has rallied over 70% even after the last year's weakness. A good yardstick is companies take 4-years to turn themselves around hence QBE is clearly overdue!

We believe investors who buy QBE under $10 have a strong possibility of enjoying a 50% return in the coming few years.

QBE Insurance (QBE) Monthly Chart

2 TPG Telecom (TPM) $7.56

TPM has been smacked well over 40% in the last few months as investors dumped their overweight / too comfortable holdings in the Telco. The selling appears to have lost momentum and the stock popped 4.7% yesterday.

This is one for the aggressive trader but we believe you can buy TPM under $7.50 targeting over $8.10 with stops under $7.20 i.e. solid risk 2-1 risk reward.

TPG Telecom (TPM) Weekly Chart

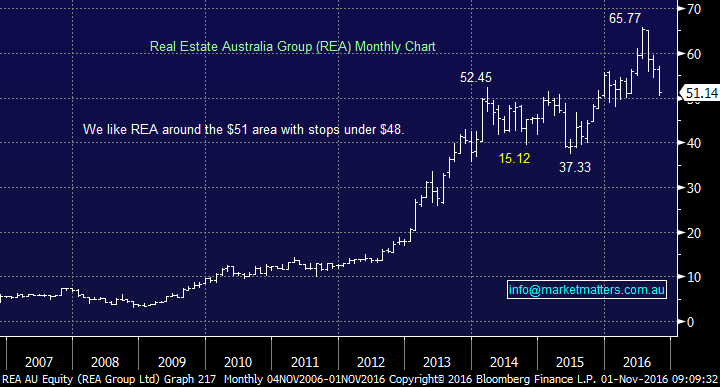

3 REA Group (REA) $51.14

REA Group has been sold off over 20% along with many of the high valuation stocks over recent months. REA is not cheap on a P/E basis compared to the market but we believe it has both the pricing power and growth to justify these levels. Worth noting, REA holds its AGM on Friday and the lower risk strategy would be to wait for this to play out.

We are buyers ~$51 as a fairly aggressive investment but ideally would want to average ~$40, traders should exit on a break below $48.

REA Group (REA) Monthly Chart

Summary

We deliberately selected 3 stocks which we would / may play in a different manner:

1. QBE is an aggressive but longer term investment. We are buyers under $10, eventually targeting $15. Stops can be run under $9.40.

2. We like TPM as an aggressive trade under $7.50 targeting $8.10 with stops under $7.20.

3. We like REA today as an aggressive entry into a medium /longer term investment or trade. We are buyers ~$51, longer-term investors should average ~$40 but traders should exit under $48.

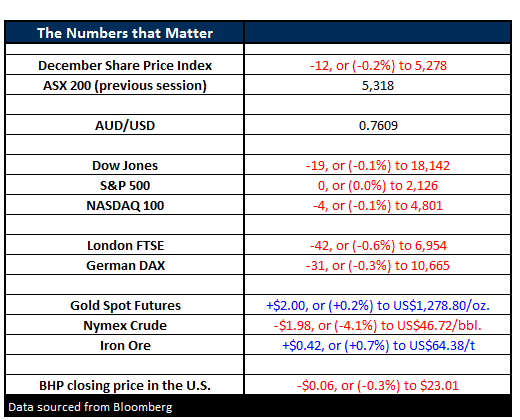

Overnight Market Matters Wrap

- The US markets traded in another narrow range last night with the Dow finishing the day down just 19 points to 18,142.42. The broader market S&P500 index closed less than one point lower to 2,126.

- Oil took another battering last night, dropping to a one-month low on fears that OPEC will not be able to implement the cut in production due this month. Oil fell US$1.98 (-4.1%) to US$46.72/bbl.

- Iron ore might help the likes of RIO this morning after it rose 42c (+0.7%) to US$64.38/t.

- The December SPI Futures is indicating the ASX 200 to open down ~13 points this morning, testing the 5,304 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 1/11/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here