US election concerns are playing the tune for stocks – buy time?

Yesterday the local ASX200 fell another 61-points (1.16%), over double the US retreat, as yet again "when the Dow sneezes we catch a cold!". Fortunately, we increased our cash position to over 20% last month but it never feels enough when the market comes under such intense pressure. Today we are going to focus on the overall market and decide if we should start buying this weakness or perhaps even sell further. A tough decision with next week's binary outcome looming i.e. Trump or Clinton. A Trump win is largely predicted to be negative for stocks - fear of the unknown.

Yesterday our local market closed below its 200-day moving average clearly illustrating the weak momentum that we have all felt over recent weeks. This technical sell signal is likely to gain much press over coming days but the practical implication is we are now firmly in the "sell" sights of global traders / hedge funds. We have touched on the SPI futures over recent weeks and this is how the selling is / will hit our market i.e. one SPI contract is $25 a point so one contract at yesterday's SPI close is $25x5184=$129,600. Hence with over 34,000 contracts trading yesterday it’s easy to see how a significant short position can be initiated -34,000 SPI contracts is equivalent to over $4.4bn worth of the ASX200.

ASX200 v 200-day Moving Average Daily Chart

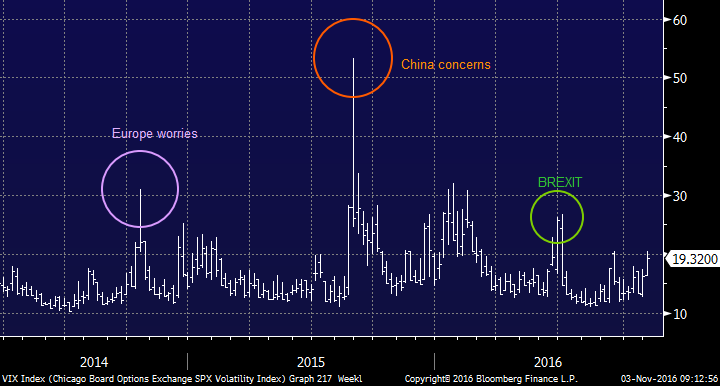

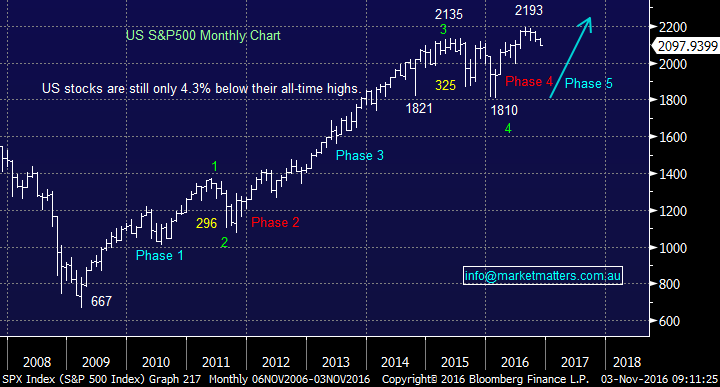

The US VIX Index universally referred to as the "Fear Index" has rallied over the last week as the polls slowly give Donald Trump a fighting chance of victory. Considering the S&P500 is still only 4.3% below its all-time high in the face of this adversity plus we have US rate hikes on the horizon it implies markets still believe Clinton will win but they are hedging a Trump victory by buying the VIX. While the S&P500 has slowly retreated 4.3% since its August highs this morning we are likely to open down ~7% below our equivalent level. On Tuesday the RBA left interest rates unchanged and last night the Fed did the same, monetary policy is not the game in town at the moment , nobody is currently talking about it.

The VIX "Fear Index" Weekly Chart

Let's look at some important historical statistics from both this period annually and in US election years.

1. US equity markets usually drift into a close election prior to rallying almost 5% for the rest of November - whoever wins.

2. The 3 months of November-January are historically the strongest for US stocks.

3. US stocks usually rebound strongly after 3 consecutive monthly declines.

4. November is usually a weak month for local stocks primarily led by banking sector falls.

5. Local stocks usually rally strongly from the last week of November.

The BREXIT turmoil remains fresh in investors' minds with understandably little respect being paid to the polls. However unlike with BREXIT when markets were strong, optimistic and complacent ahead of the UK's vote we have seen increased volatility and weakness from stocks into November 8th's big US election vote.

With US stocks usually outperforming us in November further Hedge Fund selling in Australia is likely and more importantly buying is very unlikely.

The combination of the current weakness in stocks, investors being cashed up hoping to buy stocks at lower prices plus the 5 seasonal factors above bodes well for a snap back in stocks after the US election - but from where is the million dollar question! We believe the market goes lower before it can bounce, the spring is not wound enough.

US S&P500 Monthly Chart

Summary

Taking all of the above information into account we have come to the below 3 simple conclusions:

1. We do not want to be sellers here and are comfortable with our 21% cash holding.

2. Further weakness feels likely into the US election hence like the majority we feel the sidelines is the prudent place to be – we do not normally like to be with the majority.

3. We will still consider picking up a stock if we believe it has been unduly sold down.

Overnight Market Matters Wrap

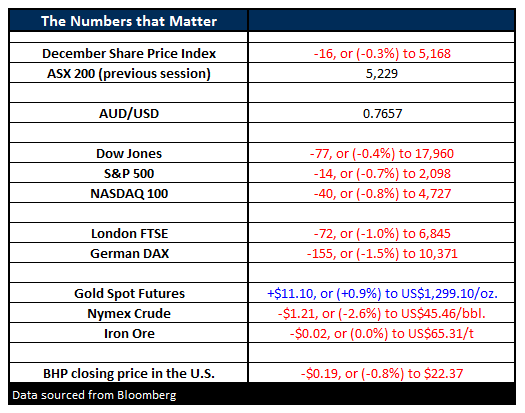

- The Dow and the S&P500 both finished lower this morning, with the Dow down 77 points (-0.4%) to 17,960, whilst the S&P:500 was slightly weaker, down 14 points (-0.65%) to 2,098.

- The Fed as expected left interest rates on hold, but the weakness generally came from the ongoing ratings between Hillary Clinton and Donald Trump, with Trump closing the gap in the polls, and in some taking a slight lead.

- Oil continued to lose ground on news that there was a record weekly build in crude stocks. The US Government IEA said crude inventories rose by 14.4 million barrels for the week. Analysts’ expectations were again way off the mark, expecting just a 1 million barrel increase.

- Gold continued to rally with concerns on the election, which in turn weakened the US$. Gold finished up US$11.10 (+0.9%) to US$1,299.10/oz.

- The December SPI Futures is indicating the ASX 200 to open down 34 points this morning, testing the 5,195 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy.Prices as at 3/11/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here