Is it time to buy our battered Tech space?

Many local tech. stocks which charged ahead of the pack for so long have come back to earth with a huge bang over last few months. The standout 2 themes within our market recently has been the aggressive selling of the yield play stocks plus those with high demanding valuations (P/E's) as the market fears disappointment – it’s received a few! Today we are focusing on 4 quality IT disruptors, all of which are household names, that have experienced significant corrections while asking the question are buying opportunities presenting themselves:

1. REA Group (REA) - REA has corrected 27.8% over the last 4 months and is now trading on an Est. P/E ratio of 24.6x for 2017, while yielding 1.72% fully franked.

2. Carsales.com (CAR) - CAR has corrected 25.5% over the last 4 months and is now trading on an Est. P/E of 20.3x for 2017, while yielding 3.67% fully franked.

3. Seek Ltd (SEK) - SEK has corrected 21% over the last 4 months and is now trading on an Est. P/E ratio of 23.9x for 2017, while yielding 2.84% fully franked.

4. Webjet (WEB) - WEB has corrected 23.7% over the last 2 months and is now trading on an Est. P/E of 23.57x for 2017 while yielding 1.55% fully franked.

An extremely clear pattern has emerged with all 4 stocks correcting ~25% as the market has become less prepared to pay a large valuation premium for future growth. This repricing makes sense on a few fronts; The market has experienced savage corrections by stocks that fell short of optimistic expectations - we’re in a low growth environment and economies are struggling to grow and that’s a headwind for business and importantly, if interest rates go up, then theoretically, we should pay less for stocks.

The clear positive takeout is quality growth companies are offering some of the best value in a long time.

Notably there has clearly been no correlation with US Tech. stocks with the NASDAQ making fresh all-time highs last month and since correcting only 4.7%.

US NASDAQ Monthly Chart

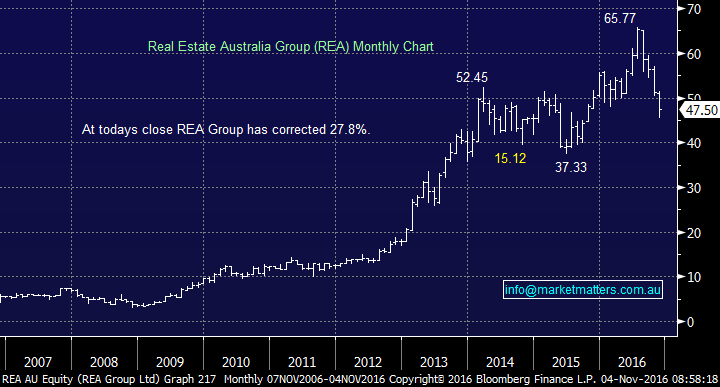

1. REA Group (REA) $47.50

REA Group Ltd and its subsidiary companies, known as the REA Group, make up a global online real estate advertising company based in Melbourne. We all know it as Realestate.com whose only real competitor at present is the less popular Domain. The main points which leads to our positive view for REA are;

1. Of the total spend to sell your home, REA only earns ~5% of it, yet it seems that the importance of their platform in the selling process in much more important than that number would imply. We believe this will increase over time and we’re starting to see evidence of this.

2. Because of their dominance, it is now almost impossible to sell a house without using REA giving them substantial pricing power - they can actually raise prices in these cost cutting times.

3. REA makes its money by a combination of the number of listings and how long they remain listed. Hence a slower market with less listings is not all bad news as properties take longer to sell.

Yesterday, Fairfax's shares were sold off 4.3% on news that it’s Domain business suffered from fewer listings. We find it amazing this was a surprise because almost every day the press informs us it's a dearth of stock driving up prices in Sydney and Melbourne = fewer listings, selling quickly = lower earnings.

We like REA as a business and believe current weakness is providing a buying opportunity. REA has it’s AGM today and technically we are keen buyers ~$40 - this is a substantially beneath yesterday's close BUT we have witnessed extreme volatility recently when stocks report.

REA Group (REA) Monthly Chart

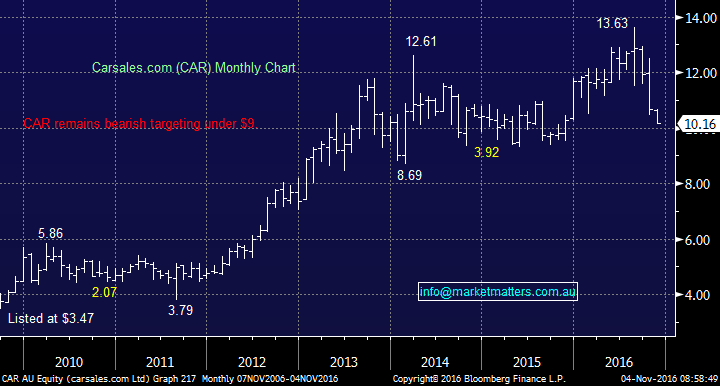

2. Carsales.com (CAR) $10.16

Carsales.com Ltd (CAR) is the largest online automotive, motorcycle and marine classifieds business in Australia. CAR shares were hit late last month after its AGM presentation. Their financial component continued to struggle and earnings growth is slowing.

While we like CAR as a business, the damage from Gumtree may materially increase over time. Gumtree is posing a competitive threat to CAR in Australia by offering free ads to private sellers and gradually enticing dealers onto its site. We believe the only reason the stock is still trading on a reasonably high valuation is their ongoing push to expand overseas.

We remain short-term bearish CAR targeting the $9 region, over 10% lower.

Carsales.com (CAR) Monthly Chart

3. Seek Ltd (SEK) $14.08

SEEK Limited and its subsidiary companies, known as the SEEK Group, make up the world's largest online employment marketplace, simply matching jobseekers and employers.

SEK has recently experienced a flat earnings profile primarily the result of the increased investment in new products, combined with a temporary step down in the earnings of SEEK Learning due to the change in VET FEE regulations and commission structures. These constraints should reduce moving forward. We are very keen on the long term outlook for SEK.

Technically we are neutral SEK at current levels and await a trigger to buy a stock we do like.

Seek Ltd (SEK) Monthly Chart

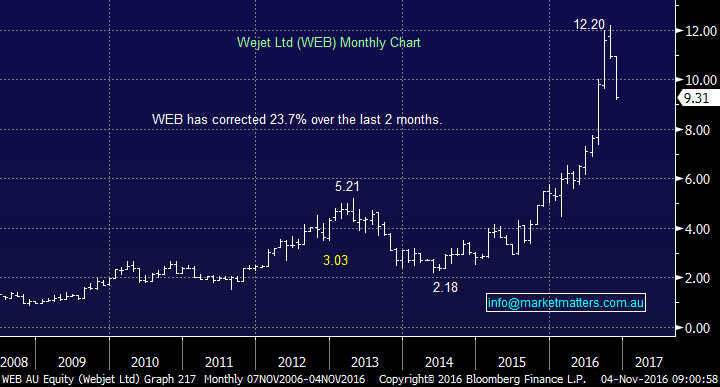

4. Webjet Ltd (WEB) $9.31

Webjet Limited is a travel booking website offering flights, hotels, holiday packages, cruises, car hire, travel insurance and travel deals.

WEB shares powered to fresh all-time highs in August on news that the online travel agency will join its rivals Flight Centre (FLT) and Corporate Travel Management (CTD) as part of the ASX 200 from mid-September forcing some fund managers to buy the stock, it's not surprising it has since retreated.

However a large part of the recent fall is due to weaker domestic travel demand which has hurt many related stocks e.g. HLO and CTD.

We believe the stock offers value under $9 but would only consider accumulating slowly.

Webjet (WEB) Monthly Chart

Summary

When considering the 4 stocks we have covered today we have kept one eye on our medium-long term bearish view for stocks and slowly rising interest rates.

1. We are keen buyers of REA, ideally ~$40 on a spike lower e.g. a Trump victory or average result today.

2. We are currently bearish CAR and will give this one a pass.

3. We like SEK as a company but are looking for a catalyst to enter the stock. Initial technical support is not until the mid $12 region.

4.We are concerned that WEB will suffer if the local economy endures tougher times in the years ahead and hence would be very cautious on entry.

REA is clearly our current top pick.

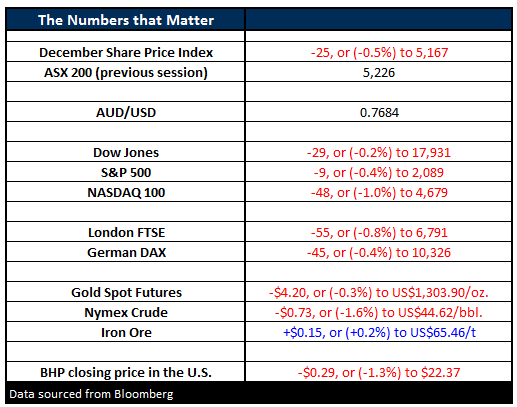

Overnight Market Matters Wrap

- The US markets were weaker again last night, with the Dow falling 6 days straight and the broader S&P500 falling 8. The Dow finished down 29 points (-0.16%) to 17,930, whilst the S&P 500 fell by 9 points (-0.44%) to 2,088. The NASDAQ was the hardest hit last night with the index falling 48 points (-1.0%) to 4,679.

- Concern on the upcoming election is weighing heavily on the markets with concern on a possible Trump win

- The VIX (or fear index) continues to climb, with last night being the eighth day in row. It has never risen more than eight continuous days in 27 years.

- Oil prices hit five-week lows last night with Crude dropping 73c (-1.6%) to US$44.62. Scepticism that OPEC can implement the planned production cut weighing again on the market.

- The December SPI Futures is indicating the ASX 200 to open down 44 points this morning, testing the 5,195 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 4/11/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here