Will fortune favour the brave this week?

Firstly we are very sorry for the late Weekend Report yesterday, unfortunately, a few of our team were out of town over the weekend and they experienced poor internet connectivity. Basically, all this week's questions are around the US election hence here are our thoughts in a nutshell barring any last minute bombshells. Nobody needs any reminder that this week is likely to be all about "Clinton v Trump" - this Tuesday US time. Markets have endured a rough ride into the election with US stocks falling for 9-consecutive days and the local ASX200 plunging 250-points (4.6%) over the last 2 trading weeks. Unlike BREXIT which caught markets totally off guard, a potential Trump victory has been analysed from all directions and to a certain degree built into prices.

While a Trump victory will stun many people worldwide markets have now been bracing for this outcome for a few weeks, clearly with significant trepidation. A Trump victory, often forgotten to be the representative of the Republican party, is still likely to increase volatility in markets short-term. Trump wants to increase spending and cut taxes which is bullish for stocks but his protectionist views and overall unpredictability is bad for stocks. On a sector basis:

1. A Clinton victory is perceived to be bad news for drug makers and finance companies.

2. A Trump win is more of an overall market risk as the US stock market is close to all-time highs and far from cheap.

Our View

1. Clinton will win but Republicans will still control the house of representatives, the US stock market will snap back ~4% - not as much as many think.

2. The ASX200 will recover ~100-points but unfortunately, we remain negative local stocks and believe selling will soon return. A close back over 5400 is required to change our pessimistic view.

3. We were extremely bullish in early 2016 when stocks were hammered under 4800 and went limit long. Regrettably, we believe today's degree of negativity has far more foundation.

ASX200 Weekly Chart

1. Investing Plan

Due to our concerned outlook for equities moving forward any buying needs to be thought out clearly. Plenty of stocks rally in poor markets but the majority clearly fall. This week it's critical to have a well-thought plan otherwise running with the heard during periods of significant volatility is rarely profitable.

Notably, we are only targeting stocks to buy that have recently been "beaten up" which ties in with both our view that an active approach is required moving forward and the overall market is not a buy.

1. Buy REA Group (REA) around $40, the stock has already fallen 27% from its highs this year but our ideal buying area remains well over 10% lower, hence likely one if we get panic selling after a Trump victory.

2. Westfield (WFD) has fallen 23% since we turned bearish around $11. Technically we are now positive under $8.60, with stops under $7.90. A minimum 10% bounce feels likely while the stop is around 7% lower.

3. Healthscope (HSO) has fallen over 30% after a recent poor report. However we are big believers in the company's business model moving forward, the government needs private health as it fights to retain its triple AAA rating. We bought 5% at ~$2.30 and are keen to add an additional 3% under the $2.15 area which is very close.

2. Trading Plan

1. Fortescue Metals (FMG) has been both a very strong and volatile stock in 2016. We are trading buyers around $4.80, around 9% below Fridays close. The stock has corrected this degree a few times this year and does not need the US election to give us our buying opportunity but with only a few days to go, a spike lower for stocks is needed for our level this week.

2. TPG Telecom (TPM) has recently been hammered around 45%. The Telco sector seasonally performs well in November . For the aggressive trader, we believe TPM is excellent risk/reward around this $7 area with minimum 10-15% upside.

Summary

A very mixed bag for our trading plan into the election with one investment and one trading opportunity likely before the US result and the balance likely if we get panic selling:

Slight Weakness - Add to HSO under $2.15, WFD around $8.50 and TPM around $7.

Panic selling - Buy REA ~$40 and FMG ~$4.80.

NB We currently sit on 21% cash but it feels it's prudent to only consider one investment opportunity prior to the election. Psychologically we want decent cash levels if markets get hammered on a Trump victory.

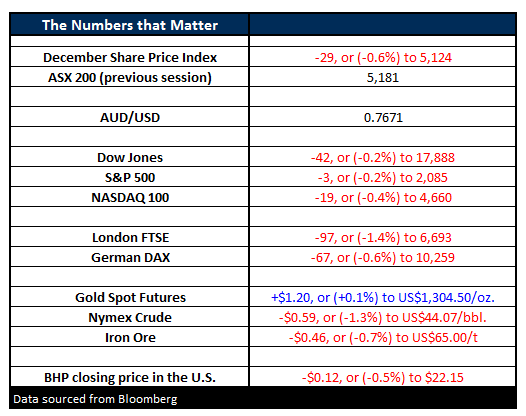

Overnight Market Matters Wrap

- The S&P put in a record-breaking move on Friday, closing down nine consecutive days, its longest streak in 36 years. The S&P closed down just 3.5 points (-0.2%) to 2,085.18, and over those last nine trading days has fallen 3%. The Dow followed suit, dropping 42.39 points (-0.2%) to 17,888.28.

- Major concerns were again focussed on the upcoming election in the US and there is no doubt that it will be a close run.

- The oil price dropped again on Friday after tensions rose between Saudi Arabia and Iran which made traders wary that the production cut promised by OPEC would be in jeopardy. Oil finished down 59c (-1.3%) to US$44.07/bbl, and for the week was down -9.3%, the largest weekly decline since February.

- The December SPI Futures is indicating the ASX 200 to open down 39 points this morning, testing the 5,141 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 7/11/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here