Inflation is the key – Part 1

Finally the US election should be over by the time our market closes today and there is a strong likelihood a winner will be announced around lunchtime today. The markets are clearly anticipating a Clinton victory and logic says they are correct. With this epic saga behind us we can finally focus on what's going to impact the stock market moving forward, the main quandary remains:

"US Stocks are historically expensive at current levels after a 7 1/2 year bull market but investors are sitting on their highest cash levels in 15 fifteen years"

Our view is the US stock market is likely to form a major top in 2017 prior to a +20% correction. The amount of cash on the sidelines should not be ignored and the ingredients for a classic blow off style top still remain firmly in place. Just as the BREXIT provided a short-term blip for markets, the US election has been a short term distraction that with some luck, will fade into the background after today.

Note at this morning's close the US share market is less than 2% below its all-time high. However, we have our strongest opinion on the combined subject of interest rates and inflation:

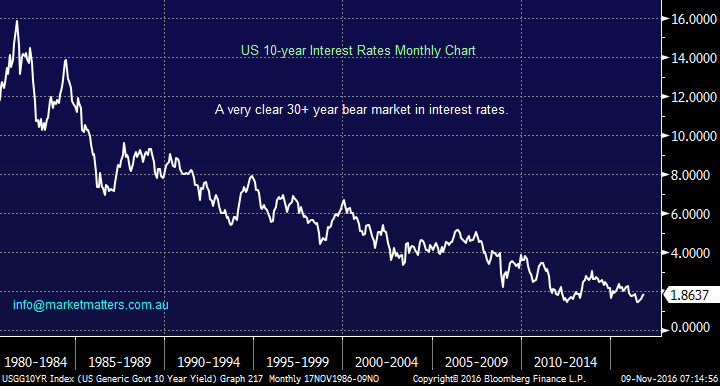

1.Global interest rates have been falling for over 30-years but as we all know economies are cyclical and all good things come to an end. We believe interest rates have bottomed and the unfathomable situation of negative interest rates will go down in history as a major panic low for rates.

2. Inflation is slowly raising its head after years of being dormant. The strong US wages data last Friday was a clear signal of things to come, but it should come as no surprise after over 8-years of global central banks pumping free money into the system in an unprecedented fashion. The growing Chinese middle class are also adding fuel to the inflation fire - just think about Sydney property prices, luxury car sales and we can see that inflation may easily accelerate much faster than many forecast after this period of enormous economic stimulus.

US 10-year bond Interest Rates Monthly Chart

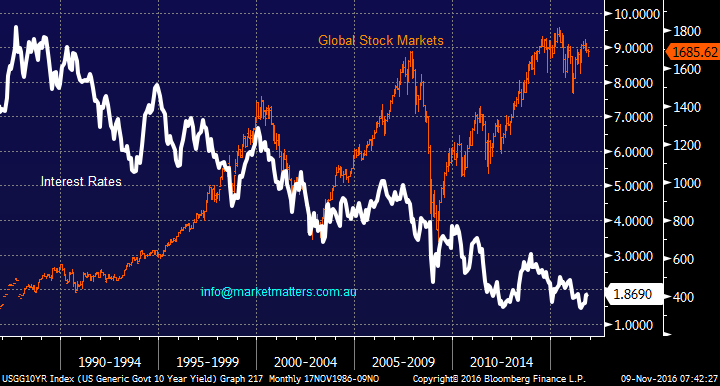

The important question to ask is how do markets and importantly sectors perform when inflation and interest rates increase? Let's look at how global stock markets have performed since the mid 1980's when interest rates entered their major bear market - Australian interest rates were up near 20% then!

1. Stock markets rallied strongly for the first 15-years of declining interest rates.

2. Stock markets again rallied very strongly since the GFC as interest rates continued to decline.

3. After 2 of the relatively short periods of rising interest rates within the multi-decade decline, stocks had significant corrections.

Overall as interest rates rally when economies are strong there has been little reason to panic on stocks when rates have risen over the last 30-years. However, it must not be discounted that a significant part of the huge bull market in stocks / asset prices has been fuelled by cheap money.

To keep faith with the stock market as interest rates rise is to keep faith with central banks to balance interest rates, inflation, and the global economy - the same central banks that did not see the GFC unfolding. While we take the GFC as a tough ask for many to have predicted, the juggling act central banks are about to embark upon is very, very complex.

Interest Rates v Global Stock Markets Monthly Chart

Our belief is far more value can be gained when we consider the combination of rising interest rates and inflation.

Inflation hurts people holding cash as the cost to buy things goes up reducing the purchasing power of cash e.g. At the start of the year you have $5 in the bank and a dozen eggs cost $4, but by December the same eggs have risen to $6 and you can longer buy them. When economies experience inflation cash is NOT king.

Historically the following sectors perform well during periods of rising inflation, we will look at these more closely tomorrow and importantly stocks within the respective sectors:

1. Value stocks usually outperform during rising inflation – stocks on lower multiples

2. Companies that can quickly raise prices in line with inflation fair ok.

3. Stocks outperform bonds - no surprise there! (inflation-linked bonds the exception)

4. Real Estate performs well during rising inflation.

5. Resources usually shine during inflation, today that's also a bet on China.

6. Precious metals historically like inflation and so does Oil

7. Food and agriculture perform well during inflationary periods

Importantly it should be noted that historically periods of unexpected inflation leads to poor real returns for stocks and increased volatility. Stocks that traditionally perform poorly during rising inflation:

1. Income generating stocks i.e. the "yield trade" that has been popular over recent years but has been hit over the last few months.

2. Growth stocks that are expensively priced do not typically enjoy high inflation – although there are few obvious caveats to this which we’ll explore later

Summary

1. We believe both global interest rates and inflation are set to rise over coming years

2. Unexpected rising inflation is bad news for most stocks.

3. Portfolios should be positioned for rising inflation over coming years - see tomorrows report for specifics.

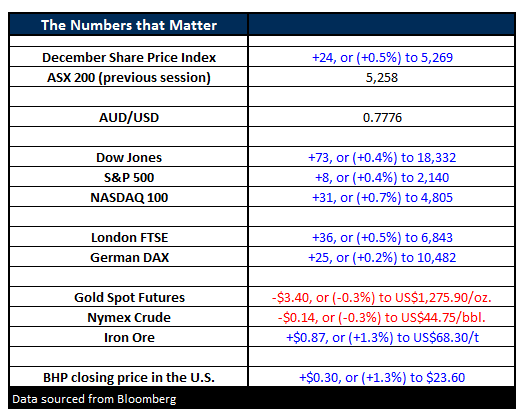

Overnight Market Matters Wrap

- The US markets were strong again last night after starting the day weaker, led by the sentiment that the election result will be what the market wants (a Clinton victory). The Dow closed up 73 points (+0.4%) to 18,332. The S&P500 closed up 8 points (+0.4%) to 2,139. For the technically minded the S&P has risen from support on the 200 day moving average on Friday to the 50 day moving average last night; all in two days.

- Oil finished slightly weaker as the market goes into waiting mode for the results of the US election. Crude finished down 14c (-0.3%) to US$44.75/bbl.

- Iron Ore, however, continued its strong trend up again last night, with the market closing up 87c (+1.3%)to US$68.30/t

- The December SPI Futures is indicating the ASX 200 to open up 14 points higher this morning, testing the 5,283 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/11/2016. 8.20AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here