BREXIT, Trump now what? 3 stocks we like after this result + Inflation – Part 2

Yesterday Donald Trump shocked the world and became the 45th American President. It certainly proves one thing - polls are a total waste of time, a bit like rating agencies over the last decade. One initial observation is this feels a sign that other European countries may follow the UK and push back against the EU as the average Western person is clearly disenchanted. Overnight the US market chased stocks that would benefit from Trump's perceived policies which coincidentally, these are largely the inflation stocks. My only comment on the election is a positive one for our children: "Like him or not, Donald Trump has shown us all that a person can achieve anything if they put their mind to it" - Market Matters.

After last night's impressive rally from US equities, their market is only ~1.3% below its all-time high. Before we move on Donald Trump's perceived policies let us remind ourselves of the statistics that we have quoted repeatedly over recent weeks:

1. The strongest period for US stocks is November to January.

2. After a close US election, the US stock market usually rallies ~5%, whoever wins.

S&P 500 Daily Chart

Now let's move onto a summary of what we know about Donald Trump's policies which are likely to have an impact on equities.

1. He plans to cut corporate and personal taxes - a short-term positive on both fronts.

2. He plans to significantly increase infrastructure spending - a short-term positive to the economy but this will lead to an increase in the budget deficit.

3. His trade views appear very protectionist with China especially in his sights which are a concern for Australia, we are particularly vulnerable to a global trade war.

4. He wants to reduce industry regulations which are potentially good for energy and especially financials.

5. He wants to repeal "Obamacare" and is overall encouraging competition.

Overall Donald Trump sounds like one big fiscal stimulus leading to higher interest rates and inflation.

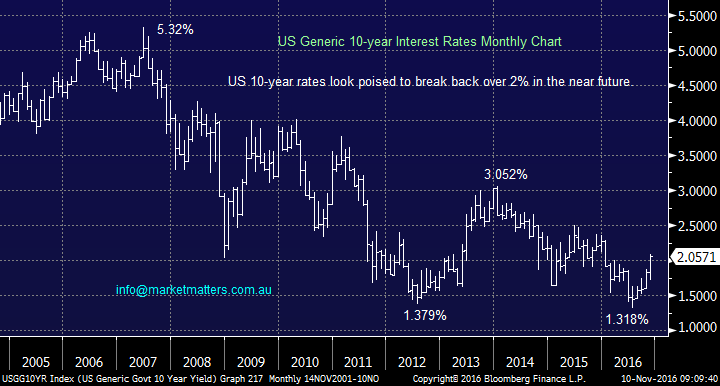

Overnight US 10-year interest rates shot up over 2% and as readers know we are targeting 3%, the fall to 1.3% in July has quickly become a distant memory.

US 10-year bond Interest Rates Monthly Chart

This is a classic time to "keep things simple / stupid" (KISS) and US stocks tell us exactly how we are likely to perform today and potentially moving forward. There are some enormous differences between the sector performances

Winners: Financials +4.3%, Healthcare +3.1%, Industrials +2.6%, Energy +1.7% and Materials +2%.

Losers : Consumer Staples -1.5%, Real estate -2.5%, Technology -0.6% and Utilities -3.5%.

We will continue to have no interest in any quasi-bond stocks until further notice and last night's move in the utilities illustrated this perfectly. As we said yesterday bigger picture "it must not be discounted that a significant part of the huge bull market in stocks / asset prices has been fuelled by cheap money".

When economies experience inflation cash is NOT king but we have US investors sitting on their largest cash holdings in ~15 years, we clearly have a catalyst to push stocks higher into 2017 and in our opinion into a major top.

Three stocks we like after a Trump victory:

1. National Australia Bank (NAB) as the cheapest local bank.

2.Macquarie Bank (MQG) in Financials Sector.

3.RIO Tinto (RIO) in the Materials Sector.

We already have decent Healthcare exposure through CSL, ANN and HSO and energy via Origin. Importantly we have zero exposure to the dangerous sectors.

Summary

- We remain committed to our view that both global interest rates and inflation are set to rise over coming years and the victory yesterday by Donald Trump simply supports this view.

- After the Trump victory, we like MQG, NAB, and RIO.

- We averaged into Mantra (MTR) yesterday in our portfolio, allocating an additional 3% to the holding, taking our weighting to 8%

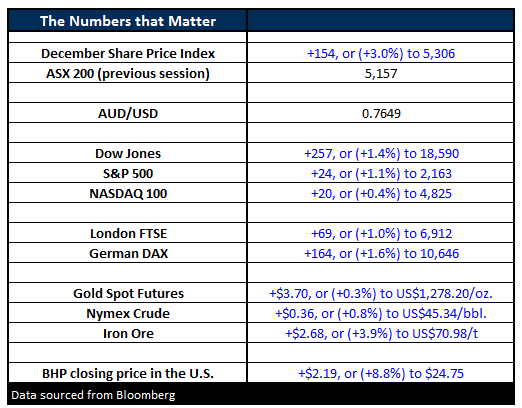

Overnight Market Matters Wrap

- A massive turnaround for US stocks overnight with the DOW FUTURES down -695pts at our close, before rallying to see the DOW up +256pts or +1.4% at 18,589 by the end.

- Oil finished up as did most other commodities. Crude put on 46c (+1.02%) to US$45.34/bbl.

- Iron Ore was very strong in Asian trade yesterday trading limit up before moving higher overnight – closing up $2.68 (+3.9%)to US$70.98/t

- The December SPI Futures is indicating the ASX 200 to open up +154 points higher this morning, testing the 5,300 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/11/2016. 8.20AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here