How far will the Trump rally go?

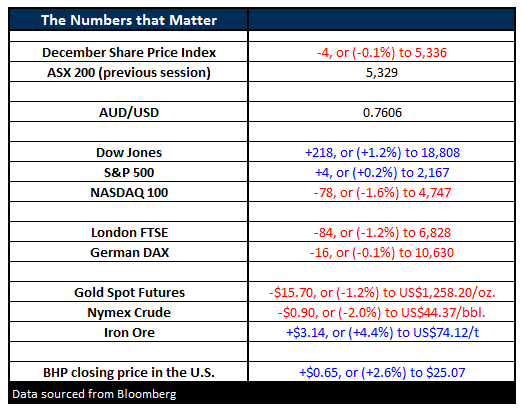

Last night the Dow made all-time highs on continued optimism following Donald Trump's election victory. However it should be noted the strength was very sector specific, even the different US indices themselves witnessed diverse performances e.g. the Dow +1.2%, the S&P500 +0.2%, Russell 3000 +0.3% but the Tech. NASDAQ -1.6%. There were again some clear standouts both ways within the S&P's 11 sectors:

Winners: Financials, Industrials, Healthcare, and Materials.

Losers: Utilities, Consumer Staples, Real Estate and Technology.

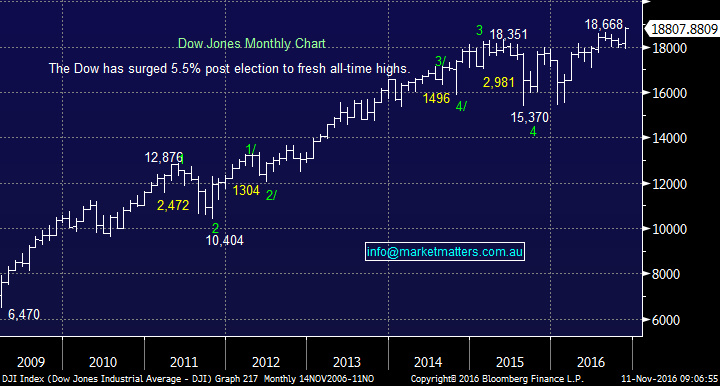

The important question is what to buy for the coming months taking note that the Dow has already rallied over 5% since the election result - already achieving its usual gain after a close election.

Dow Jones Monthly Chart

We believe the markets are getting the overall thematic of anticipated significant fiscal spending, leading to inflation and higher interest rates, correct. It should be remembered that we have been targeting rising inflation and interest rates, over recent months, whoever won the election. On a fundamental basis we see more risks in one part of the two locally performing sectors:

1. Financials - We see rising interest rates and inflation which combined with a likely reduced regulatory environment courtesy of Mr Trump is bullish for Banks / Financials.

2. Resource stocks have rallied hard courtesy of anticipated inflation plus fiscal spending by the new president. However it should not be underestimated how long it will take Mr Trump to commence building a new airport for example, say 2-3 years in which time he may be close to losing his job! Hence while we agree he can start spending on strengthening his armed forces quickly which is clearly bullish for commodities, overall infrastructure takes time and big gains have already been witnessed.

Our favourite chart of a US index during 2016 has been the NYSE Composite Index, which comprises of over 2000 stocks. We remain bullish the NYSE Composite Index, as we have all year, targeting ~8% further upside.

Hence importantly as investors we remain overall comfortable buying stocks in the correct sectors especially as we know institutions are sitting on record levels of cash and are missing out on the recent gains - they will start to get very nervous about their relative performance. Simply a "Fear of Missing Out (FOMO)" rally is unfolding before our eyes.

NYSE Composite Index Monthly Chart

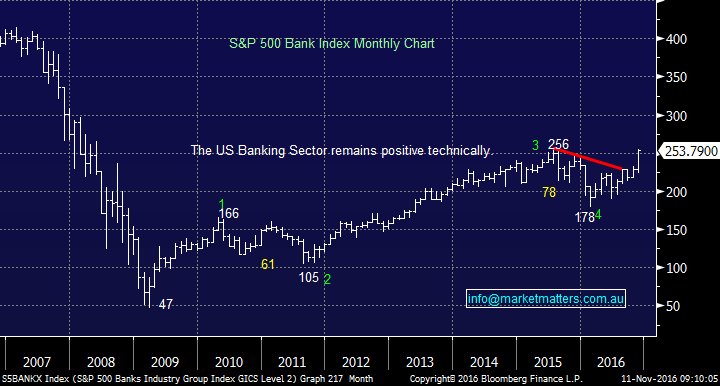

Unlike many people, we have been bullish Banks / Financials during 2016 hence our holdings in CBA, Westpac, and Suncorp. The obvious question is should we add to these positions, or is it time to take some profits. The S&P500 Banking Index has now rallied over 40% from the lows and is within a whisker of breaking the highs for 2015 - our equivalent was CBA trading at $96 compared to $73 yesterday illustrating perfectly our disappointing local underperformance.

We remain bullish US banks in the months ahead looking for ~10% further gains before its time to cash in.

S&P 500 Banking Index Monthly Chart

As mentioned yesterday our favourite 2 stocks within the Financial Sector are NAB and Macquarie (MQG).

1. National Australia Bank (NAB) as the cheapest local bank

2.Macquarie Bank (MQG) in Financials Sector. We feel MQG will be the big winner from the US election with potential benefits from lower taxes, infrastructure spending and overall substantial US earnings.

Summary

- We remain committed to our view that both global interest rates and inflation are set to rise over coming years. We remain bullish equities into at least early 2017.

- Our favourite bank today for the new unfolding US is Macquarie followed by NAB.

Overnight Market Matters Wrap

- The US market have finished yet again very strongly with the Dow closing up 218 points (+1.17%) to 18,808, however the S&P500 was more mixed, closing just 4 points higher (+0.2%) to 2,167. The technology sector covered by the NASDAQ was well down, falling 78 points (-1.6%) to 4,747.

- Oil slipped last night dropping 90c (-2.0%) to US$44.37/bbl after traders were hit with another rise in domestic stocks and concerns that OPEC will be unable to rally non-members to cut production in their meeting due 30th November 2016.

- Iron Ore continued its astonishing run, rising another US$3.14 (+4.4%) to US$74.12/t.

- The December SPI Futures is indicating the ASX 200 to open up 21 points higher this morning, testing the 5,350 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/11/2016. 8.20AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here