Reviewing the MM Portfolio

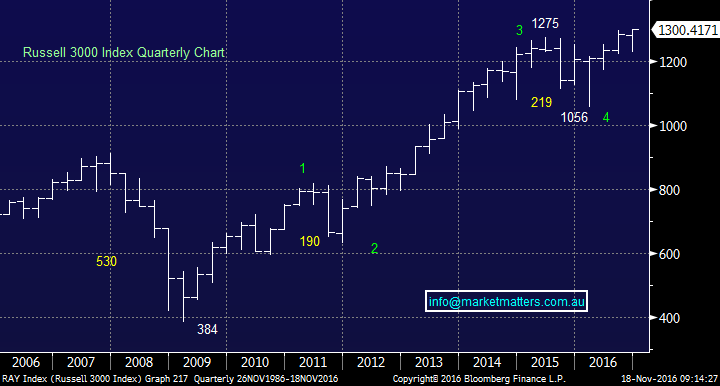

Today we are going look at the 13 stocks in the MM Portfolio hopefully giving clarity on our current thought process and plan moving forward. However firstly we will recap our medium term view for stocks which obviously has a significant bearing on our investment intentions over coming months / years. We have used the Russell 3000 quarterly chart to illustrate our views as it's longer term and a broad index being based on the 3000 largest US listed stocks by market capitalisation.

We have been forecasting new all-time for US stocks for well over a year which has put us in the minority and unfortunately created doubts with a few subscribers who potentially were influenced by the deluge of negative stock market press over recent times. At MM we will always call it as we see it and not be influenced by others - we adopt a live by the sword die by the sword mentality. Our current views around US stocks:

1. Most US stock indices have now made the fresh all-time highs in 2016 that we have been targeting BUT our ideal target is another ~8% higher.

2. The last two major tops in the US market were after very quiet quarterly periods, a potential warning signal to watch out for in 2017. Even before the GFC the market basically spent 9-months trading sideways before plunging over 50%.

3. The Russell 3000 has advanced 238% since early 2009 and this bull market is in the mature phase. We are targeting the 1400 area for the Russell 3000 prior to a few years decline of ~25%. We believe the next 12-months will be very exciting BUT very dangerous for the average investor.

4. The final leg of a bull market, often called the "5th wave", is often the weakest and is likely to be choppy, lacking follow through momentum. Be prepared for a few false signals of a top before the market "falls over".

Russell 3000 Index Quarterly Chart

MM is currently sitting on only 6% cash and we are holding the largest number of stocks since our inception. The current diversification has been deliberately implemented as the individual stock volatility has gone simply wild! We have outlined our current thoughts on the stocks in our portfolio and importantly our ideal selling levels, reminding readers that we will be comfortable moving to 100% cash if we expect a 25% correction - it will then become short-term positions for a while:

1.Transurban (TCL) $10.01

Our most recent purchase, we are targeting at least $10.50 plus the part-franked dividend in late December.

2. Westfield (WFD) $8.65

We are initially targeting the $9.30 region but believe this stock can surprise on the upside.

3. QBE Insurance $10.96

Technically QBE looks great initially targeting $12 but potentially the $15 area.

4.Macquarie Group (MQG) $82.85

MQG feels poised to test the $90 region as it benefits from US earnings and improved operating conditions for the banking sector.

5. Ansell (ANN) $21.64

ANN has followed our anticipated path over recent weeks, we are targeting another test of the $25 region.

6. Healthscope (HSO) $2.25

HSO has recently been rerated by the market but we remain very comfortable with its long-term fundamentals. Our initial target is ~$2.60 area.

7. Mantra Group (MTR) $3.26

MTR has experienced a choppy ride of late and is seems to be a stocks that polarises the market. We remain positive Australian tourism and see at least a test of the $3.70 region.

8. Westpac (WBC) $30.83

WBC has enjoyed a solid few weeks, even after trading ex-dividend, as global banks have rallied. We are looking to take profit on this position over $32.

9. Origin (ORG) $5.64

Our ORG position has been in and out of profit like the changing weather. We still see a test of the $6.20 region and potentially $7, where we will be selling our position.

10. Suncorp (SUN) $11.89

SUN remains technically bullish but it has lagged of late probably as some of the insurance sectors allocated monies has been switched into QBE. Our target of $15.50 feels miles away at present but we still like the stock.

11.Vocus (VOC) $5.28

VOC has been a nightmare journey both of 2016 and since our inception. We are looking to exit the stock but still believe on opportunity will occur over $6 - an enormous amount of bad news is built into this stock and sector. The key will be the AGM on the 29th November.

12.CSL Ltd (CSL) $101.09

We remain positive CSL as company but unfortunately jumped on board the pullback too soon. Ideally we will sell this position back up towards $110.

13. Commonwealth Bank (CBA) $76.65

CBA is the oldest member of our portfolio, we took part profit yesterday as we see better returns from TCL from here - time will tell if we are correct. However note we remain comfortable with our 6% holding in CBA and can see $78/9 into Christmas and potentially a "pop" over $80.

Summary

We remain bullish stocks into Christmas and early 2017 but we will be slowing reducing our market exposure in coming months with the potential to sit at 100% cash for a while and focus on short-term opportunities

Overnight Market Matters Wrap

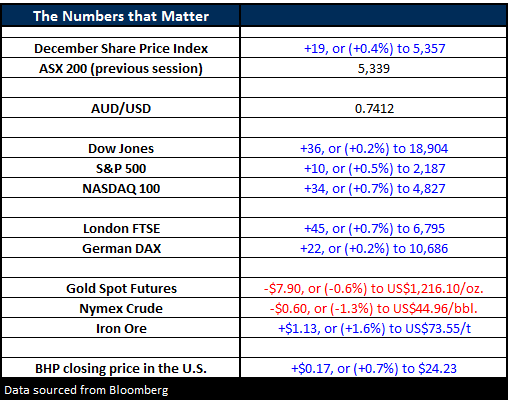

- US interest rates remain in focus with the US Fed Chair, Janet Yellen signalling a rate hike to come soon.

- The US share markets climbed modestly, with the Dow ending up 36 points (+0.2%) to 18,904 and the S&P 500 up 10 points (+0.5%) to 2,187.

- Risk continued to dissipate, as investors reduced their ‘safe haven’ assets such as gold, which closed down 0.6% at US$1,216.1/oz.

- Our Aussie battler continued to decline against the US$ because of the US Fed’s comments, now at US74.12c.

- The ASX 200 is expected to open higher, testing the 5,350 area as indicated by the December SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/11/2016. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here