Subscriber Questions this morning

Great to see more questions flow in over the last week or so with a broader topic base – not just around the implications of Trump – although one has crept through the cracks! Firstly though, lets re-cap our view both in the very short term and for the end of CY16 and early CY17.

This week we’re looking for further consolidation / small pullback for the ASX prior to a run up into Christmas. We maintain our view that US stocks will rally ~8% over the coming months prior to a significant decline. On that basis, our favourite sectors locally into early 2017 are the Financials (including banks), $US earners and Healthcare. Last week we saw money flow into some of more ‘unloved’ sectors with Real-Estate up +2% while Materials were down -3.4%.

Question 1; Quick Question regarding Airlines. For some reason there is a surge in interest in Airlines. Wall Street Journal has reported that Berkshire Hathaway has, in a regulatory filing, announced it has taken stakes in American Airlines Group Inc. (US$800m), Delta Air Lines Inc. and United Continental Holdings Inc (combined US$500m). Buffett also told CNBC that Berkshire had taken a stake in Southwest Airlines Co. Further I just realized the intrinsic value of QAN have increased up to $7.01 (bearish) and $8.52 (Bullish). Plus, I think Magellan Financials called QAN a buy few months ago and they are betting on growth next year which was a surprising bet. Finally, Keep up the good work. I'm learning a lot from your reports. Lakshan

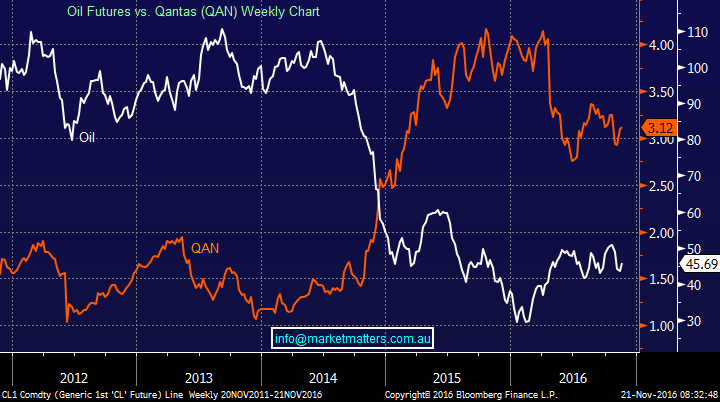

Answer; Great question and it’s a sector we’ve looked at numerous times from a trading perspective. We all know the old adage of ‘never invest in an airline’ however as you’ve clearly shown above, some pretty well-known investors are actually ‘investing in airlines’. Should we look at them now? Qantas has run from sub $1.00 to a high of $4.22 and now trades at $3.12 – most will sight the benefit from a falling Oil price which (as the chart below shows) is clearly a big factor however it’s not the only thing that has driven performance (just look at Virgin which is down -37% for the year versus Qantas which is up +88%).

Oil Futures vs Qantas (QAN) Weekly Chart

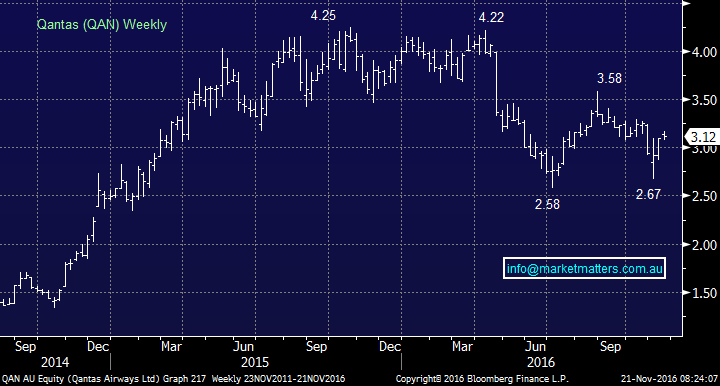

The investors outlined above are value investors, and it’s easy to see why they’re looking at Airlines – and probably why they should be looking at Qantas. On our numbers, QAN is the cheapest airline in the world trading on a Est P/E of just 6 times. RyanAir for instance trades on ~11 times. Clearly this is a deep value play and on the face of it, it looks incredible cheap (as do Airlines globally). However, if we think the Oil price is moving higher (as we do) it’d hard to get excited about Airlines, and unfortunately QAN is 50/50 here for us technically. Worth keeping on the radar but not a stock we would buy here.

Qantas (QAN) Weekly Chart

Question 2; Firstly, thanks for the last two weekly video updates – they’ve been good. Will these be a regular thing - and if so, are you open to topic suggestions? I note in the last video you talked about being positive the banks and more negative the resources, but then you sold some of your CBA – why did you do that? Thanks Lindsay

Answer; Thanks Lindsay – yes, it will be a regular weekly event, aiming for Tuesday / Wednesday each week covering something topical. We might do some from the trading desk at times, and well mix up the approach / subject matter and true to the Market Matters philosophy, we’ll always have a view. We are open to suggestions but it’s won’t be a Q & A style approach – it’ll be on one specific topic each week.

For those who missed last week’s update, you can view it here – we talked about Resources versus Banks

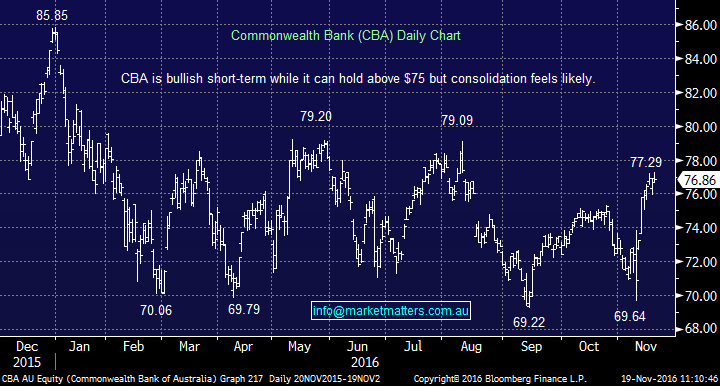

In terms of CBA it has rallied $7.64 (11%) since the election upset and our preferred scenario is CBA pulls back under $76 in the short term. We had a large holding (12% of the portfolio) – were in profit and saw better opportunity elsewhere, particularly in $US exposed stocks plus, we also bought Macquarie (MQG) which is also in the financial space. We still have 6% of the portfolio in CBA, 10% in Westpac, 12% in Suncorp and now 4% in Macquarie – clearly we still like the financial space overall however opted for a more balanced exposure.

Commonwealth Bank (CBA) Daily Chart

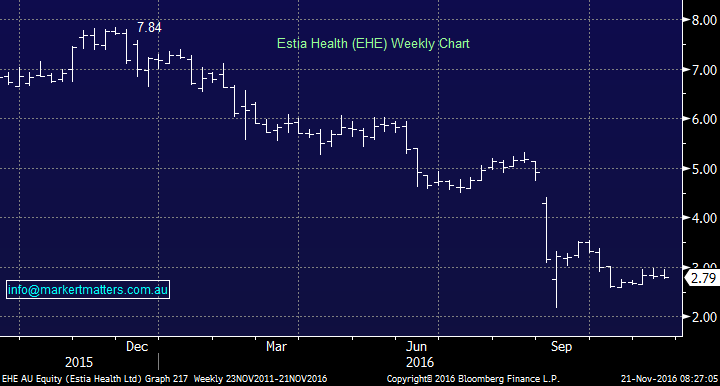

Question 3. Hi Market Matters. I am thinking about putting some money into Estia, what are your thoughts on them. Shane

Answer; It’s been a very poor time for Estia and the other aged care stocks with Estia falling from ~$8 to now trade at $2.79. The stock now seems cheap however there is a lot of uncertainty in terms of Government funding as well as within the company itself. We think the longer term drivers for this sector remain sound, and the Government need a strong aged care sector, however we’d be buyers of a new low ~$2 – which seems a long way off however as we’ve seen, these stocks can have big moves.

Question 4; Hi MM team, There was references made back in late October that MM believes Clinton victory was more in favour but it seems now Trump really trump us all. And I believe even MM didn't expect the magnitude of this "Trump Rally". Given his policy stance around financial systems especially domestic in the US, would you know consider holding CBA, WBC and SUN a little longer because it is evident the yield curve is becoming more and more steeper - BEN was sold little premature because it seems at least technically it will retest $11.50 in the coming week. Also, I have a question around the recent purchase of HSO - given November on a historical basis been a great month for healthcare stocks, what is MM view on HSO fair value given the recent profit guidance and it seems the stock is trying really hard to close above $2.40 but sellers come in around this region. What is MM targeting for HSO in the coming weeks ? Kind Regards, Tianlei

Answer; Thanks T ianlei – a few parts to this question. In terms of Trump – yes, we thought he was a long shot as did most others (and indeed Trump himself!!) In terms of CBA, WBC, SUN, we have targets for each.

SUN; Our target of $15.50 feels miles away at present but we still like the stock.

CBA; We now have a 6% holding in CBA and will look to sell $78/9 however if we do get a decent Christmas ‘pop’ then $80 seems likely

WBC; Looking to sell over $32

Obviously the market is fluid and these targets can change, however the steepening of the yield curve is now a well-known theme and is clearly being priced into bank stocks at present. We picked the theme early and typically, when the rest of the market catches on, it’s time to trim. For now, we’re comfortable with our targets above but never say never!

Healthscope (HSO) – We like HSO and will look to increase our current 5% holding on a dip sub $2.10. We think the stock can trade back to ~2.60.

Summary.

- We are 50/50 Qantas at the moment even though it seems ‘very cheap’

- We would look to buy Estia on a capitulation low near $2

- We still like financials for now even though we trimmer CBA

Overnight Market Matters Wrap

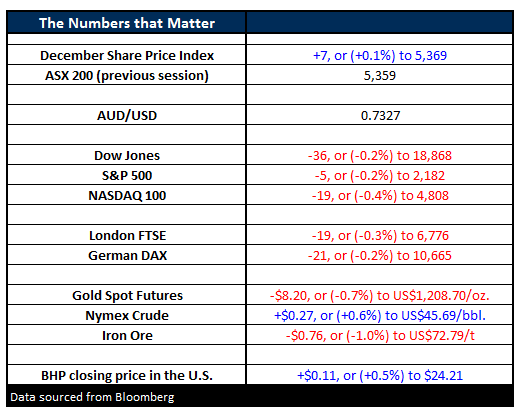

- US markets fell on the last day of the trading week, with the Dow closing down 36 points (-0.2%) to 18,868, whilst the S&P500 closed down 5 points (-0.2%) at 2,182.

- Traders were reporting the market appears to be running into possible ‘exhaustion territory’, after the market transitions from reaction to the election to reaction from fundamentals.

- Oil finished the week on the plus side, as hopes switch from fear that OPEC won’t reach agreement to cut production, to them reaching consensus. Iran appears to be the possible stumbling block, but all will be revealed when they finally meet on 30th November. Crude finished the day up 27c (+0.6%) to US$45.69/bbl. For the week it rose US $2.28/bbl.

- The ASX 200 is expected to open slightly higher, around the 5,363, area as indicated by the December SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/11/2016. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here