Will gold fall with rising interest rates?

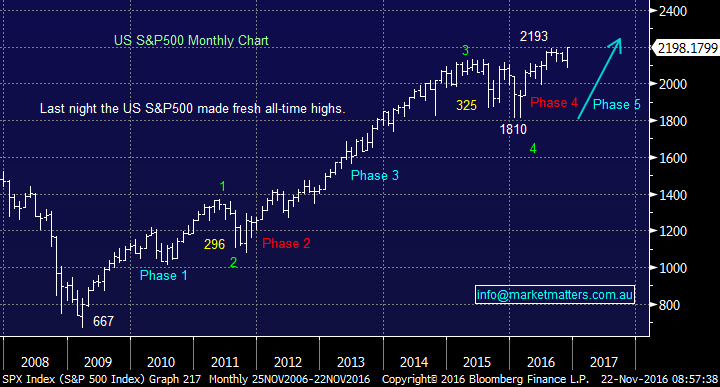

Last night global equity markets continued to surge with the S&P500 making the fresh all-time highs we have been forecasting all-year. Hopefully the local ASX200 will regain some much needed "mojo" into Christmas, it currently sits 4.9% below this year's high, 12.1% below its 2015 high and a horrible 28% below its all-time high. On the index level at MM we channel a significant part of our energy into tracking the US market for 2 main reasons:

- The US Index has shown more clarity to us over recent years, enabling MM to be an aggressive buyer when many were scarred e.g. early 2016.

- The local ASX200 and US stocks are highly correlated when it comes to large swing lows / highs and underlying trends, just not in pure relative performance.

We remain committed to our view that US stocks will likely rally a further ~8% prior to experiencing a bear market that we feel will last a few years and correct well over 20%. The current strength is being fuelled by liquidity with most fund managers overweight cash, note the correction we are looking for is a simple healthy correction of the impressive bull market rally since early 2009.

Today we are going to look at gold, the precious metal that can do very well in bad times and many think rising inflation, the question is when do we start buying gold stocks again considering our medium term concern for equities?

US S&P500 Monthly Chart

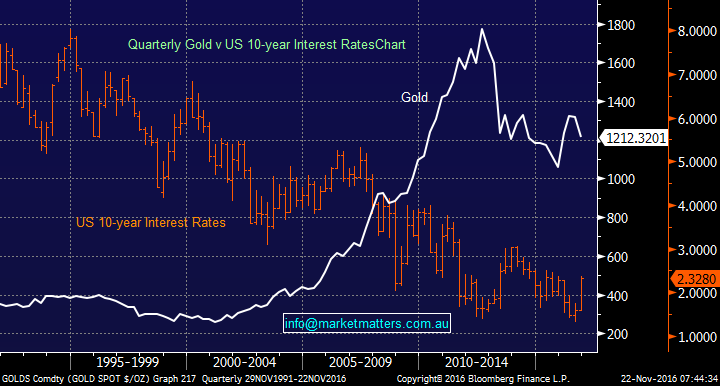

Gold enjoyed a meteoric rally lasting over a decade from around the year 2000 gaining over 600% into late 2011, prior to then almost halving into last Christmas. The correlation with interest rates is average at best:

- Gold went nowhere when US 10-year bond yields fell from around 8% to under 4%.

- Gold only exploded when rates then fell from 4% to under 2% but the precious metal began its advance when rates actually had a counter trend rally from the 3.5% to 5%.

- Gold almost halved since its 2011 top but during this time interest rates remained weak with deflation getting significant air play as opposed to inflation.

- Gold almost doubled after the GFC implying the panic value attached to gold is more short-term noise than long term trend.

We all know that holding gold does not pay any interest but it appears that interest rates alone is not a huge influence on the price of gold.

Gold v US 10-year interest rates Quarterly Chart

So if interest rates, hence inflation expectations, and panic do not have a major impact on the gold price the question is what does?

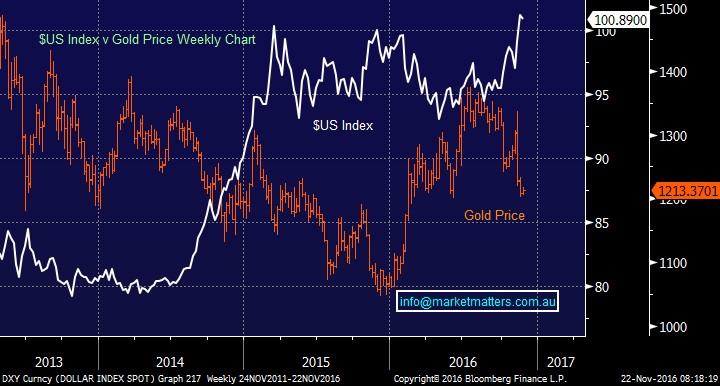

Our initial thought was the $US would be a huge influencer as gold is denominated in $US hence a higher $US should pull the gold price lower e.g. From 2002 to the start of 2011 the $US fell over 30% against the Euro, during this time gold rallied over 500%!

However again this was not the case, short-term there was often a knee-jerk reaction but no trend was evident:

- When gold surged for 10-years the $US was overall choppy but with an upside bias.

- When gold halved the $US again was quiet except the last few months.

- When the $US surged 25% from 2014 gold fell but only $US200/oz compared to the previous $US700/oz decline that had unfolded from the 2011 top.

$US Index v Gold Price Weekly Chart

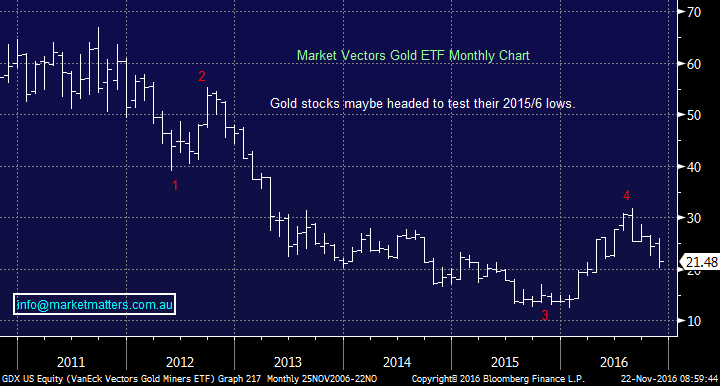

So it looks like gold moves by good old fashioned supply and demand with interest rates/inflation, the $US and "panic" exerting mixed influences at different times. Our view is a often the case "KISS" (Keep it simple stupid) watch the gold stocks for signals and do not bring too many conflicting thoughts to the table.

We have a slight bearish bias on gold stocks at present which combined with the 3 negative influences of a strong $US, rising interest rates / inflation and current global calm makes being an observer easy for now.

Market Vectors Gold ETF Monthly Chart

Summary.

- Short-term we are 50-50 gold so are likely to just be observers into 2017.

- When we feel US stocks are topping out and the $US has run out of strength our interest in gold stocks is likely to manifest into some buying.

Overnight Market Matters Wrap

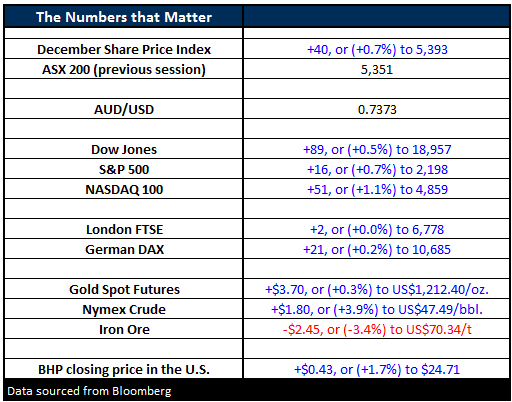

- The US share markets started the week on a positive tone overnight, with the DOW finishing the day up 88 points(+0.5%) to 18,957, while the broader S&P 500 closed at first all-time highs since August 2015, 16 points higher (+0.8%) at 2,198. However, some selling was seen in the futures after, as news of a 7.3 magnitude quake was hit just off Tokyo and a tsunami warning was issued.

- The strength seemed to have followed on from the Energy sector as seen yesterday, our time. Crude oil rallied 3.9% higher to US$47.49/bbl.

- Iron Ore was weaker overnight, down 3.4% to US$70.34/t., however we expect to see some gains on the iron ore giants today, with BHP closing an equivalent of 1.6% higher at $24.69 from Australia’s previous trade in the US overnight.

- The December SPI Futures is indicating the ASX 200 to open 30 points stronger, above the 5,380 level this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/11/2016. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here