Subscribers Questions

Morning All,

We are sorry for today’s late report, we had a coffee spillage on our keyboard!

Thanks again for the volume of subscriber questions; it’s great for Market Matters to receive magnificent subscriber engagment. We actually had more questions this week than during the US election! Such a large response, maybe due to the rising market, but thanks again! The markets are in an exciting position for next few years.

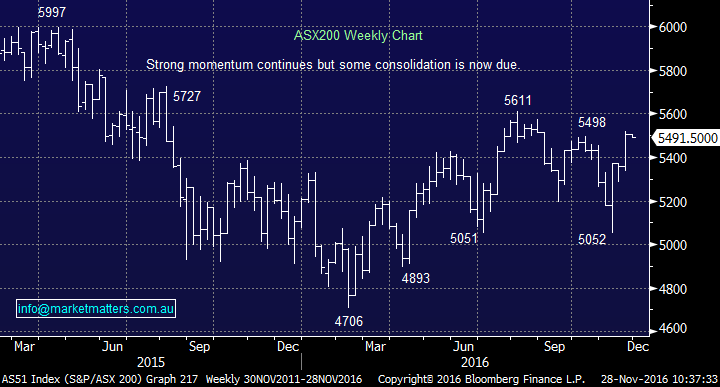

ASX200 Weekly Chart

Question 1.

"Hi, MM I have been watching APA Group (APA) as the yield play unwinds and I would like your thought and when would be a good time time to start averaging on them, or if they have further to fall. Any other comments would be apciated to" - thanks Paul.

Thanks Paul, APA the natural gas operator has fallen 27.6% as the yield play has been sold off aggressively - very similar to Sydney Airport (SYD) and Transurban (TCL). We bought TCL recently, but after its strong 6% bounce; we are more of a seller than a buyer. APA has now bounced back to strong resistance at $8. Technically we are now neutral, but volume over $8.25 would generate buy signals.

Question 2.

"Hi Team, Any thoughts on the Watermark IPO" - King Regards Mic.

Morning Mic, The Watermark Global Funds is a market neutral fund that relies on the stock picking skills by its fund managers. However, due to 1-2% of the valuation being taken up in fees and often these vehicles trade below discount to NTA, we would rather review this after its IPO

Question 3.

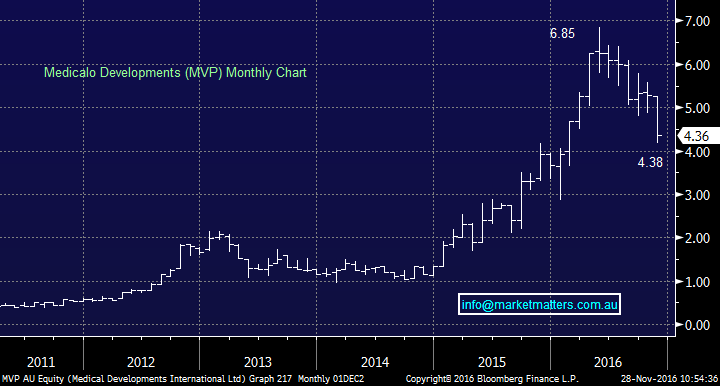

"Hi Guys, Any view on Medical Develoment (MVP)." - Thanks Andrew.

Medical Developments International (MVP) develops and manufactures pharmaceutical drugs for the healthcare market. The stock has corrected over 37%, in line with the weaker healthcare sector. Technically we can accumulate at current levels, with stops under $%3.90 - we like healthcare to recover from current weakness.

Medical Developments (MVP) Monthly Chart

Question 4.

"After reading the Market Matters portfolio position email, for the investors looking medium to long term would it be considered prudent to sit on the sidelines for a few months in cash now, given MM is looking to sell out into cash entirely at some point early to mid-2017, and re enter market probably on the dips? The outlook doesn’t look great in the near to medium term if a strong cash position is being considered." - Kind Regards, Phil

Hi Phil, for investors in cash we would not be buying now, but if you’re ‘long’, as we are from decent levels, we prefer selling into strength. It’s not long until we hit the seasonally strong period for stocks. à From mid-December, the ASX200 has rallied ~2% into the end of the year over the last 20-years. We do anticipate having much higher cash levels in January 2017. Hence, we would be geared at today’s levels. Note we are being patient short term, prior to any aggressive selling.

Question 5.

"Question for MM, maybe for next week …The insurance sector … I followed your advice a few weeks back and got some QBE under $10 which at the moment is looking good on a 3 month outlook, though the stock is only consistent in failing to deliver. What about others? AMP, Suncorp (yes $15.50 looks miles away), IAG? I am perhaps overly long financials about 20% QBE, 20% Macquarie and 10% Bank of Queensland. Views on sector allocation?" with - Hugh

Hi Hugh, Thanks for another question. Simple answer - we like QBE, SUN and BOQ at present, but would not be adding AMP and IAG. We believe we have the best exposure to the sector(s) - 50% in financials feels about right at present – boring, but we'd be staying as you are.

Overnight Market Matters Wrap

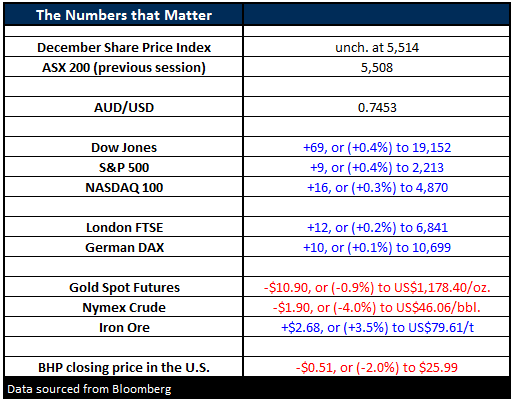

- A quiet, but positive half day session was experienced in the US share markets last Friday, as investors reeled in the after effects of celebrating Thanks Giving.

- The Dow rallied 69 points higher (+0.4%) to 19,152, while the S&P 500 closed 9 points higher (+0.4%) at 2,213.

- Domestically, the ASX 200 is expected to open with little change this morning, above the 5,500 level. However, with oil down 4% over the weekend, a negative bias is expected to be seen today.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/11/2016. 11.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here