Italy becomes another punch absorbed

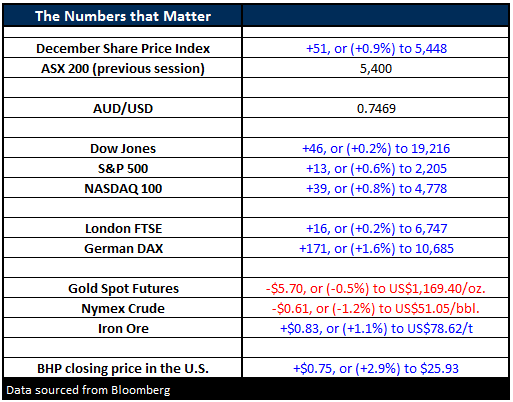

In yet another déjà vu moment for our time zone yesterday, it felt like stocks were in for a tough few days following the Italian referendum. Although the anti-government NO Vote winning was anticipated by the polls, unlike the Trump result, the crushing margin sent our ASX200 down 43- points (0.80%) and the European / US futures lower. However, this morning our Bloomberg is showing strong gains from most of Europe and the S&P500 gaining ~0.6% in a reaction bearing resemblance to the US election, just on a smaller scale.

This morning, futures are pointing the ASX200 to open up ~50-points at 5450. Gains should be led by BHP which closed in the US, on the ADR market, up over 2.5%. We get an excellent technical buy signal if the market can close over this 5,450 area, targeting at least 5550 into 2017 - a great signal as we enter the very strong seasonal period, albeit a week early. Remember, we are looking to reduce our equity exposure into this strength if it unfolds.

It's very hard to know what sectors will outperform if / when we get a Christmas rally because the main characteristic is just a pure lack of selling, as opposed to aggressive buying. Historically it's the healthcare sector that kicks the goals between November and years end, but that has definitely not been the case so far in 2016.

ASX200 Daily Chart

European indices almost embraced, or perhaps just ignored the Italian referendum result, with the Austrian pro-EU result arguably ending up carrying as much weight. We remain concerned for the EU moving forward, but until the heavyweight French and German elections later in 2017, its short-term fate will remain uncertain. Ironically, the votes are likely to be fought around EU stability versus immigration policies, not fundamental country specific economic / trade policies.

The German DAX has been trading sideways for 5-months, but last night's strength took the index within striking distance of the highs for 2016. While the DAX technically remains neutral / positive, our "Gut feel" is a sharp rally for stocks is close at hand, with the limited European news coming through until the Dutch election on the 15th of March.

German DAX Monthly Chart

When markets fail to fall on so called bad news, it's a bullish sign and that's exactly what has unfolded during 2015/2016 as stock markets have shaken off a number of potential strong headwinds.

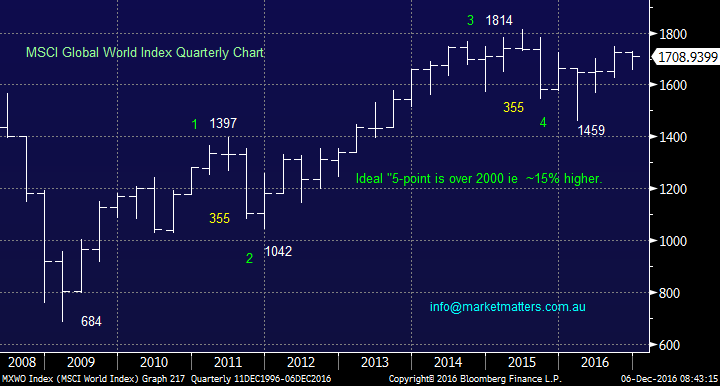

When we stand back and look at the MSCI World Global Index, which combines all developed world markets, the picture remains bullish with a minimum upside target of ~9%. However, somewhere in the 15-20% region feels more likely, which implies strongly, the European stocks will need to come to the stock market party which has been led by the US market in 2016.

This is another index we are watching carefully as we look to identify our targeted top for stocks prior to a ~25% correction.

MSCI World Global Index (MXWO) Quarterly Chart

Summary

- We will have our short-term bullish ASX200 call reinforced if it can close over 5,450 today with a minimum target ~5550.

- We intend to reduce our large equity holding into this strength in anticipation of a pullback in early 2017.

- While we are targeting further gains of around 8% from US stocks into 2017, a larger advance of ~15% would not surprise from the MSCI global indices (MXWO).

**Origin Energy (ORG) is just out with a positive announcement which will help to reduce its reasonably high debt levels - this should be positive for the stock**

Overnight Market Matters Wrap

- Global equities rallied overnight, with investors looking at a new chapter, beyond the outcome of the Italian referendum.

- The Dow rallied 45 points (+0.2%) to 19,215, while the broader S&P 500 closed 12 points higher (+0.6%) at 2,203 – attempting to break new highs yet again prior to the end of year.

- Volatility continues to fall back towards the ‘complacency’ level, down 12.1% with the CNN Money ‘Fear and Greed’ Index at extreme highs (see below).

- Despite crude oil losing 1.2% overnight, BHP is set to outperform the broader market yet again. This is after Mexico’s state oil, Pemex awarded BHP with a joint venture to develop an impending profitable deep water field.

- An open of 45 points higher to 5,445 in the ASX 200 is expected as indicated by the December SPI Futures this morning.

CNN Fear and Greed Index – Markets optimistic but further to go before we tick into extremes which is a characteristic of a market top

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/12/2016. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here