Subscriber questions before Christmas

With Christmas looming rapidly next Sunday it's no surprise that we have a fewer questions than usual this week, although it would nice to think this was because our subscribers fully understand our thoughts for the weeks / months ahead and hence are on the same page! We had a number of questions around the Fed's fully flagged decision to raise interest rates last week so addressing them today seems a bit retrospective however the view remains relevant we think.

One piece of important news that the AFR is focusing on today is the government's budget update and subsequent potential loss of our AAA credit rating. This is without doubt a political hot potato and an important issue for the market and Australia. The rhetoric from the S&P rating agency is they are looking for evidence that the government is addressing the deficit, this should give Mr Turnbull some wriggle room - fingers crossed.

If Australia were to lose its AAA rating this week its likely to end any hope of a substantial Christmas rally but the $A sitting unchanged ~73c implies markets have no major concerns at this stage. The other issue in the short term may be around the perceived ‘tightness’ by Mr Morrison and co in today’s update. There is little doubt that Australia is under some pressure from a ratings perspective, and this will obviously put some added pressure on the Government to appear very prudent / tight and the media will likely run with this line for the next news cycle, however the reality is that our position is in a LOT better shape post the rise in Commodity prices and a ‘credit downgrade’ if it were to occur would be another example of the rating agencies backward looking, behind the curve mentality.

Question 1

"Is there more risk in holding shares as opposed to reducing exposure today, ahead of the Fed? I appreciate it is a big leap of faith if they don't increase given the economic signals to date however just curious on your view." - Peter

Hi Peter, Sorry we are answering this question after the Fed's decision but we have seen US stocks correct 1.3% and the ASX200 1.5% so we will evolve the question to "what to do now".

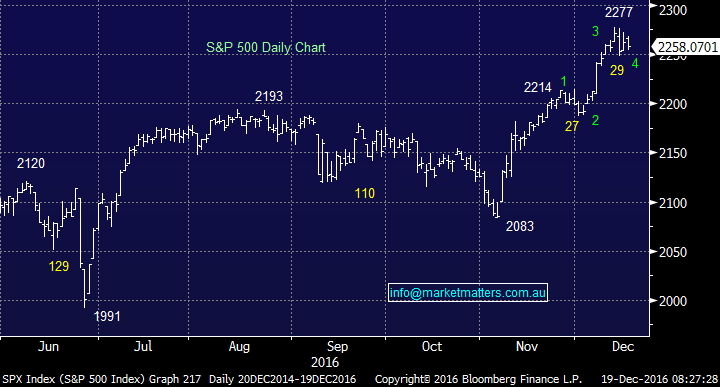

We feel US stocks will rally another 2-3% into 2017, a pullback before another crack at a ‘blow off style top’ before the risks of a decent correction increases significantly. The local market is harder to feel technically but we will maintain faith with the seasonality and statistics targeting a break of 5600 into 2017, hence we are sellers of strength over the next few weeks.

US S&P500 Daily Chart

Question 2

"Hi MM, Two questions for Monday. Just wanted to know your thought on Fridays close. It seemed at match out the volumes went from 5bn to 7bn. That seems like a big match out on a Friday. Is that an indication of the strength in buying we are going to see in the next 8 trading days? Also, if our credit rating in lowered on Monday, how will that effect our banks for the week? Profit taking?" - Mark

Morning Mark, Fridays large volume match out was almost definitely courtesy of a large buy order that hit the SPI futures at ~3.58pm leading to arbitrage buying in the stocks on the match. The SPI was pushed up 30-points in a matter of minutes with over 10% of the days SPI trading in the same short time. Usually we would take this strong close as a bullish sign for the days ahead.

On the credit rating front we believe the entire market is likely to experience a setback including the banks. It's bad news for the banks as their cost of capital will rise, just like the governments, but as we have witnessed many times before it's the consumer who will wear the brunt of any pain hence slowing the economy and potentially exacerbating the issues.

Friday Share Price Index (SPI) 3-minute Chart

Question 3

"hello there, not advice but just after information of how I can invest (in SMSF) in say the top 100 ASX or 200ASX to give me an option as opposed to individual shares?" - Lawrence

Hi Lawrence, Unfortunately as you have acknowledged we cannot give personal advice but there are some solid ETF's that give excellent exposure to the index.....Here is a very brief overview;

SPDR/ S&P/ASX 200 Fund (STW); The ‘Spider’ as we call it simply tracks the ASX 200 , is low cost (0.19% management fee) and pays dividends quarterly with a current yield of 4.29%. Given it’s a mirror of the index it has 9.25% in CBA, 7.14% in Westpac, 5.79% in ANZ, 5.35% in BHP and 5.27% in NAB as its top 5 holdings, which goes to show how ‘heavy’ our banks are from an index perspective.

Staying in Australia, if you have a focus on income, then the Russell High Dividend Australian Shares ETF is reasonable, however once again, the top holdings are the banks. This fund has a management fee slightly higher than the STW at 0.34%, but a yield slightly above.

Going offshore, the IVV, which is the iShares S&P 500 ETF is the cheapest, and most popular ETF around. It tracks the S&P 500 which is a higher growth, lower income market than the ASX. With a management fee of just 0.04%, and it’s top 5 holdings being Apple, Microsoft, Exxon Mobil, Johnson and Johnson and Amazon this clearly gives a different exposure than the companies on the ASX.

In Europe, the IEU ETF tracks the top 368 stocks from European countries therefore giving a broad exposure to the region. It has a management fee of 0.60% and holds companies like Nestle, HSBC, Roche and Novartis. A solid exposure in Europe.

There are literally 100’s of ETFs now trading, and the international ETFs are more appealing. The issue with ETFs in Australia is that anything that tracks the index, has a very high concentration in the banks. You also need to be careful of cross exposures, for instance, holding the STW for a broad market exposure then investing in the Russell High Dividend ETF will leave you with a BIG exposure to many of the same stocks, most notably the banks.

Betashares has an interesting ETF that could be useful for us next year called the BEAR fund (ASX code BEAR). This gives investors a ‘short exposure’ to the ASX, or in other words, by buying this ETF we benefit when the market declines. Probably the simplest way of playing the downside in markets or hedging a portfolio if you’d still like to receive dividends.

Question 4

"Hi Nick and team, This query is definitely down to FOMO! I'm at 50% cash following some good selling in May and Aug so can't complain BUT am getting itchy fingers. Have closely followed your reports and appreciate the directness, but do you still think the US market has only 10% left in it and do you have any time frame on it peaking? Crystal ball stuff I know but perhaps I just need to be slapped! " -Thanks, Radley

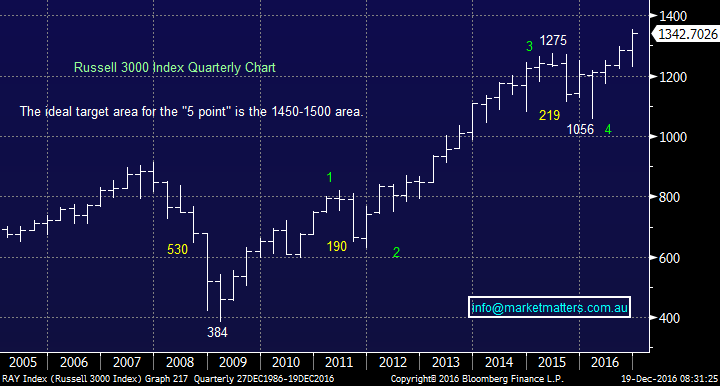

Hi Radley, yes we do think the US equity market now has limited upside, perhaps 8-10%. However as you have picked up we do believe the market will be 25% lower at some stage over the coming years so any buying should be selective and relatively short-term.

Sitting on cash over Christmas with an open mind moving into 2017 sounds like a nice position to be in.....put on some gloves and don't scratch those fingers!

US Russell 3000 Quarterly Chart

Overnight Market Matters Wrap

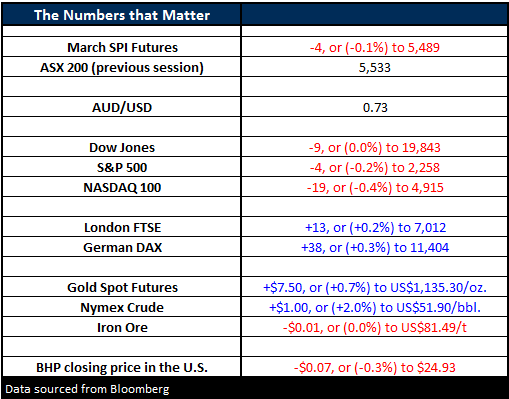

- US markets closed marginally lower ahead of the Christmas period.

- The Dow closed 9 points lower at 19,843, while the S&P 500 was down 4 points to 2,258 last Friday.

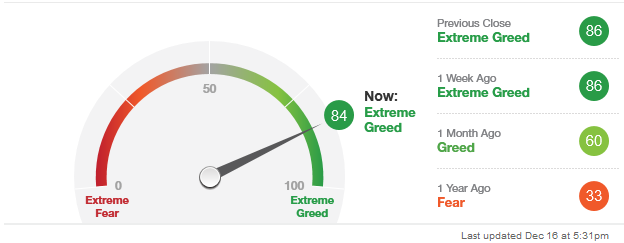

- Volatility continues to dry up, down 4.6% to the 12.20 level, with CNN’s Fear and Greed Index indicated the Extreme Greed remains.

- The December SPI Futures is indicating the ASX 200 to open 10 points higher, near the 5543 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/12/2016. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here