A Quick Update on our Market View

Market Matters Morning Report 4th January 2017

Happy New Year everybody!

Market Matters have been extremely active in the recent days, with us taking some very nice profits in Vita Group (VTG), Westpac (WBC), Transurban (TCL) and Westfield (WFD). We have simply stuck with our trading plan that was outlined in detail throughout December, hopefully we can also realise some nice gains in Macquarie Group (MQG) ~$90 in the near future.

Importantly, this is an ideal time to update how we see stock markets trading in the first quarter of 2017, prior to a comprehensive report this weekend. We have been very bullish both local and overseas stocks over recent months, hence the obvious question is - Are we now bearish as we are taking some $$$ off the table?

Firstly let's look at the statistics for January since the GFC, after December delivered its typically bullish returns:

1. The ASX200 has been up 3 times, down 3 times and unchanged once.

2. Whether up, or down, the average move is ~225-points.

Hence the seasonal influence is neutral, but if yesterday’s low of 5670 holds for the ASX200, there is a strong possibility that recent strength will continue for local stocks propelling the market to ~5900.

ASX200 Monthly Chart

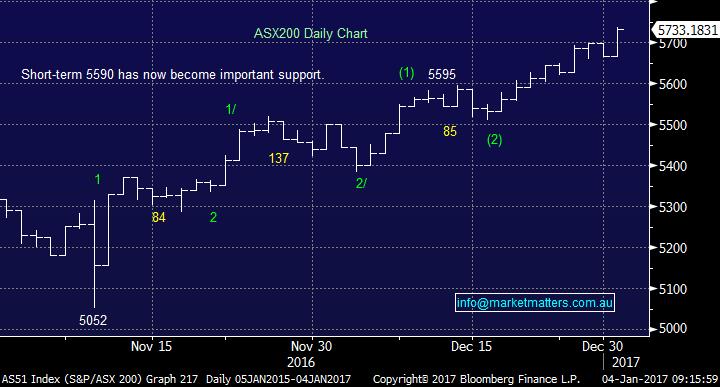

When we look closely at the structure of the 681-point / 13.5% "Trump rally" by the ASX200, since the 9th of November, it remains bullish unless we see a break back under 5590. We are likely to see a ~90-point retracement sometime in January, but at this point in time, we believe this pullback should be bought plus it is likely to occur from higher levels.

ASX200 Daily Chart

The US market continues to trade strongly into 2017, three important medium term views:

1. We expect this mature bull market to advance between 7-10%, before warning bells start ringing loudly.

2. As this mature rally evolves, it is likely to become more volatile and choppy.

3. We are still anticipating the start of a ~25% correction in 2017 i.e. a major top.

US S&P500 Monthly Chart

Short-term, the S&P500 is ideally targeting fresh all-time highs this month, over 2300, prior to a decent correction of ~4%.

US S&P500 Daily Chart

European indices are supporting our short-term bullish outlook for equities with the German DAX on track for a test of ~13,000, an impressive 8-9% higher.

German DAX Monthly Chart

Summary

No change, we remain short-term bullish stocks, but believe 2017 will be a choppy / volatile year with plenty of opportunities, but more than ever we will be following market adage closely:

"Buy on weakness and sell on strength".

Recently we took profit on 4 holdings, but only one was a generally index sensitive stock:

Westfield (WFD) and Transurban (TCL) - both of these holdings were countertrend trades of the "yield play" sell off, importantly not an area where we want to be invested medium-term.

Vita Group (VTG) - an active play / trade which reached our target area yielding a nice ~30%.

Westpac (WBC) has traded ex-dividend late last year, we prefer other banks into weakness.

* Please watch for alerts.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 4/1/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here