3 short term trades in the resource space

Yesterday’s large market decline was almost as surprising as the previous days strong rally but now we suddenly have the chart pattern that we have been looking for, so importantly what now?

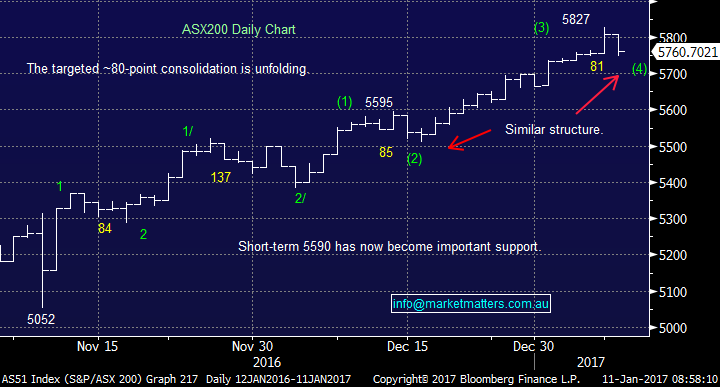

We are looking for the local market to evolve higher towards 5875 prior to a 150-point (2.5%) correction, we will stay with this roadmap until the market shows otherwise.

In the short-term we see a sequence of up-down-up moves unfolding for the ASX200 so we will continue with our "buy weakness and sell strength" adage. Yesterday we made a small 5% investment into fund manager PTM when the market fell over 50-points.

ASX200 Daily Chart

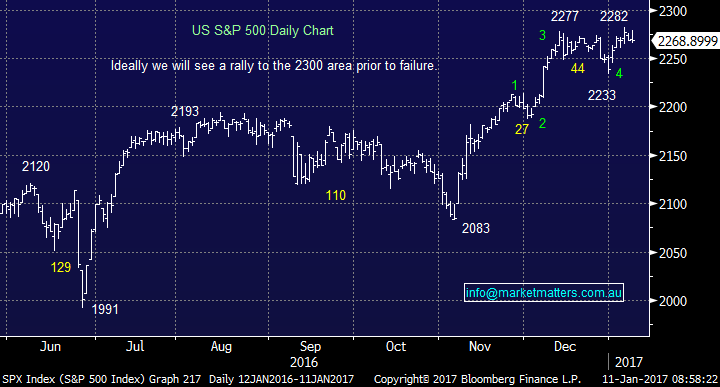

US equities have been trading in a tight range over recent weeks which ideally will see one final move higher before a decent correction, hence supporting our view for local stocks. However today we are going to look at 3 heavyweight resource stocks which can lead to us running our own race on the index performance level in the short term.

The US S&P500 Daily Chart

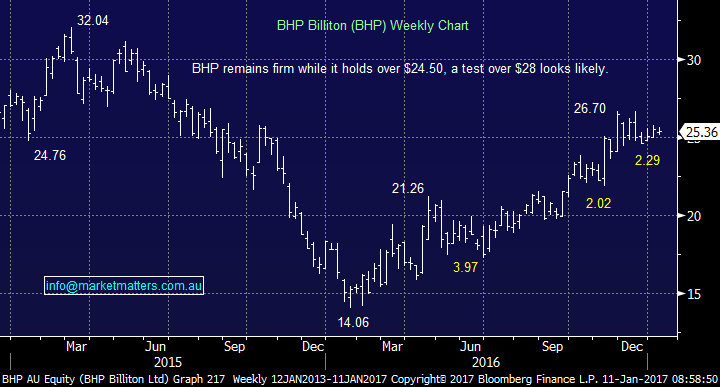

Over the past few months we’ve been of the view that resource stocks generally, had run too hot too fast and were due for some consolidation / weakness. Consolidation has now played out from the November 2016 high, however only slight weakness has been obvious. BHP for instance peaked at ~$26.50 last year and has tracked back ~$2 before closing yesterday at $25.36. From a technical perspective, corrections can happen in price or in time, and this recent move from BHP in terms of time is a positive technical sign in the short term.

Our caution in the resource space recently was a result of weakening underlying commodity prices. Met Coal for instance is 38% below its December highs, Iron Ore dropped 10% from its highs (and has recovered somewhat) and other commodities have been weak, which isn’t really a surprise after such a big move in 2016. Although we continue to think that these price declines are the start of a bigger drop for commodities at some point in 2017, and we discussed this yesterday in our Weekly Video Update(click), the short term picture for resources is more bullish – and is throwing up a few short term trading opportunities.

The combination of recent strong economic data from China and our view that the very well owned $US trade is due a correction ( very supportive for commodities), leads us to believe the resources space is ready for a pop to the upside in the short term.

Last night this opinion was echoed by the resources rich UK FTSE making fresh all-time highs and the Canadian TSX Composite closing within striking distance of the same yardstick.

1 BHP Billiton (BHP) $25.36

BHP has consolidated its gains of 2016 since the end of November and we now believe a rally towards $28 is the most likely scenario.

We are short-term buyers of BHP around $26, targeting $28 with stops under $25 – certainly a short term trading scenario.

BHP Billiton (BHP) Weekly Chart

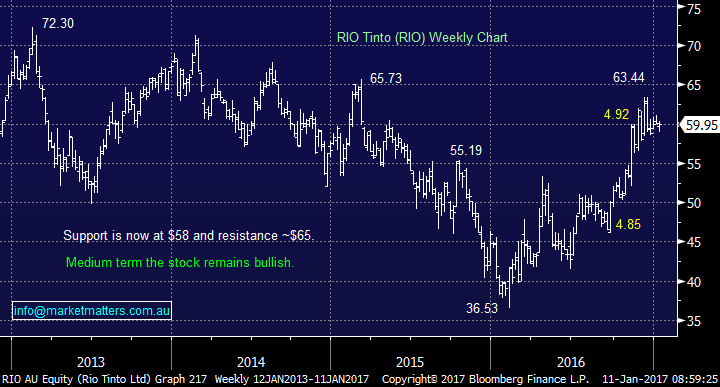

2 RIO Tinto Ltd (RIO) $59.95

RIO has been trading sideways since mid-December and we believe it has formed the foundations for a rally towards the $65-70 area.

We are buyers of RIO targeting +$65 with stops under $58.90.

RIO Tinto Ltd (RIO) Weekly Chart

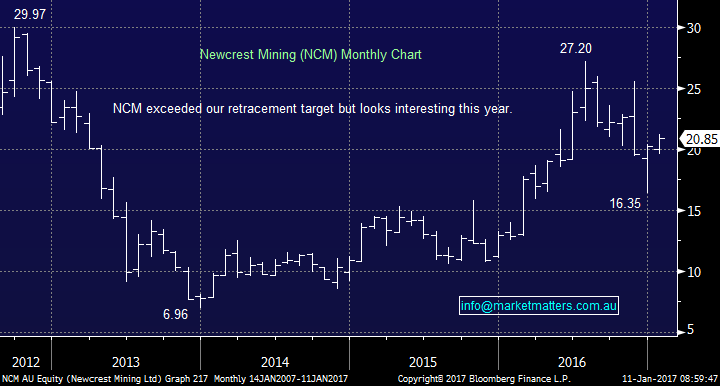

3 Newcrest Mining (NCM) $20.85

NCM is now looking very constructive after a savage 40% correction, while its relatively late to be a buyer compared to last month's lows the overall technical and short-term fundamental picture looks attractive.

We are buyers of NCM with stops under $19.50.

Newcrest Mining (NCM) Monthly Chart

Summary

- We believe the ASX200 will rally ~150-points / 2.5% from current levels with the strength coming from the resources sector.

- We like both BHP and RIO as short--term trading opportunities and we are looking to explore this through options today.

- We like Newcrest (NCM) as a slightly longer term play and are more likely to look at this through outright stock.

*Watch out for alerts*

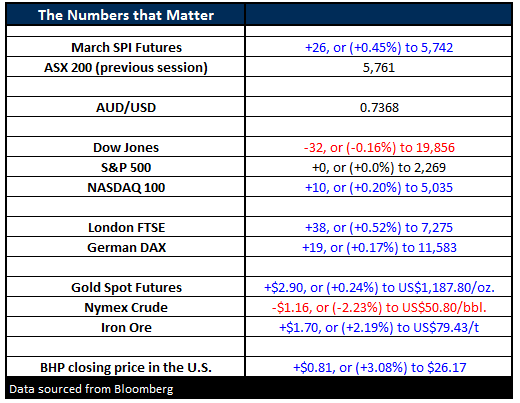

Overnight Market Matters Wrap

- Another mixed session for US share markets overnight, with the Energy sector taking another beating, while the financials and healthcare sector moved higher.

- The Dow closed 32 points lower (-0.16%) at 19,856, the S&P 500 unchanged at 2,269, while the Nasdaq 100 closed 10 points (+0.2%) at 5,035 – another record closing high!

- The base metals had a great session, with Iron Ore rallying 2.19% to US$79.43/t. BHP is expected to outperform the broader market, after its US performance, closing an equivalent of 3.08% higher to $26.17 from Australia’s previous close.

- The ASX 200 is expected to test the 5,800 level again today, with the March SPI Futures indicating a 30 point gain to 5,790 this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/01/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here