Managing Risk & the MM Service

As most global equity markets have entered a relatively quiet period, we thought today was an ideal time to follow on from yesterday's report, which outlined our likely strategy for the current MM portfolio and look at how we like to manage risks / use stops.

Firstly, a quick update to our short-term view for stocks:

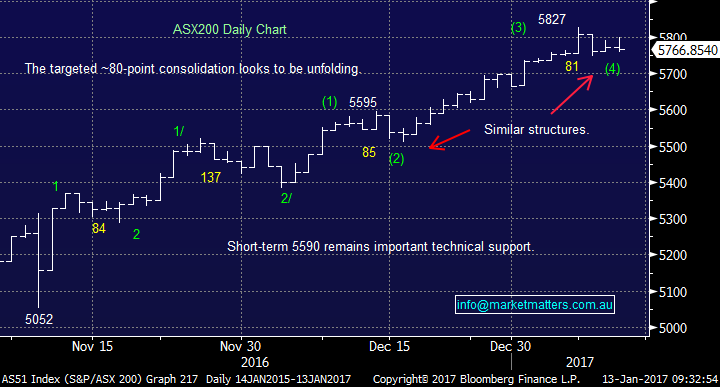

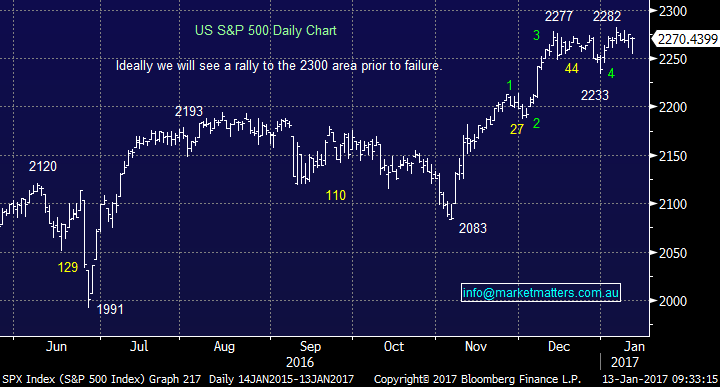

- We still believe that the both the ASX200 and Dow should make fresh 2016 highs, probably next week, but the upside momentum has clearly waned for now.

- The current minor weakness in stocks we believe is mainly because the US financial sector starts reporting tonight and they have had a huge rally, hence investors are simply taking some profits in case of disappointment.

- There is still appetite for US stocks into weakness, as we witnessed a ~180 point descent earlier in the session last night, the Dow managed to rally in the and close down only a moderate 63-points.

- The resources sector continues to advance strongly as anticipated - We have approximate targets of $28 for BHP and $65 for RIO.

ASX200 Daily Chart

US S&P500 Daily Chart

Managing risk is the arguably the most important aspect to investing and a topic, probably too large for a single morning report, but today we will outline some of our major thoughts. At Market Matters, we like to follow a simple saying which is self-explanatory: "Look after the downside and the upside will look after itself".

There are a number of factors to take into account when managing a portfolio / position with below some of the most important:

- What is our overall view for the market moving forward and how much exposure do we have to stocks when we take this into account?

- What is our overall macro / technical view of individual sectors?

- What is our current opinion of an individual stock on the fundamental and technical levels?

A great example of this is when we consider our medium term view for stocks into 2016.

We believe stocks can rally a further ~8%, BUT our strong belief is the bull market since 2009, is very mature and coming to an end which should lead to a 25% correction, probably through 2017/18.

Hence we are now holding ~30% cash as opposed to almost 100% in stocks when we became very bullish in early 2016. We will have no hesitations moving to extremely high cash levels when we think the market is at / close to a top - it's our, and your, hard earned money and we do not have to hold stocks if we believe they are about to fall!

We should remember there are only 2 simple reasons to hold stocks - capital gain and yield (dividends).

US S&P500 Monthly Chart

Most brokers will quote "Portfolio theory" to clients advising a spread across all market sectors we believe this is simple poppycock and totally disagree with the strategy. Our view is Warren Buffett was closer to the mark when he said something along the lines of:

"I like to keep a small number of eggs in my basket and then watch those eggs closely".

Our twist on this is more around sectors,we see zero reason to be exposed to a sector that we are bearish and hence the reason we were fortunate to miss the very painful decline in resource stocks during 2015. For example, moving forward we will not invest in the "yield play" as we believe that interest rates have bottomed - we only may trade occasionally as did successfully with TCL and WFD in December.

However, a spread across a few companies within a sector we like makes total sense to us.

We believe investors need to flexible at times with holdings especially when news hits the market, otherwise you will likely join the masses who sell near the lows (Panic scarred selling) and buy near the highs (FOMO - Fear of missing out).

We feel at MM one of the biggest "value adds" we give to subscribers is live alerts when we buy or sell stocks. We like to give subscribers a constant insight to our feelings around the market but obviously these views are fluid as we sit glued to our Bloomberg's for more hours than is probably healthy!

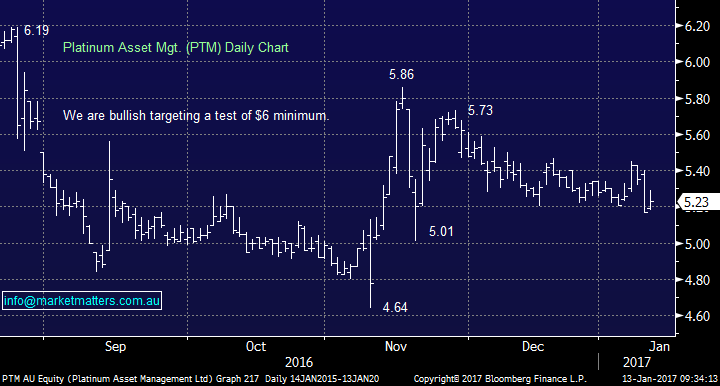

A good case in point is our recent purchase of Platinum Asset Mgt. (PTM) which mentioned a stop below $5.20 - subscribers regularly and understandably ask for stops, however when we mention this, as we did in this instance, and have done in the past, (a stop below a certain price), this is a suggestion for those that like to use a defined stop loss level to assist in risk management, positioning sizing etc, it is not necessarily the stop we will religiously run with. Only when an Alert is sent via SMS & email we transact on the MM portfolio.

In the case of PTM, we did not set this stop for a couple of reasons, and still hold the position:

1. We only allocated 5% into the position hence are actually happy to buy the stock under $5.

2. We are holding over 30% in cash hence do not feel too exposed to equities at present.

Investing is like a jigsaw made up of a number of pieces and all these pieces should be considered in decision making. At MM we always live and die by our calls and hence our portfolio is always available to subscribers as are past trades but if this is how we are judged we obviously must do what we feel is optimum at the time. Many ‘theoretical’ market commentators, writers / guru’s will suggest to always follow your trading plan and certainly always adhere to your stops. As we suggested above, markets are fluid and things change. New information comes to light, the overall portfolio composition will change, market views may change or external conditions may improve / deteriorate and these factors will prompt an amendment to the plan.

Platinum Asset Mgt. (PTM) Daily Chart

Summary

- We believe that the best way to follow the MM report is by using our trading alerts but we understand all investors circumstances are different, hence we will continue include stops with alerts e.g. some subscribers are often not in touch with technology on a day-day basis and simply like to quantify their financial risk at any point in time.

- However, the Market Matters portfolio only transacts when a specific Alert is sent to members.

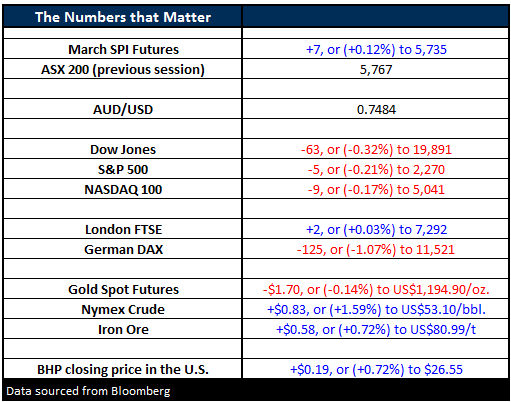

Overnight Market Matters Wrap

- The US Share markets declined overnight, as investors took risk off the table, ahead of the fourth quarter 2016 earnings season as well as further economic policy information from President-elect, Donald Trump.

- Oil ascended for the second day after further reports that key OPEC members were reducing oil production, as well as an anticipation of strong demand growth in China. – Yesterday, we sold our energy sector exposure, Origin Energy (ORG) into this strength.

- The ASX 200 is expected to open near the 5,785 level this morning, up 18 points as indicated by the March SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/01/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here