3 stocks to watch as BREXIT looms

Theresa May is preparing a very important speech for tonight which markets are hoping will deliver a long-awaited blueprint of how the UK "hopes" to leave Europe - we must remember this is a two way negotiation with the whole EU. The respected Sunday Times has reported that May is ready to withdraw from tariff-free trade with the region in return for the ability to curb immigration and strike commercial deals with other countries - this article led to the pound falling over 1% yesterday, trading around 20% below its level prior to the BREXIT vote.

With plenty of water to flow under the bridge the only certainty feels like volatility at present, today we are looking at 3 stocks we will consider buying if BREXIT fears lead to weakness and hence opportunity. Our view is the market has priced in a "hard BREXIT" and the downside to the pound is potentially limited under last year's 1.18 low, implying pound facing stocks can be bought if they spike down.Obviously with the political uncertainty these will be relatively high risk investments.

Over recent weeks we have kept a distance from Europe / BREXIT facing stocks in anticipation of the very volatility that is now unfolding but this can provide value. We have not surprisingly focused our attention on the Financial sector that we like over the next 6-months.

The British Pound versus the $US Daily Chart

1 Henderson Group $3.86

HGG is a stock we have been fairly active in over the years and a company we like, especially after their $6bn merger with US based Janus Group last year . Our view is the stock is in the too hard basket for many investors because prior to the merger it had over 60% earnings exposure to the UK, but it now has diversification with Janus and if the pound is close to a medium term low we are likely to get a an excellent entry level into the stock.

We are buyers of HGG ~$3.75 with stops under $3.50

Henderson Group (HGG) Chart

2 BT Investment (BTT) $10.58

BTT similarly to the old HGG has over 60% of its revenue generated in the UK. The stock has enjoyed a ~30% rally since Donald Trump's victory and to us only represents value into a correction.

We are buyers of BTT ~$10 with stops under $9.60.

BT Investment (BTT) Monthly Chart

3 Clydesdale Bank $4.68

As NAB's spin out of its UK assets CYB earns 100% of its revenue in the UK, clearly both high risk and return largely depending on the swings of the pound. This is a longer term story with a cost out program the main driver of earnings growth for the bank. Do note however, CYB does not pay a dividend now with expectations of an unfranked yield of 1.5% in FY17 going to 3.8% in FY18.

We are buyers of CYB around $4.20 but stops are under $3.50.

Clydesdale Bank (CYB) Daily Chart

Summary

- While we like all 3 discussed financials into weakness our favourite is HGG ~$3.75 with stops under $3.50.

- Our second choice would be CYB which we believe will be value around ~$4.20.

Overnight Market Matters Wrap

- The European markets were broadly lower overnight, while the US was closed commemoration of Martin Luther King Jr.

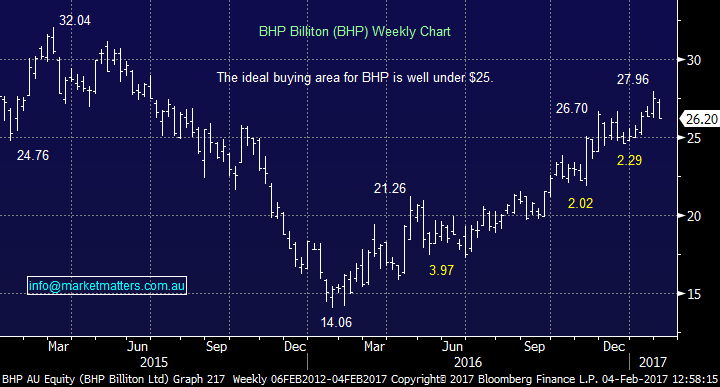

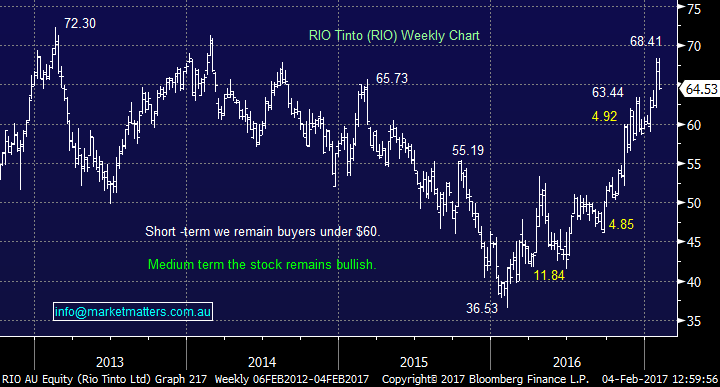

- Iron Ore continued the strength from Asia trade, rallying 3.86% higher to US$83.65/t. where the major miners, BHP and RIO rallied 1.58% and 2.06% higher in London trade.

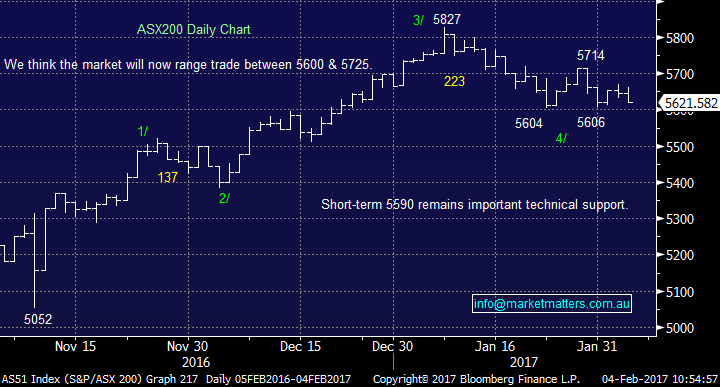

- A quiet start is expected in the ASX 200 this morning, where the March SPI Futures is indicating a mildly soft open, testing the 5,740 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/01/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here