Another 3 Stocks on our Shopping List as Pullback Unfolds

After yesterday’s switching within our portfolio, plus recent profit taking into the December / early January buying frenzy, we find ourselves sitting on over 30% in cash, hunting for opportunities . One thing we have learned at MM over the years is opportunities always come along and sitting on cash for a few weeks / months, rarely is too detrimental to overall investment returns and it can be good for our sleep!

A week ago we wrote a morning report with the same title and we have since bought 2 of the three stocks so a new list is clearly required!

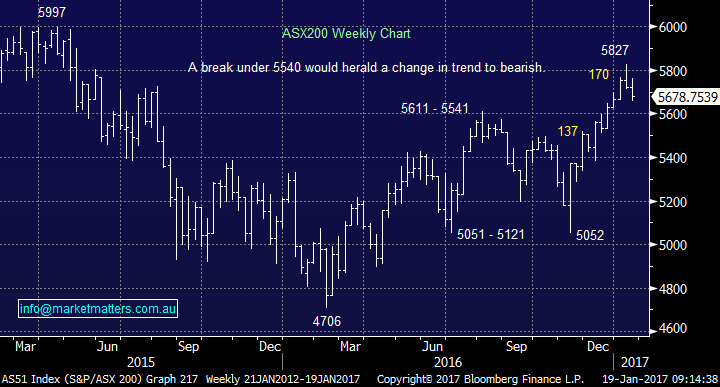

Firstly let's examine the ASX200 index for optimal levels, to put some of our cash to work. The recent weakness which has been focused in the financial and healthcare sectors courtesy of Mr Trump (how often will this phrase be used this year?), has led to a 2.9% correction.

Technically this might have interested us, but 3 things create a degree of caution short-term:

- The last pullback since the start of the "Trump rally" took 3-weeks, implying we may see lower levels next week.

- The ASX200 made fresh lows for January yesterday, but the lowest monthly range since the start of 2016 was 199-points strongly implying a test of 5625-5600 i.e. another 1-2% lower.

- The US market still looks poised for a meaningful retracement.

ASX200 Weekly Chart

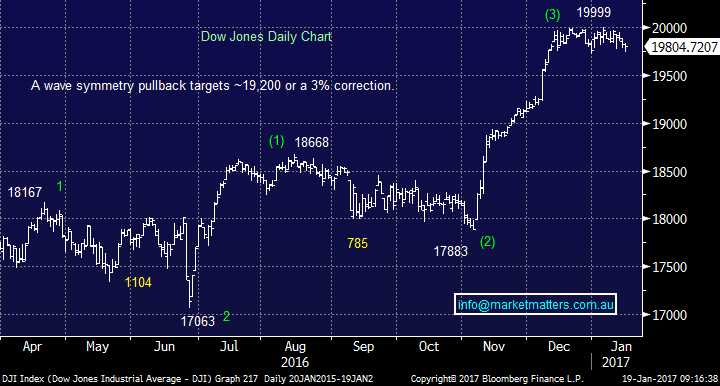

US stocks have tracked sideways for a few weeks, giving us no clear directional leads.

Two points of interest:

- We often quote that the NASDAQ is regularly the leading US index, which implies US stocks will at least test their all-time highs.

- The ASX200 strangely can also be a leading index, perhaps because we have less depth than many, hence built up buying or selling shows results faster. The ASX200's recent pullback maybe a precursor to a pullback in the US.

We remain mildly bearish the Dow short-term with a 19,200 target area.

US Dow Jones Daily Chart

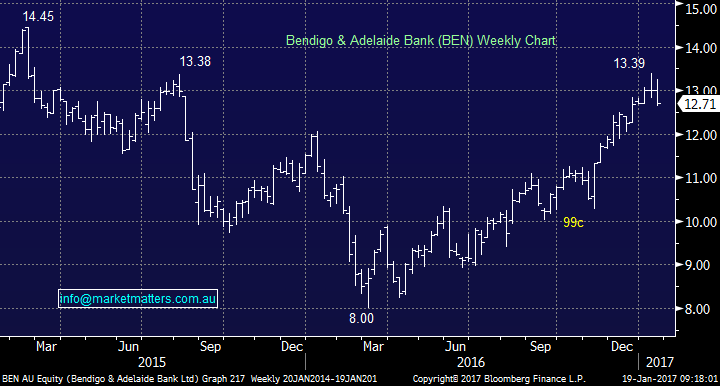

1. Bendigo Bank (BEN) $12.71

BEN has enjoyed a great rally recently, being perceived to be a large beneficiary of "Trumponics". However, yesterday the stock fell 4% as concerns that all election promises may not eventuate and / or deliver anticipated results. In simple terms, it's no surprise that some profit taking has hit BEN after its strong rally since the US election.

Currently our ideal buy area for BEN is ~$12.25, with one eye on the looming February dividend.

Bendigo Bank (BEN) Weekly Chart

2. RIO Tinto (RIO) $63.14

RIO have produced some excellent production numbers this week, illustrating perfectly what an amazing cash generating machine the company has become with commodity prices at current levels. Increased dividends / buybacks are both now on the cards. However, RIO has run hard over recent months as equities generally do - stocks regularly move 6-months ahead of the obvious reason.

On a risk / reward basis, we are keen buyers of RIO on both an investment and trading basis, around the $59 area.

RIO Tinto (RIO) Daily Chart

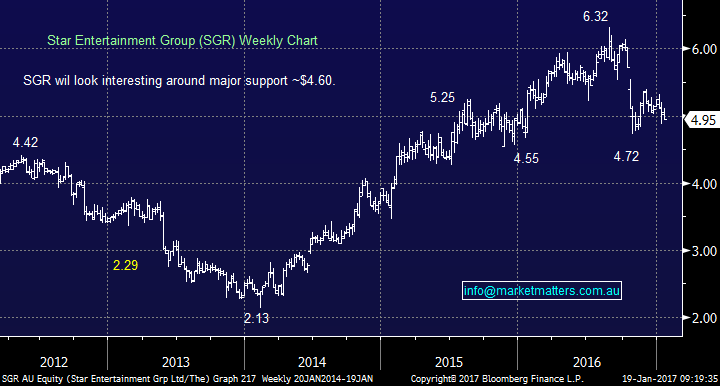

3. Star Entertainment (SGR) $4.95

Yesterday we sold our tourism exposure in MTR that had simply not been performing in a strong market, but SGR is in a very different space within the sector. We like SGR around the $4.50-4.60 area with stops under $4.

Star Entertainment (SGR) Weekly Chart

Summary

We remain buyers of stocks into weakness (for now!) We like BEN ~$12.25, RIO ~$59 and SGR ~$4.60.

Overnight Market Matters Wrap

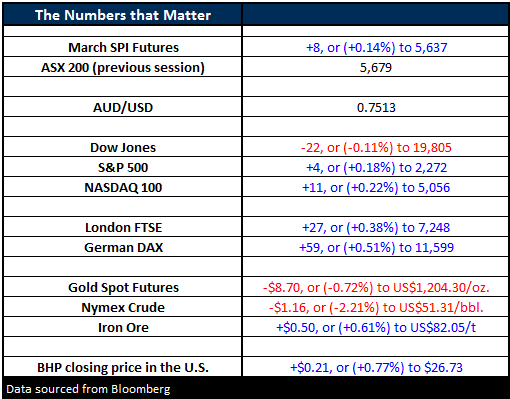

- The US share markets closed mixed with little change overnight, as investors were deciphering comments being made by US Fed, Janet Yellen and their view on further rising interest rates.

- The Dow closed 22 points lower (-0.11%) at 19,805, while the broader S&P 500 closed 4 points higher (+0.18%) at 2,272.

- Both the financial and material sector outperformed, with BHP in the US rallying an equivalent of +0.77% to $26.73 from Australia’s previous close.

- The March SPI Futures is indicating a positive open this morning, towards the 5,685 level, however volatility on open is expected, as it is January Index Options Expiry.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/01/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here