We refine the shopping list as the correction unfolds

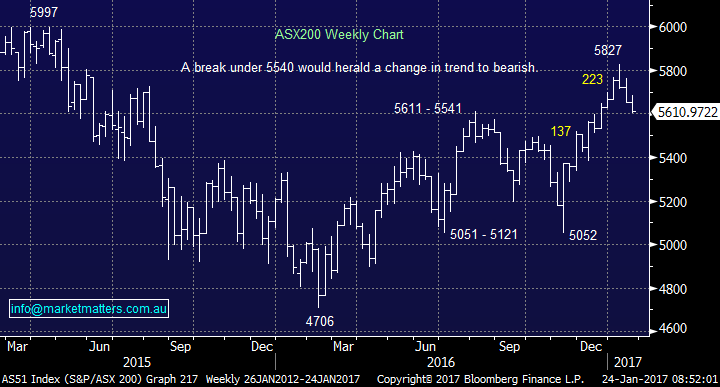

The local ASX200 has now fallen almost 4% over the last 3-weeks while US stocks continue to tread water. Having locked in some nice profits during the markets explosive rally after the US election we are now back in "buy mode" into current weakness. The ASX200's correction has primarily been focused in the financial sector where investors appear to have locked in some profits while the resources have held up reasonably well courtesy of a pullback in the $US which supports underlying commodity prices - we have played this scenario via our purchase in Newcrest Mining (NCM).

Last night Donald Trump withdraw the US from the Trans-Pacific Trade Pact, which includes Australia. This action is a simple follow through on an election promise but it illustrates perfectly that it will be far easier / quicker to implement his policies around trade which concern the market, as opposed to commencing with his massive stimulus package - US equities holding onto their recent gains is very constructive taking this into account.

Today we have refined our shopping list so subscribers can fully understand our likely actions in days / weeks ahead and importantly be prepared for alerts when they are delivered. Please note in this Tweeting world with Donald Trump at the helm of the world's largest economy we believe volatility is inevitable in the months / years ahead hence maintaining reasonable cash levels through 2017 for panic style opportunities makes total sense to us.

ASX200 Weekly Chart

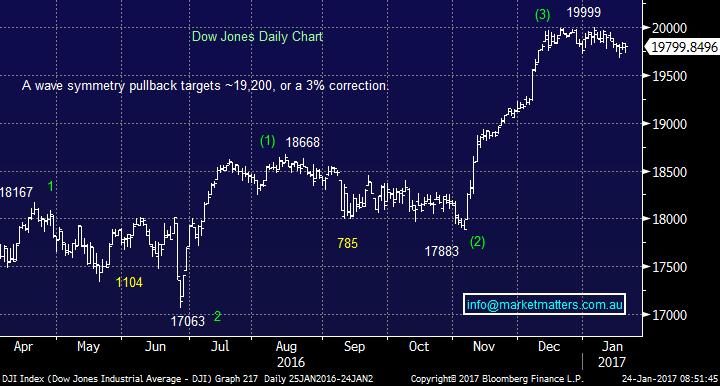

No change on our view for US stocks, with our preferred scenario is an ongoing correction of ~3% but we will not become panic buyers if the US stocks go against this prediction and squeeze to fresh al-time highs over coming weeks as we believe there is enough good news baked into current valuations that they will not follow through.

NB There has not been a fall of over 1% in US stocks since October 11, the longest streak since 2006 and a warning from a statistical perspective.

US Dow Jones Daily Chart

1. ANZ Bank (ANZ) $29.27

ANZ Bank has now corrected 8.2% and is rapidly approaching our $29 buy level. With the market sentiment clearly anti-banks at present we will remain pedantic on entry but are buyers of ANZ ~$29.

Within the financial sector we will also consider averaging our HGG around $3.80 and PTM under $5.

ANZ Bank Weekly Chart

2. Brambles (BXB) $10.34

BXB was smacked yesterday after a profit downgrade, while we have no interest at current levels we do ~$9.75 if the current sell-off continues. The downgrade from BXB yesterday was poor, and signs that better inventory control / systems from retailers are impacting the use of pallets is a concern, however if the market gets too bearish this stock, which is easy to imagine if the US market falls ~3%, we’d likely step up to plate.

Brambles (BXB) Monthly Chart

3.Cochler (COH) $126.18

We remain keen on COH but closer to $120 which is ~4.5% lower than yesterday's close.

4. Altium (ALU) $7.94

As outlined in yesterday's report we like ALU but are concerned over its daily turnover. Hence we are buyers of ALU under $8 but likely to be a smaller portfolio weighting.

5. South32 Ltd (S32) $2.56

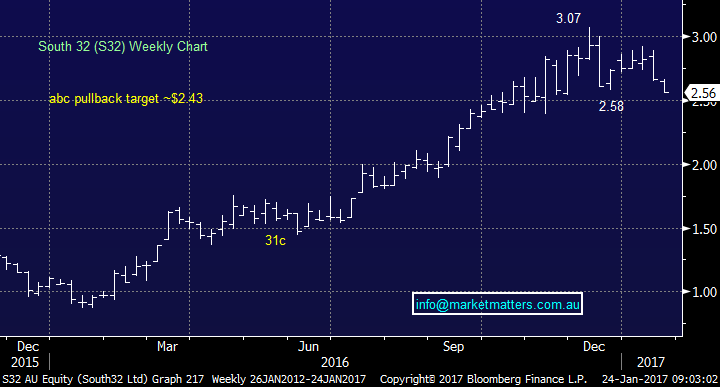

We like S32, the BHP spin-off, from a technical standpoint around the $2.45 level. The caveat to that call is the recent weakness in the bulk commodities it produces. Last year they were up ~170% as a group while this year they have declined by ~20%. Capital management likely for S32 when it reports later in February.

South32 (S32) Weekly Chart

6. RIO Tinto (RIO) $62.40

We remain keen on RIO ~$59.

Summary

- We remain buyers of stocks into weakness - for now!

- We currently like ANZ, BXB, RIO, ALU, S32 and COH at levels outlined above

- We may consider averaging current holdings.

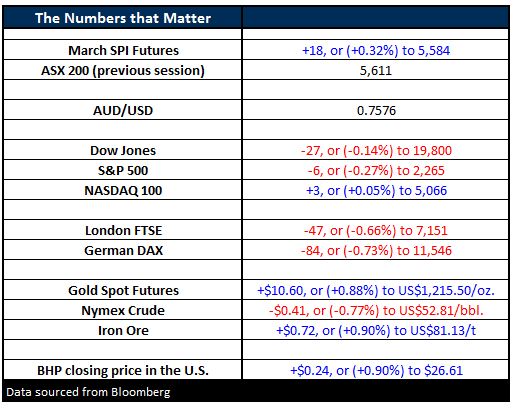

Overnight Market Matters Wrap

- US President Donald Trump axed the decade long Trans-Pacific Partnership (TPP) with 11 other nations overnight following through on one of many election promises

- The Dow closed marginally lower, down 27 points (-0.14%) at 19,800, while the S&P 500 closed 6 points lower (-0.27%) at 2,265.

- Though the volatility rose 2 % higher, it still remains at complacent, however CNN Money’s the fear and greed index show investors are 50/50 – Volatility is expected to jump soon!

- The ASX 200 is expected to open 25 points higher towards the 5635 level, as indicated by the March SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/01/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here