Subscribers questions

Stocks continue to climb a wall of worry as investors have one eye the Whitehouse awaiting Donald Trump’s next move while watching US equities continuing to eke out gains to all-time highs. We have now seen ~34% of the S&P500 stocks have now reported with 74% beating earnings estimates giving the market a nice shot in the arm (although that number is pretty much in-line with historical averages).

Currently the wall of money moving out of global bond markets, as interest rates rise around the world, is very supportive of stock indices but we continue to believe while the road higher is probably not complete it is likely to get progressively more bumpy, starting pretty soon. The Dow is close to our estimated 20,250 target area and we feel a decent correction is likely to commence in coming weeks, a move back under the psychological 20,000 area would be an initial warning signal.

NB There has not been a fall of over 1% in US stocks since October 11, the longest streak since 2006 and a warning from a statistical perspective.

US Dow Jones Daily Chart

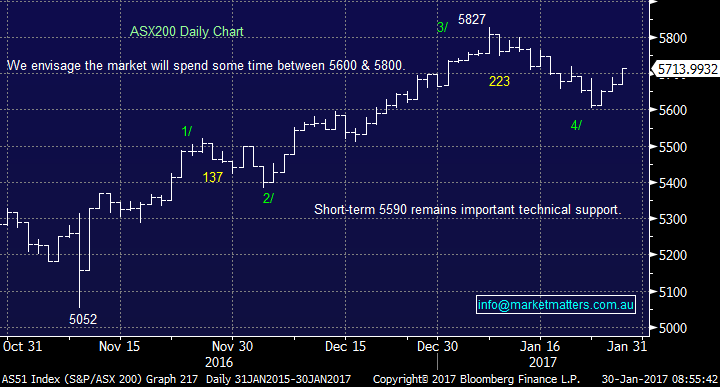

The local market held the 5600 support excellently last week and feels likely to range trade between 5600 and 5800 in early February hence opportunities to pick up stocks into weakness are still likely, especially taking our view of the US market into account.

ASX200 Daily Chart

Question 1

"Hi Adam, I hope you are well and had a great Australia Day. In the coming weeks if possible could there be an update on the Australian retail sector and if market matters believes shorting stocks such as JB HiFi and Harvey Norman due to the expected impact of Amazon. In addition any guidance on how you could take a bear position on some of these retail stocks." - Thanks Michael.

A great question Michael with the Amazon powerhouse soon to hit our shores with a big bang, this subject has not surprisingly generated plenty of discussion within our investment team. Amazon is due to arrive around September and are promising to sell everything at a 30% discount! There is no doubt they have the financial clout to win a price war locally and are likely to significantly reshape the local retail landscape wherever they tread.

Analysts are suggesting that Amazon can gain ~$4bn in local sales with JB Hi Fi and Harvey Norman clearly the most vulnerable. The customer in Australia is definitely about to enjoy a whole new level of service from the American "super shop" – Amazon is as much a retailer as a logistics behemoth enabling delivery within the hour!

Our simple conclusion to the subject is as follows:

- We are not investors in any retail stocks that are likely to come up against Amazon in the foreseeable future. We see the best outcome of survival with reduced margins which is clearly not compelling.

- Technically JB Hi-Fi looks a good short if it pops back over its $31.20 2016 high, targeting a 20% correction.

- Harvey Norman looks neutral with no clear reason to buy or sell.

We will consider establishing a short position in JBH if the opportunity arises via stock options which are traded on the ASX - please note this is generally more suitable for sophisticated investors.

JB Hifi (JBH) Monthly Chart

Question 2

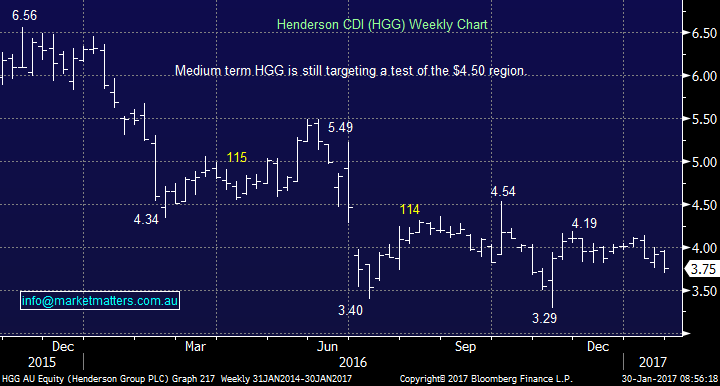

"Howdy, Is Henderson Grp still a buy recommendation by MM , as share price had dropped due to mkt down , and announcement of dividends .Are you still sitting on the sidelines ,waiting for more weakness in share price .Put a memo out in rpt if possible" -cheers Paul

Janus Capital in the US who recently merged with HGG reported disappointing earnings leading to the shares falling 3% in one day. They also flagged that they would pay a dividend before the merger, which HGG have confirmed they will as well.

We still like HGG and will increase our weighting by 3% into weakness, with a minimum $4.50 target still in play for 2017, but we are being fussy on entry as HGG short-term feels it may test under $3.60.

Henderson Group (HGG) Weekly Chart

Question 3

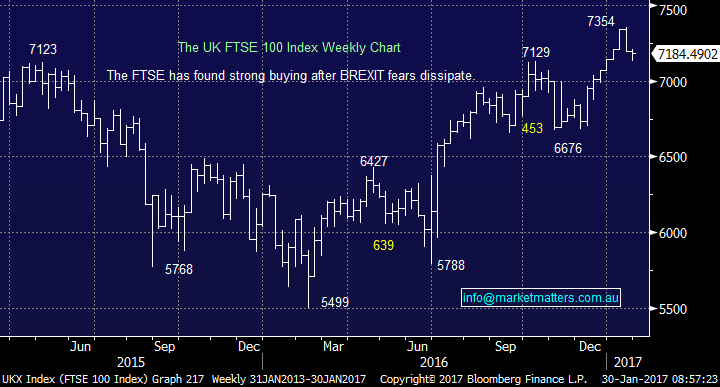

"Hi to MM and happy new year. If you buy a bullish offshore index and at the same time the offshore currency falls relative to the Australian dollar, I don't understand why you would do the trade. For example, recent gains in the FTSE in the UK were offset by further falls in the GBP (pound Sterling) compared to the Australian dollar." - Thanks Frances.

Hi Frances, I think the key to your question is the word "trade".

Firstly, If you simply bought UK stocks you are correct profits on the rally in the shares would be eroded by a devaluation in the Pound, the denomination of those shares.

However if you had bought FTSE futures, or a FTSE based ETF not denominated in pounds, you would have made a nice profit. There are many ‘currency hedged’ vehicles that can be traded that alleviate the impact of the currency, either positive or negative.

It’s important when trading to consider your entire market view and the use the appropriate trading vehicle - we are blessed with plenty of healthy alternatives in today's market.

The UK FTSE Weekly Chart

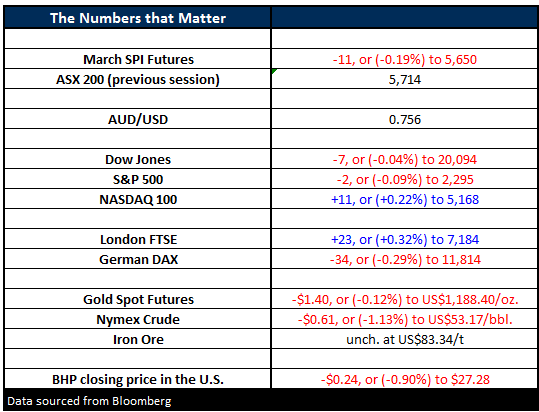

Overnight Market Matters Wrap

- US Equities closed with little change last Friday, however the broader S&P 500 gained 1% over the course of the week.

- 168 of the S&P 500 have now reported and 74% have beaten profit estimates.

- This week, the FOMC meet, with the market seeing no change ion rates as the likely outcome (85.5% probability).

- The $US has had its 5th weekly slide post a GDP miss on Friday and Gold is in its longest correction for 3 months. Note - Newcrest Mining (NCM) is due to release their quarterly activities report today.

- The ASX 200 is expected to have a soft open, still testing the 5,700 level as indicated by the March SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/01/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here