Subscribers questions

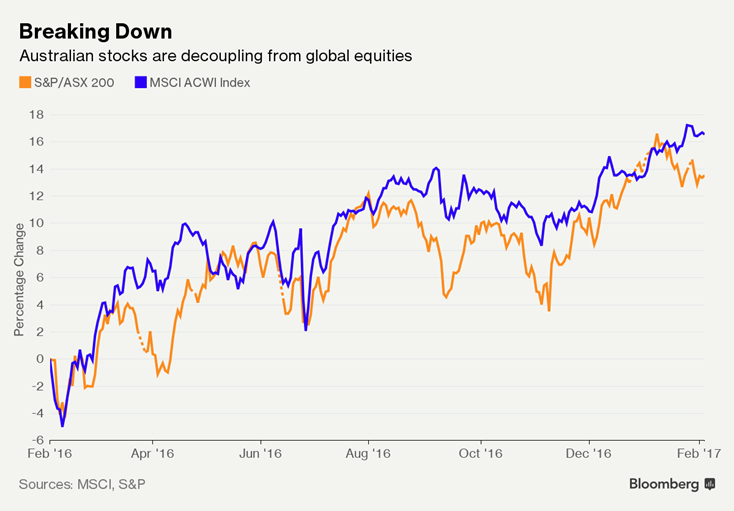

Bloomberg this morning is leading with an interesting story titled "The Stock Market down under is decoupling from the world", are we being cast aside? Over the last 5-years local stocks have been the region's most correlated index to global index heavyweights the S&P500 and MSCI World Index but this has unravelled so far in 2017.The reason is simple the US Fed is looking to raise interest rates 3 times this year but in Australia markets are only factoring in a 15% chance of rise over the same period - a definite relative negative for our local banks – which make up a large portion of our index.

Unfortunately the local stock market has underperformed the US for the last 11-years, both before and after the GFC. Statistics would say were due for a win but the question is where can it come from? Firstly, we believe that resources will still make fresh highs for the year after this current period of weakness around China concerns. Secondly, we believe that the market looking for 2-3 interest rises in the US and none locally is at the extreme, we think 1-2 in the US maybe more likely as the Fed is forced to wait and see how Mr Trump runs the world's largest economy, with any acceleration in raising rates likely in 20-18/9 after clarity emerges.

Hence we would not run away from the local banks and the market for now, there should be some life in the old dog yet!

Correlation ASX200 v MSCI Index Daily Chart

Question 1

"Hi MM, Two questions for Monday. With regards to BEN, Goldman has a sell and I thing 7% of the register is short sold. As well as the Dividend, is MM looking for a good report on BEN 2nd March and your thoughts on a possible short squeeze? Secondly, just wondering on MM buying strategy when deciding to buy a share. Do you put a limit order in, buy at market or in parcels over the day ect? Is it stock dependent?" - Mark

Morning Mark, a big question in a few lines so I will answer in bullet form for clarity:

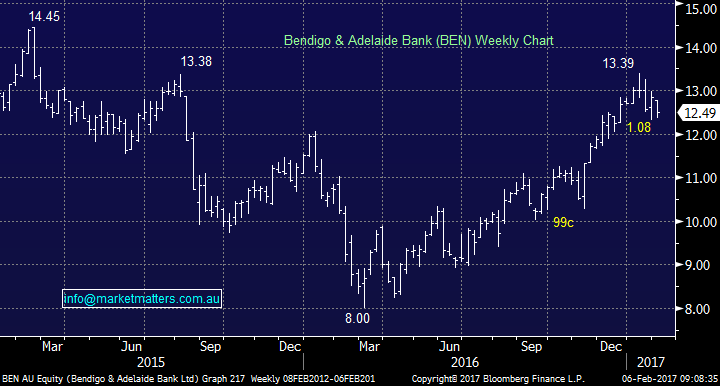

1. BEN could perform well on a good report as you say expectations are not too high. However BEN has been the best performing bank locally over the last 12 months rallying 21.9% compared to the second best ANZ +20.8% and the worst BOQ at -8%. I feel many investors have sold BEN and bought BOQ for some mean reversion.

2. We do generally use a limit when purchasing stock for obvious risk / reward reasons. On larger and generally deep volume stocks like say CBA we just buy at market but more illiquid stocks requiring work over the day - so yes, it is stock dependant.

Bendigo (BEN) Weekly Chart

Question 2

"What are your views on WebJet? Obviously/Fundamentally not cheap, but market seems to have confidence in management as historically they have kept producing good growth. Do you see further consolidation in the sector (a la Wotif/Expedia) or just market appreciation of a company with good Business to Business / Business to Customer relationships? Webjet was sold down during the “high P/E” sell-off theme of the past 3 months – but has since recovered quite strongly while most others have not." - Thanks Andrew

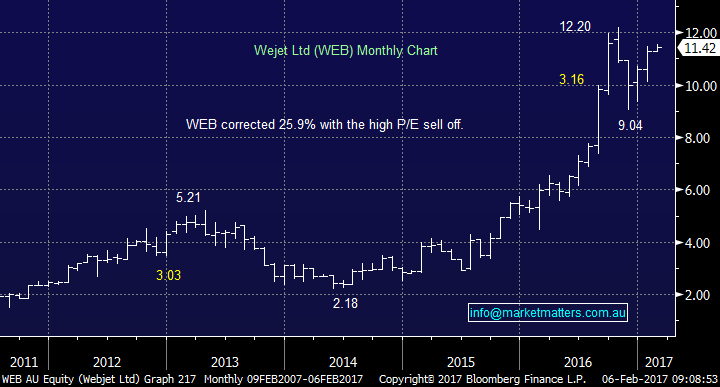

Morning Andrew, we like WEB after its +25% correction and the market has clearly voted with its feet, as you point out, buying the stock aggressively from its ~$9 low. The stock is trading on an estimated P/E of 27x for 2017 which is not outrageous if they continue to deliver which we feel they probably will.

We continue to believe that 2017-9 will be a choppy time in stocks with WEB following this path over the last 6 months. We would be accumulators under $9.50 and profit takers over $12.50 of at least part of any holding. The other interesting point to make here is around the markets positioning in these type of stocks. Clearly, high PE/Growth stocks have been out of favour while resources have been the place to be. That trend in the short term looks like changing.

Webjet (WEB) Monthly Chart

Question 3

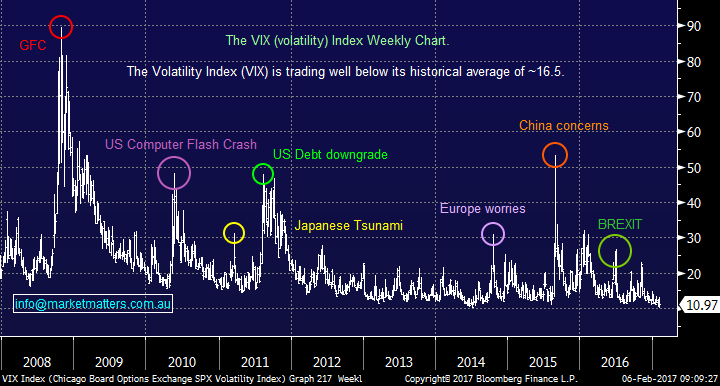

"Hi Market matters, I refer to the VIX chart in your email today, Would you please explain how the capital value of the VIX performs over time, is it similar to an ETF, eg buy and hold or does it perform like an option with an expiry date and have a deteriorating value towards expiry? Can it be bought on the ASX." - Thanks Brendan.

Morning Brendan, we don’t actually trade the VIX itself, we use it as a guide to the market's overall complacency plus its important when deciding upon strategies when trading stocks via options –it’s often referred to as the Fear Index. The VIX can be traded via ETF's and the futures market plus we believe there are some CFD products available. Our preference would be a simple US based ETF and we recommend you consult your financial advisor before proceeding.

NB. The largest vehicle is the iPath S&P 500 VIX Short-Term Futures ETN (VXX).

The VIX / Volatility Index Weekly Chart

Question 4

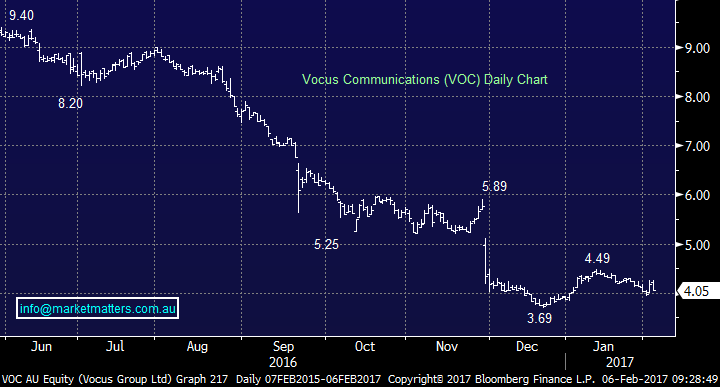

"Guys, What is your view on Vocus and Telco stocks in general? I am sitting on TPG, VOC and TLS (the latter being held as a long-term yield source for my super pension). I’m of a mind to dump VOC and TPG if no recovery is imminent." - Paul

Hi Paul, thanks for touching on our exposed nerve - Vocus! The market is finding it extremely hard to value these Telco's at the moment given it’s hard to get a handle on what future earnings will look like. The complexity around the NBN rollout, and the new entrants into the market is making it difficult to get a lot of clarity, hence the stocks in this area are struggling. International player My Republic launched in late 2016, while AYS has indicated it will launch its offering early CY17, and Vodafone is targeting a launch at the end of CY17.

One way we get a handle on how each player is performing is around the NBN quarterly subscription data, which is released by the NBN – so independent of the providers . At the moment, TLS is continuing to defend market share aggressively – which many thought would not be the case originally. They are holding total market share of NBN at 49% versus their natural broadband market share of 47%. Optus and TPG have been strong in metro areas while VOC has also been strong. All up, they are performing in line with natural market share or taking market share – which is good. It’s the reason why VOC popped up last Thursday. The real test will be the entrance of new players into the NBN cauldron!

We continue expect volatility, and will ideally sell / reduce our Vocus at higher levels. The best way to answer your question is to say we would not be choosing to hold a large exposure to the Telco sector as it may take months / years for the market to understand where the sector goes next.

Vocus Communications (VOC) Daily Chart

Question 5

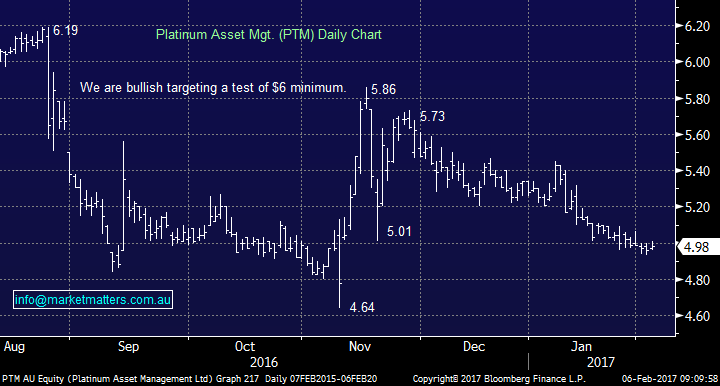

"Hi there, with reference to Platinum Asset Management (PTM) I see you are recommending them again recently. You seem to imply in today’s commentary that – for ?? reason - punters will be prepared to bid the price up to a PE of 17.5 " - best wishes, Doug.

Morning Doug, hopefully quality investors not "punters" will take the stock back to its levels of August 2016. On a serious note, the stock is currently on an estimated P/E of 16.5x 2017 earnings so you numbers are correct but other fund managers are trading on much higher valuations e.g. Magellan (MFG) 20.6x 2017 earnings. For PTM, current PE is 14.5 times implying that analysts are bearish on future earnings. When a stock has been under pressure for a long time, as Platinum has, we often get a situation where analysts get too pessimistic, just as they are prone to getting overly optimistic at time. We think this is what is playing out in PTM at the moment, and we’re seeing some very tentative signs of improvement.

Overall we still like PTM, especially its sustainable 6% full franked yield. The stock has held reasonably well during recent market weakness and if we are correct that the financial sector will trade higher in 2017 our target remains in play.

Platinum Asset Management (PTM) Daily Chart

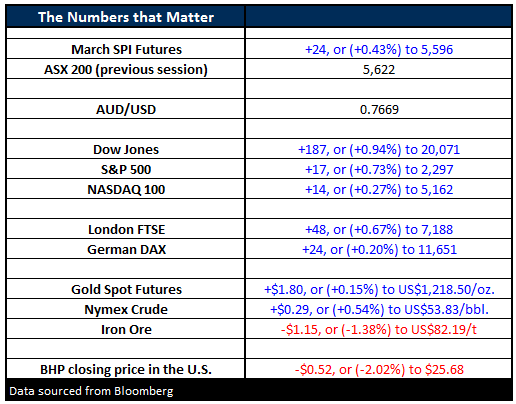

Overnight Market Matters Wrap

- A change in tone was seen in the US financial sector, that helped edge the broader indices higher last Friday, with investors seeing a positive in the potential deregulation of on banks and an a review of the Dodd-Frank rule.

- Iron Ore is likely to underperform our domestic market today, with BHP in the US closing an equivalent further -2% to $25.68 from Australia’s previous close.

- The Volatility Index remains at ultra-low levels of complacency, down 8% last Friday.

- A 30 point jump is expected to be seen in the ASX 200 this morning, with the March SPI Futures indicating an open towards the 5,650 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here