Gold keeps on shining

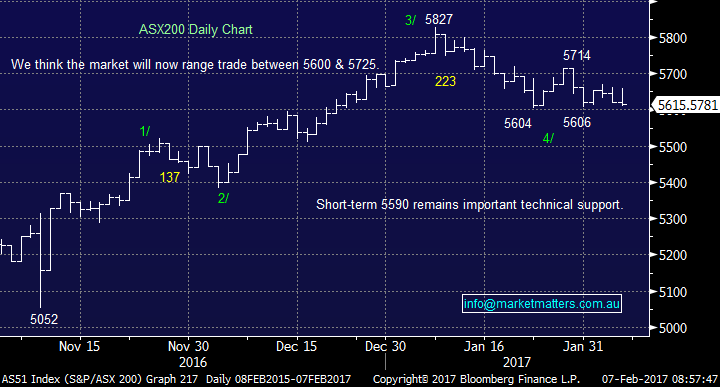

The local share market continues to feel very "saggy" at best, falling 6-points yesterday after the Dow rallied 188-points to test its all-time high. This morning the ASX200 will again test 5600 support, a 220-point / 4% correction while global equities remain firm, not great price action from local stocks. Australian investors have certainly moved into the "glass half empty" mindset and while the momentum remains poor reallocation of our 24.5% cash position into the market will definitely not be aggressive - things just do not "feel" right at present. Ideal candidates at present, are stocks with a low correlation to the ASX200 index i.e. low beta stocks.

A test under 5600 support now feels inevitable for the ASX200 and we remind subscribers that a break back under 5540 will herald a bearish change in trend, conversely it needs to rally back over 5725 to excite us to the upside which feels a big ask at present. The ASX200 being the highest yielding global stock market is not exciting to international investors when interest rates worldwide are perceived to be on the rise.

When we look at the two most influential sectors the picture does not improve:

1. We remain comfortable with our pullback targets for the resources sector e.g. BHP well under $25 and FMG under $6.

2. The banks yesterday failed to follow the positive lead out of the US, sending a clear sign that the market is not seeing value in them at current levels, even with the NAB result leading to outperformance. A market that cannot rally on good news is clearly weak - it feels like our small purchase in CBA was a touch premature.

The only market sector that is generating buy signals on both the technical and common sense level is gold.

ASX200 Index Daily Chart

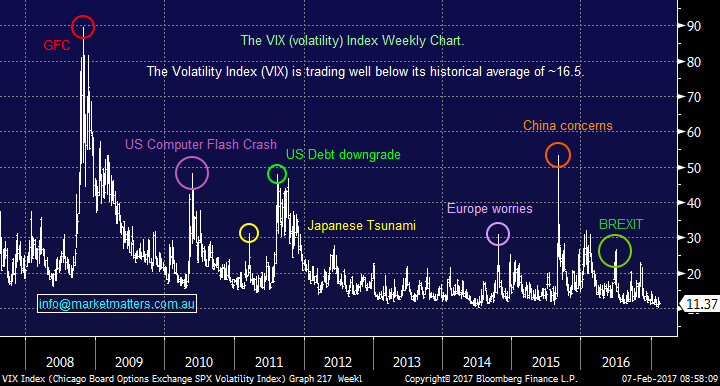

With Donald Trump sitting in the Whitehouse volatility and uncertainty feels almost guaranteed for at least most of 2017, as we learn about the intentions and ability of the new President. While the VIX - Fear Index, may be trading at extremely low levels, investors are paying a significant premium for plunge protection - for the option traders the Skew Index has rallied substantially.

The "VIX" Fear Index Weekly Chart

It's not surprising that with investors chasing crash style protection the other standout vehicle to protect against panic is gold, and its related stocks.

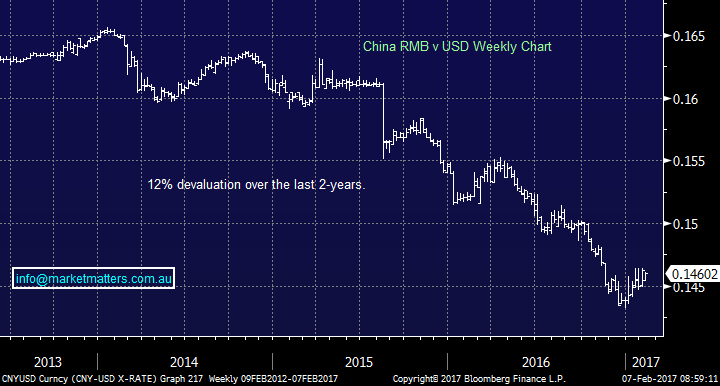

We have a second important, almost panic style event unfolding in China, as the locals desperately attempt to get their hard currency out of the mainland to avoid the depreciating Yuan - buying gold, which is the favourite investment vehicle along with property of the Chinese, satisfies this need very quickly and easily.The Chinese currency has fallen 12% over the last few years, but most pundits believe it has much further to go with a risk of one large shock devaluation.

Chinese Yuan / RMB Weekly Chart

Overall we see many reasons for gold to rally to our $US1,450 target in 2017, but very few reasons for it to fall as it shrugs off concerns of higher interest rates and a rallying $US.

Gold Monthly Chart Monthly Chart

We already have a position in Newcrest Mining (NCM), which is showing a nice ~10% profit at present and while it remains over $22.50, the position feels solid.

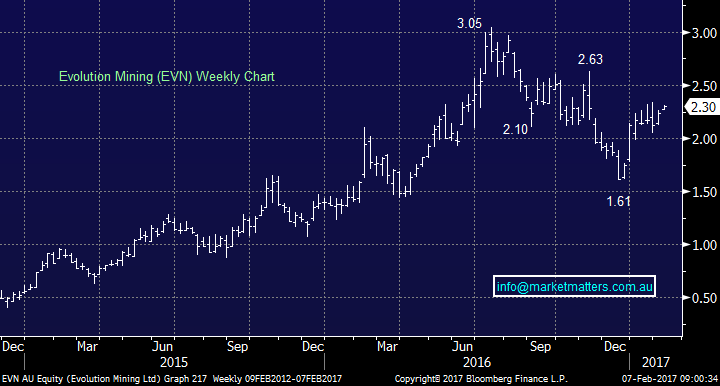

We now believe it's time to increase weighting to the sector - our favourite exposure at current levels are EVN and RRL. However, we will be buying strength hence we would advocate only 4-5% into a position and will categorise this as a trade / aggressive position.

1. We are buyers of Evolution Mining (EVN) ~$2.40.

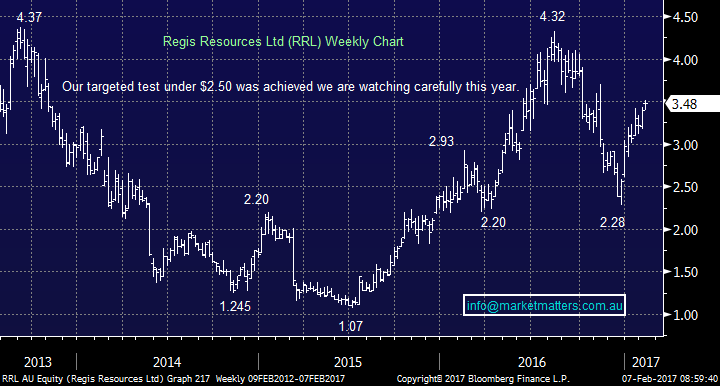

2. We are buyers of Regis Resources (RRL) ~$3.60.

Evolution Mining (EVN) Weekly Chart

Regis Resources (RRL) Weekly Chart

Summary

We are overall bullish the gold sector moving into 2017, anticipating some excellent opportunities.

Today we may buy either RRL or EVN as a trade / aggressive play.

*Watch for alerts.

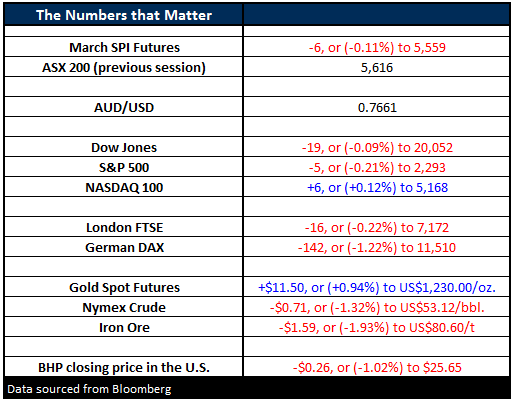

Overnight Market Matters Wrap

- US equities were mixed with little change overnight, with the Dow down 0.09%, the S&P500 down 0.21%, while the NASDAQ 100 up 0.12%.

- So far in the US reporting season, three-quarters of companies have beaten profit estimates and about half have beaten sales estimates.

- US Bonds rallied and Gold, Silver and Copper posted >1% gains. Oil pricing was softer with Crude oil down 1.32%.

- The ASX 200 is expected to open with little change, but with a bearish bias, testing the 5,615 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here