Be wary when many investors are positioned the same way

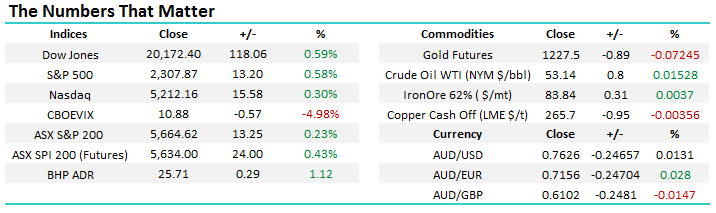

Donald Trump talks and the market walks...last night it was again up as he made a vague promise of a "phenomenal" tax plan to be announced within weeks. US stocks made fresh all-time highs, yet again, and our AX200 is set to open ~25-points higher with banks / financials the likely main areas of strength. No change to our overall outlook for stocks in the short-term, remembering they are in a bullish seasonal period until late April:

- The ASX200 will trade between 5600 and 5725, a clear break over 5735 will target at least the 5800 area.

- US stocks will grind higher in the current choppy manner, with our Dow target around 20,500 before a pullback looks likely.

- The German DAX, which is the clearest picture at present, is targeting a test of the 12,000 area i.e. a 3% rally from current levels.

Dow Jones Daily Chart

These recent comments from the new US President reset fires under the "reflation trade" which has dominated much of the reasoning behind the strong rally in equities since Novembers US election e.g. US S&P500 +10.8% and the ASX200 +12.1%.

However, trading with the crowd can be dangerous when markets start to question their view, and extremely painful when they experience a clear change in sentiment. Unfortunately human psychology is a very dangerous emotion for the average investor - Fear & Greed has cost many in all societies their hard earned money.

"Two super-contagious diseases, fear and greed, will forever occur in the investment community. The timing of these epidemics will be unpredictable. ... We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful." - Warren Buffett.

We think markets often trade around 6-months ahead of the actual underlying fundamentals which propels them, hence the saying "buy on rumour and sell on fact" can often gain significant traction, especially over the short-term i.e. smart investors are already positioned so when the news finally reaches the press they take profit and many are left wondering at the markets irrationality.

Let's look at 5 current major market views and their subsequent positioning plus importantly where the major risks lie.

1. Interest rates and $US are headed higher

We have discussed a number of times over the last 6-months our view that global interest rates are set to rise as both wages and inflation pressure kick into economies. We were ahead of the market when we said sell the "yield play" that saw major corrections in some of Australia's previously most loved stocks e.g. Sydney Airports (SYD) -23.9%, Westfield (WFD) -26.3% and Transurban (TCL) -25.3%.

The view that interest rates are set to rally in the US has pushed the $US to fresh multi-year highs but we believe this positioning is fraught with danger – it is a very overcrowded trade. The $US has already appreciated ~30% in only 2 1/2 years so much of the strong US economy, hence higher interest rates, is clearly baked into this cake. Arguably our biggest call for the next 12-18 months is around the $US:

While we are 50-50 whether the $US can make fresh highs since 2003, to around the 105 area, we are confident with our view that the $US will correct into the 90-95 region and hurt all the dollar bulls.

The $US Index Monthly Chart

It's easy to imagine this view unfold on the grass roots level e.g. Donald Trump simply becomes a disappointing President / growth fails to materialise etc. While there are many influences that may see our view unfold we feel the best way to hold exposure to this eventuality is via the gold sector.

We are bullish gold in the medium term and will be looking to increase our current 5% exposure to the sector which is via Newcrest Mining (NCM).

Gold Monthly Chart

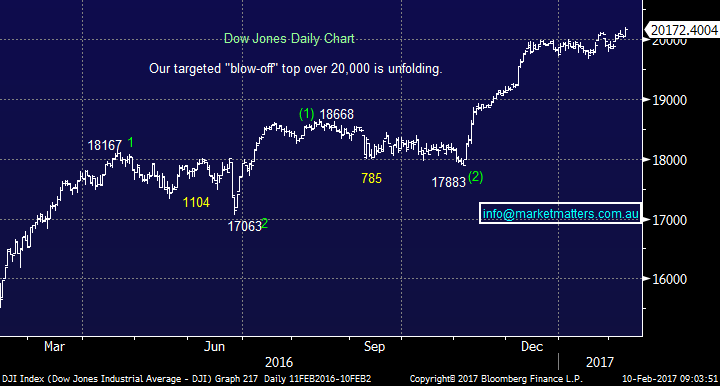

2. The $A is going down towards 60c, simple buy o/s earners & stocks

The $A has been very firm and its now almost 12% higher than 2016 lows – which makes sense given the strong rally in commodity prices. We actually see the next 10% move in the $A to the upside which will put more pressure on the Government / RBA to act.

We see 2 issues here:

- Australian retail investors now have a record % of the stock market investments in overseas markets, understandably after the ASX200 has consistently underperformed US indices for the last 11-years.

- Many investors are holding major positions in Australian stocks with overseas earnings assuming they will continue to perform well while enjoying a weak $A.

We feel both these trades / views are very mature at best and subsequently believe they are about to enter a period of clear underperformance.

Australian Dollar $A Monthly Chart

3. Inflation is rising so buy resources|

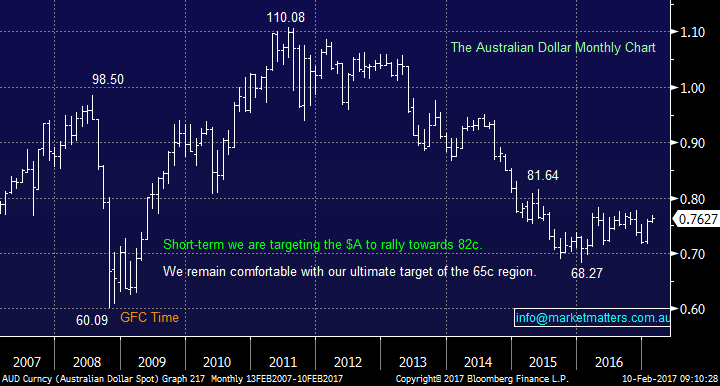

Presently a very interesting topic and one that we agree with, however at this juncture, after a big run up in share prices, the risk / reward to buy resource stocks is poor at current levels. We’ are starting to see some weakness play out in the sector despite some good results e.g. FMG is down 8% this month while CBA marginally higher.

We don’t believe investors are fully exposed to this market view hence pullbacks will be well supported. e.g. Another 8% lower for FMG will interest us

Fortescue Metals (FMG) Monthly Chart

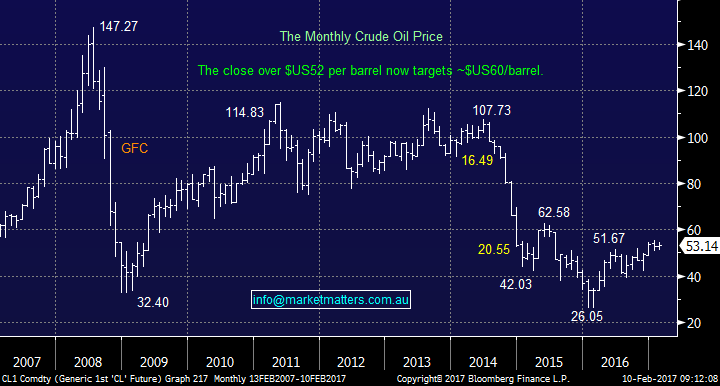

4. Oil has bottomed so buy weakness

Oil has enjoyed a phenomenal bounce since the panic lows of 2016 with OPEC, led by Saudi Arabia, now uniting (term used loosely!) together to push the price higher. However, we feel the recent 100% increase in prices acknowledges much of this news and with shale / renewable energy risks only likely to increase we are happy to now be out of this sector, probably for much of 2017.

Crude Oil Monthly Chart

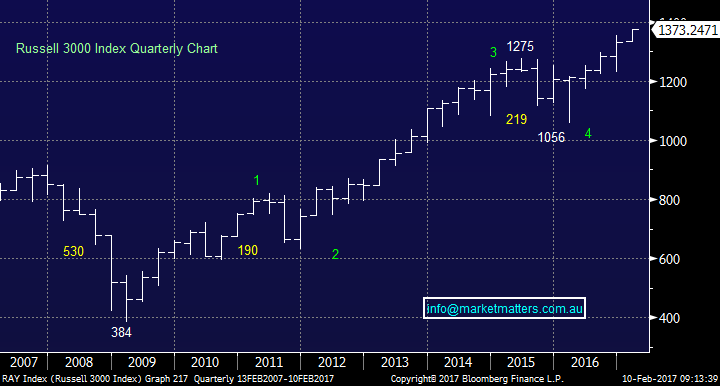

5. Stocks are scary but ok as growth is improving

We had to include this topic as it's our second big call at present i.e. we believe a 25% correction for stocks is just around the corner. However, many fund managers / investors continue to hold relatively high cash levels. Hence we feel the current rally probably has another ~8% to unfold as many of these disbelievers will ideally be sucked into the market which would then pave the way for a painful correction.

One caveat here is if Donald Trump does start a trade war with China in the near term, stocks will fall and there will be every reason to be sitting on cash i.e. no squeeze higher short-term.

Russell 3000 Quarterly Chart

Summary

We have covered an enormous amount of ground in this morning's report but the catch phrase is simple "always be open-minded" and if we are correct that mantra will be very relevant over the next 1-2 years.

Overnight Wrap

- Solid day in the US with the DJIA up by 0.7%, S&P 500 by 0.6% and the NASDAQ by 0.7% also. Banks and Financials were the standout sector gaining 1.4% and Energy has staged a recovery and gained 1%.

- Both WTI and Brent Oil have rallied 1% ahead of the monthly reports from OPEC and the IEA and Gold has eased slightly from its highest level since last November.

- The $US is stronger by 0.3% and US bonds have retreated in yield with Trump vowing to introduce a “phenomenal” tax announcement in the coming weeks. Have a great week-end from SHAW and Partners.

- The ASX 200 is expected to open ~25 points stronger testing the 5,700 level

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here