Subscriber Questions

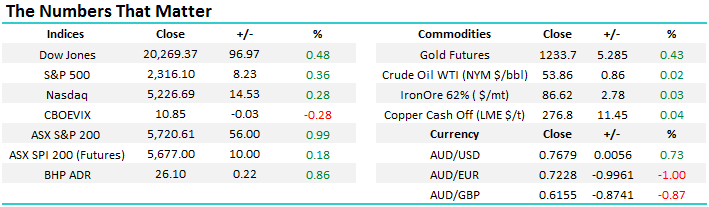

A good five days for Australian stocks last week with the market advancing by 1.8%, and interestingly the sectors that drove the performance were those that have been out of favour in recent times. The ‘dogs are starting to bark’ as we titled one afternoon report through the week. This morning SPI FUTURES are suggesting a +10pt move higher however that may be underdone given the strong moves higher in the commodity space on Friday. Rio Tinto (RIO) in the US for instance was up +5.63%. Our view remains that a break of 5735 is bullish and that will bring 5800 into play fairly quickly – at which point we’ll be more inclined to reduce holdings.

Some interesting questions this week as always with some broad topics covered.

Question 1

‘From what I can see/read, there has been a lot of selling pressure in the smaller end of the market over the last few months – have you got any buys in the smaller cap space ’. Gary

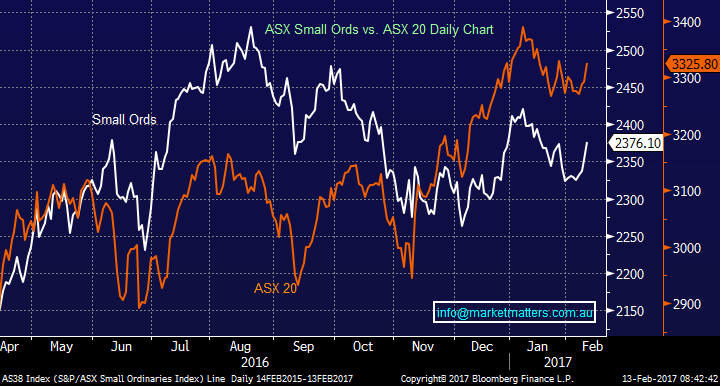

A good question and you’re right, over the last 6 months the ASX top 20 has rallied by 11.6% while the small orders is up 3.89% over the period – which is considerable outperformance by the large caps, plus there has been a lot of ‘blow ups’ in the smaller part of the market. We have Altium (ALU) in the portfolio after buying it at $8.00 following it’s steep correction from ~$10. Buying ALU under $8.50 seems reasonable. BWX (BWX) which sells skin and haircare product (which I obviously don’t need!) delivered very strong results last week with their Sukin Brand performing exceptionally well - the stock up ~16% on the day of reporting was a clear vote of confidence by the market. We like this stock under $4.80. FirstWave (FCT) is a stock we’ve mentioned in the past and one we continue to like. They do cloud security and have a great deal in place with Telstra. Aconex (ACX) look likely to test ~$4.00 from its current price of $3.55

Importantly though, the small caps are still a place of high volatility and higher risk. Liquidity is always a concern for us, and despite ‘everyone’ talking up the growth in this part of the market, you need to have a very good understanding of the businesses you are investing in.

ASX Small Ordinaries versus ASX top 20 Daily Chart

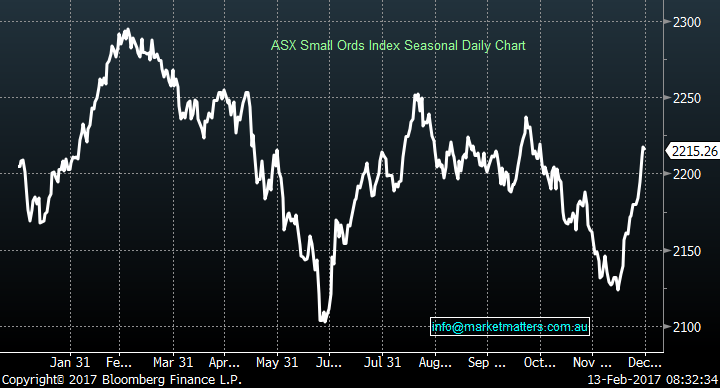

Interestingly, from a seasonal perspective the time to BUY the smaller companies is in June for a run up into October.

ASX Small Ordinaries Seasonal Chart

Question 2

" If I don’t currently hold Vocus in my portfolio, should I currently purchase the store say (5%) of the portfolio value? Or should I wait until Vocus reports tomorrow? Thanks Justin

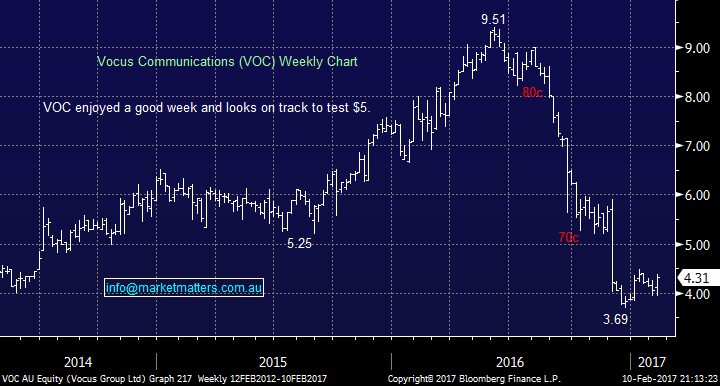

Thanks Justin – a timely question given the more positive price action we saw in Vocus (VOC) last week with the stock advancing by +6.42% to close at $4.39. Although we can’t provide personal advice we can highlight our approach and it does imply we’re now more positive the sector. We have a 10% allocation to Vocus which is high for a stock with this risk profile. We’ve been patient with it, and hope to reduce the size of our holding into strength – preferably over ~$5. Last week we put a shorter term trading position on in TPG, again looking for higher levels.

Vocus reports their half year numbers on the 22nd February which is obviously going to dictate where the share price trades after that. It seems the market is ‘scared’ of amending their views on VOC before they report, which is understandable given there is a high degree of uncertainty around what they’ll deliver. That said, we have continued to see VOC maintain market share in the NBN space which is a positive but most attention for this report we believe will be on their corporate business , which is really the jewel in the crown. To us, it seems a lot of negativity is already in the price. We’re positive VOC here however a break and close above $4.50 would provide confirmation of that view.

Vocus Communications (VOC) Daily Chart

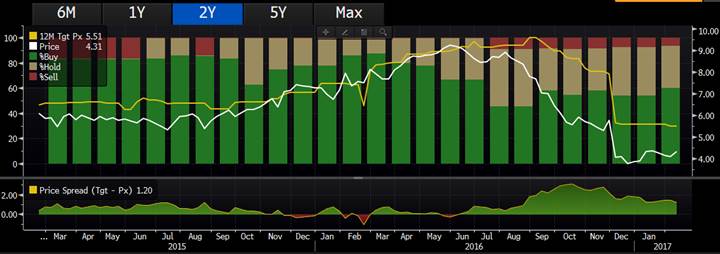

This is an interesting chart which highlights the above. The GREEN is the number of BUY recommendations on the stock, the RED is SELLS and the BONE is HOLDS. The yellow line is the consensus price target and the white line is the share price.

Source; Bloomberg)

Question 3

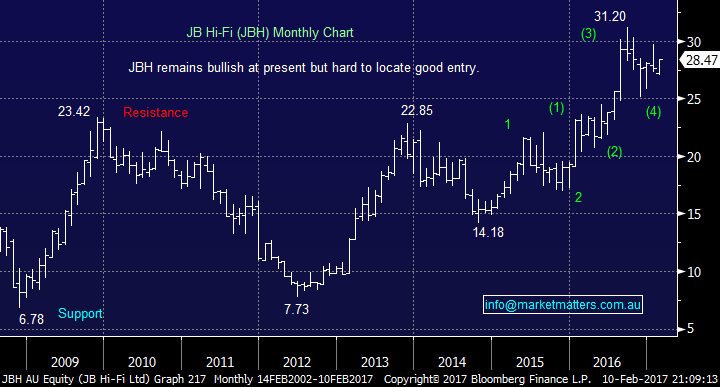

Thanks for your update on major themes. One I am interested in is the consumer discretionary - ie. JBH. They report next week and with the integration of Good Guys now in force (established business) it would appear the stock has been trading sideways for past 6 months awaiting reporting. Analysts are talking JBH up however the consumer on the whole appears close to maxing out spending whether this is adjusting to lower FT employment and/or longer and lower inflation. (Notably the incoming of Amazon in near term is a considerable risk to certain retailers). Appreciate your guidance. PW

Thanks PW – timely questions given the JBH report has just landed now and we’re reviewing as write. On the face of it, the revenue number was OK, the dividend was a tad below expectations, while the earnings per share (eps) was a little light on, 95cps versus 99cps Bloomberg consensus. Like for Like sales growth was strong and above expectations while they are managing their costs exceptionally well. NPAT was $125m with the market looking for $116m – which is obviously a beat. A good result overall and some upgrades here likely.

You make a very good point around analysts being optimistic on JB and that suggests that a lot of a positivity is already in the price. Technically JBH looks positive however we think the entrance of Amazon into Australia will have a significant impact on the retail space over time. Conflicting signals here for JB Hi-Fi which makes it too hard for us at present.

Overnight Market Matters Wrap

- The US share indices ended the week in the black, with the Dow up 0.48%, S&P 500 up 0.36% and the NASDAQ 100 up 0.28% last Friday.

- The outperformers were the Materials, Energy and Utilities, while the laggard was Health Care.

- Iron Ore, Copper and Oil all advanced strongly with Copper up over 4% the standout.

- The ASX 200 is expected to open marginally higher, up ~10 points towards the 5,730 level this morning, with the materials sector likely to outperform the broader market.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here