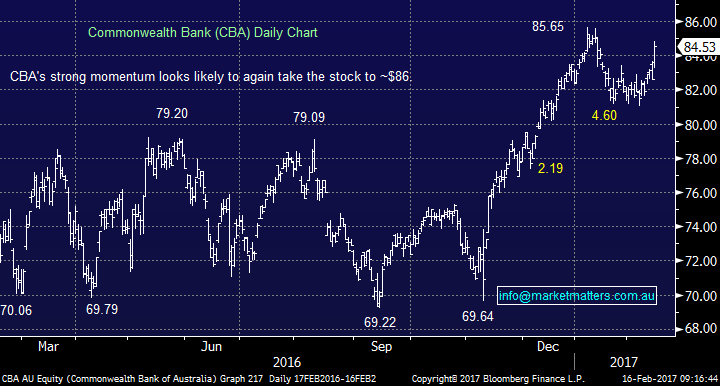

The ups & downs of reporting season – Part 2

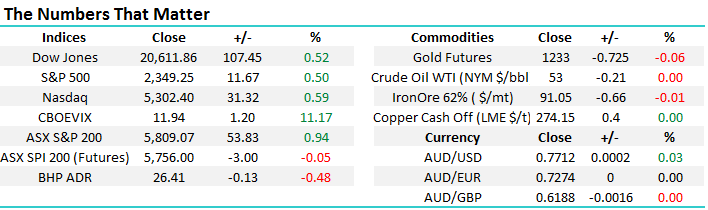

The local market has again rallied strongly over 5800 as we have been expecting, if not faster than we anticipated, courtesy of a good result from the new "big Australian" - Commonwealth Bank (CBA). We have been relatively bullish banks and bearish resources over recent weeks and that view really kicked in after CBA's report, sending CBA $1.90 higher which is the equivalent to around 10 index points while the banks as a sector contributed to almost exactly 50% of the whole market's advance yesterday. US stocks yet again made fresh all time highs last night with suddenly 21,000 closer for the Dow than the recently psychological 20,000 resistance barrier - as we have repeatedly said fund managers have been caught underweight equities after the US election.

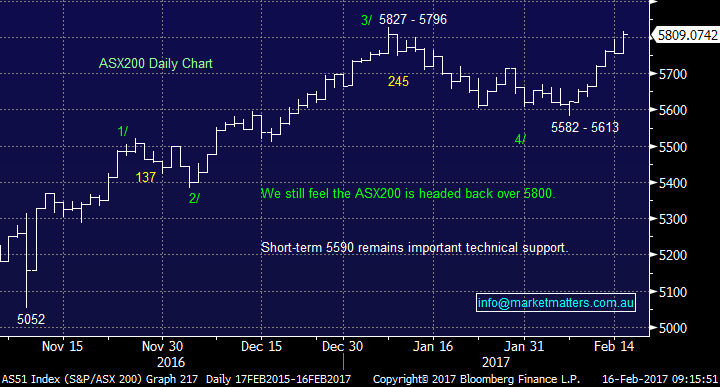

On a statistical note a rally like US stocks are currently enjoying has not been witnessed since 2013. The main characteristic of last night's advance was strength in banks / healthcare, weakness in interest rate sensitive stocks and no gains from the resources sector - this is consistent with our current view on the market and more importantly how we are positioned in the MM Portfolio.

Yesterdays reporting was clearly a net positive for the ASX200 with strong performances from Boral, Computershare, CSL Ltd, Wesfarmers and of course CBA with relatively minor, on an index level, negative moves from Domino's Pizza, Primary Healthcare and IOOF Holdings. Today we will again look at 5 stocks that we are watching carefully following recent reports / moves.

Last night Goldman Sachs, the famous US investment bank, made fresh highs and has now surged close to 40% since Donald Trump's victory as investors get excited the new administration will reignite trading, deal making, cut taxes, reduce regulations etc. The market is very much in "glass half full" mode and we are starting to smell there is increasing room for disappointment although we do agree that Mr Trump clearly looks good for US banks. Our holding in Macquarie Bank (MQG) should gain strength from this move by its US equivalent - we continue to target the $90 to take profit on MQG.

ASX200 Daily Chart

The current advance by US stocks implies that we are the strongest part of the completion to the bull market since the GFC. Until further notice we believe the following 2 points must be considered for short/medium-term investing.

- US stocks have further to go before completing this move from 1810 in February 2016 and the next 4-5% correction can still be bought.

- US stocks will still retest the 2016, 1800 area lows, in the next ~2 years i.e. a 25% correction.

US S&P500 weekly Chart

Today we will again look at 5 stocks who caught our eye yesterday, with one leaving us very frustrated!

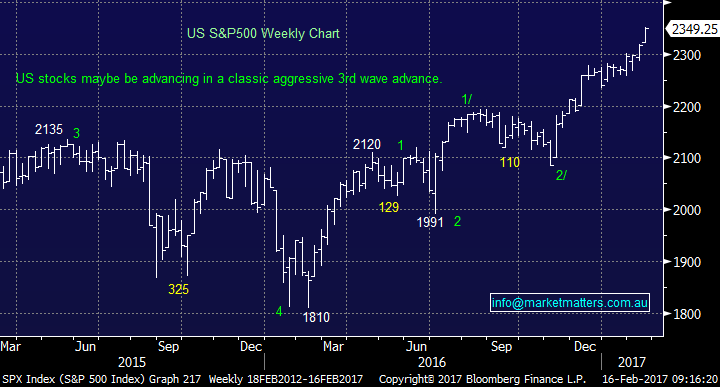

1. Commonwealth Bank (CBA) $84.53

CBA overall had a good result but with no major surprises, as you would hope from such a heavily researched stock. However with many local analysts continually saying the stock is too expensive and a number calling the stock an underweight / or even a sell it certainly helped ignite the fire under the stock yesterday - probably some short sellers taking their medicine and crystallizing some losses.

We added to our CBA position around $82.60, just over a week ago, targeting at least a "free" $2 fully franked dividend, a position that looks very healthy now. We would expect the stock to again challenge the $86 area, before paying its $1.99 fully franked dividend in a week's time, and then drifting back towards $82. Interestingly we received much criticism for this alert but we would reiterate the MM view that 2017 is the year to be open-minded.

We currently remain happy holders of CBA with 8.5% of our portfolio in the stock.

Commonwealth Bank (CBA) Daily Chart

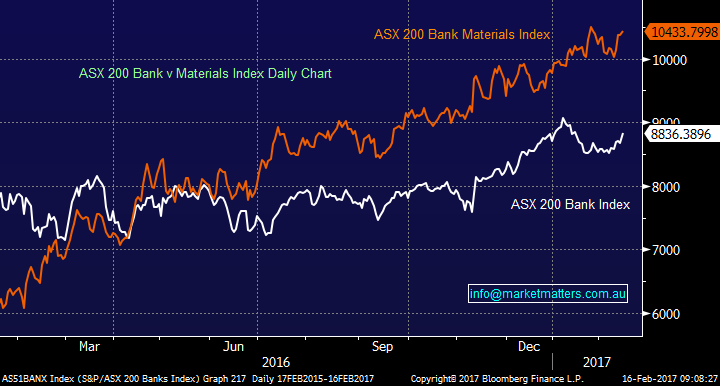

Also, we continue to believe that the banking sector will outperform resources over at least the next 3-months. We are looking for banks to close the performance gap of the last year, illustrated by the following graph, where resources have been all the rage i.e. Resources +39% v banks +18%.

ASX200 Banking v Materials Indices Daily Chart

2. Cochlear (COH) $129.2095

We discussed COH in yesterdays morning report with the below conclusion: We are buyers of COH around $124, or another 4% lower.

Yesterday was extremely frustrating for us at MM as COH plunged in early trade into our buy zone before rallying strongly to close unchanged. This price action is a great example of the transparency at MM. COH spiked under $125 for only 10 minutes but importantly trading almost no volume making it impossible for MM to distribute an alert, and / or buy any stock of consequence - hopefully a few subscribers followed our recommendation and bought a few shares on their own accord. We would to take this opportunity to reiterate:

- MM will never quote trades that were impossible to practically implement.

- MM will only purchase stock ourselves once subscribers have received a trading alert

Cochlear (COH) Monthly Chart

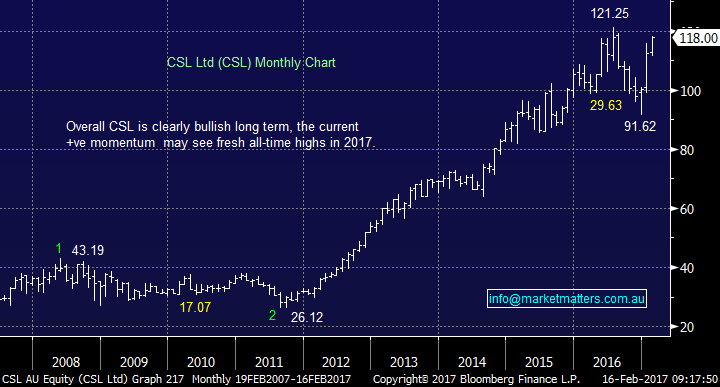

3 CSL Ltd (CSL) $118

CSL Ltd reported excellent numbers but they were in line with expectations having previously upgraded the market to improved operating conditions back in mid-January. The stock initially fell ~$3 as there was no added good news but buyers flocked back into this quality business rallying the stock $6 off its lows. We remain happy holders of CSL but will look to take profit into fresh all-time highs over $122.

Note we are not afraid at MM to take profit on quality companies if we believe the share price has run too far, remember CSL itself recently corrected 24% and market favourite Domino's Pizza has now corrected 34% over the last 7 months.

CSL Ltd (CSL) Monthly Chart

4 Wesfarmers (WES) $43.33

As we said in last night's report there was some good and bad in the WES result this morning however the market seemed to like it for now. Cash earnings were ahead of consensus expectations at $1,577m (exp $1,500m) which is up +13.2% on this time last year. Most attention on the result should be on the food and liquor business which accounts for 38% of earnings, and margins were lower (1.3%) but within the expected range of 1.0% to 1.5%. Interestingly, price deflation was -0.9% which was a drag as competition hots up in the sector. Importantly the trending like for like sales growth of Coles, which is clearly deteriorating as the BIG behemoth of Woolworths turns its ship around and new entrants come into the fray.

In summary, a beat on their headline profit but we feel the underlying picture is less attractive with Coles under ongoing pricing / margin pressure and Bunning's growth clearly slowing. We are watching WES for a trading sell for our aggressive subscribers.

Wesfarmers (WES) Weekly Chart

5 IOOF Holdings (IFL) $8.50

IFL's result yesterday was 5.5% below consensus estimates, leading to the stock falling 7.7%, with the company experiencing margin pressure. We do not believe IFL is a quality business at present but it has an excellent dividend yield of ~6.4% fully franked, payable in early March and it has a very strong balance sheet to support it. The stock seems to range trade between $8 and $9 and gives decent exposure to a rising equity market - our view for the next 3-6 months.

We advocate this as a trade around $8, however the risk is that IFL makes a large acquisition, which seems likely given the consolidation in the wealth management sector (and the desire of the banks to get out of this area). If the acquisition is large, which it probably would be, IFL would need to raise equity.

IOOF Holdings (IFL) Monthly Chart

Summary

- We remain short-term positive stocks but will look to sell into strength over 5800 in the ASX200.

- We are buyers of COH ~$124 and will have a look at IOOF Holdings if it comes back to ~$8.

- We are sellers of MQG ~$90 and CSL ~$125.

* Watch for alerts*.

Overnight Market Matters Wrap

- The US share markets gained further momentum, making fresh new highs and on its 7th consecutive day in the green, led again by the financials.

- US CPI rose 2.5% YoY and Retail sales solid leading to a now 40% chance of a March US rate rise.

- Iron Ore was slightly weaker, with BHP in the US closing 0.42% lower to $26.43 from Australia’s previous close.

- The ASX 200 is expected to open marginally higher, above the 5,810 level as indicated by the March SPI Futures – keep in mind volatility is expected this morning as it is February Index Options expiry.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here