Subscribers question(s)

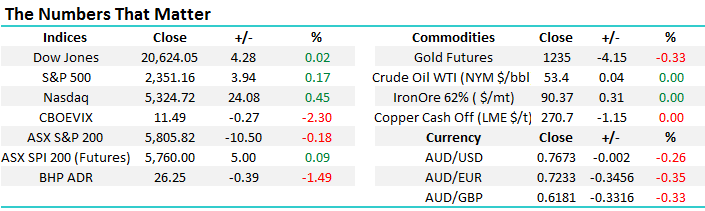

The US stock market continues to make fresh all-time highs despite plenty of fear, especially on the political front. The S&P500 has enjoyed an almost 13% advance since the US election as potentially good news / policies become baked into equity valuations e.g. Reduced regulations for the financial sector, large infrastructure spending and substantial tax cuts - the room for disappointment is clearly growing on the horizon. We believe the likelihood of a ~100-point / 4% correction for the S&P is increasing rapidly - on a simple risk / reward basis we would not consider buying the market now around this 2350 level. However, for now we will be putting our hand up to buy US stocks if they correct ~4%. The current market optimism has sent valuations to 21x earnings, the highest since 2009. That said, earnings growth estimates sit around +15% for the S&P500 which is good, but rising wages is just one of the issues that may challenge these buoyant growth forecasts in the not too distant future.

US S&P500 Weekly Chart

One very comprehensive question we’ll address this morning around the property sector and the potential impact this will have on bank earnings and therefore bank share prices. The other question posed this week will be covered in due course.

Question 1. "Brisbane Construction Slowdown ahead. Yesterday on the way home, it looked weird as we drove past two large blocks of newly completed unit blocks, which were obviously vacant. Last year more than 5000 apartment units were completed within 5klm of the city centre, plus a more than 10,000 new apartments are due for completion by Mid-2018.Understandably, apartment vacancy rates increased substantially and this is expected to increase further in 18 months. The corporate body expenses in these blocks can be very high, so vacant units are an investment nightmare (unless you actually want to make a loss). New Brisbane residential construction approvals are also dropping alarmingly, so there appears to be lag between the economy and the construction activity with the construction now feeling the negative effects as it coincides with the low economy. However, nobody anywhere is comparing the reported increase against the actual total – is it only 0.1% increase in units or is it much higher?

Questions:

1. How will this affect the bank profits and share prices?

a. What might the realistic % figures be later this year and early next year?

b. Are these Brisbane numbers the same for other major cities?

c. If so what is the national picture?

2. Whilst 2017 & 2018 are generally predicted as being recovery years for resources and other export market sectors

a. Do you see a change in the relative investment sector popularity?

3. Australia has for a long time been a one-trick (resources) country. Another driver is domestic construction.

a. If both of these are languishing, what do we keep pace against the world economy?

b. Are the predicted 60 cent AUD/USD values actually likely to come true?

c. How can your MM customers turn that into increased trading profit?”

Good morning Phil, this is certainly one of the more in depth questions we’ve had, no doubt a challenge to answer in a timely and interesting way this morning.

In short, we think that excess supply of residential units in the coming years is a very well flagged issue for Australia. From the regular updates provided by the banks and the property companies themselves that we attend, they are very cognisant of this trend and they’re preparing for it – it’s not new news therefore we doubt it will be as calamitous as many forecast, especially considering the looming slowdown in construction activity that you correctly mention. Unfortunately many Australians forget that property investing is a risk just like with any other market and that prices do not always just go up e.g. Property prices in London fell 50% in 1988 and took 10 years to recover to their previous level - it's not just WA and the Gold Coast where prices of property go up and down!

So let's assume that the current "drift" in unit prices / income does continue in Brisbane and to a lesser degree in Melbourne, the appetite in Sydney may buffer much of a pullback although this comment probably has some degree of bias in it, given we own property in Sydney. The overarching theme here, is that the cost of capital has a big bearing on the value of the underlying asset, given that a buyer can afford to pay more. As the cost of capital goes up, which is will, the value of the asset should come down all else being equal.

The other element to consider is leverage. Investors who are too heavily geared and cannot withstand interest rates rising say 3% and rents falling 20% may have an uncomfortable few years. When people ask us the most important rule (s) for investing / trading stocks one of the first things we say is remain flexible and this applies to all investing, you never want to a be a forced seller. Warren Buffett's concern around leverage is clear within one of his most famous quotes......many property investors are geared ~ 10 to 20 times. "I've seen more people fail because of liquor and leverage -- leverage being borrowed money. You really don't need leverage in this world much. If you're smart, you're going to make a lot of money without borrowing." Warren Buffett.

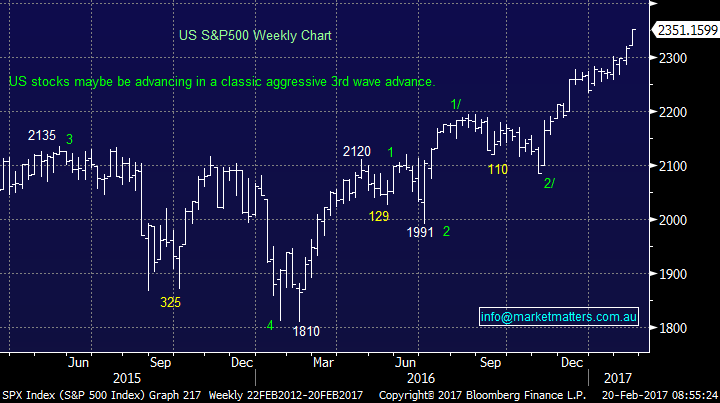

It should also be remembered that banks have significant "fat" built into their loans given the reduction in high LVR loans in recent years. A chart from Mortgage Insurer Genworth (GMA) is their recent results highlights this. The 60-80% LVR is clearly the biggest cohort however the proportion of loans with an LVR <60% is rising.

Source; Genworth

So, while we believe that bank's bad debts will increase from current extremely low levels, banks have been very active in tightening credit criteria (at the request of regulators) and that has put pressure on loan growth. That is theme that will likely persist especially if prices wobble / fall this year and beyond, however the financial impost of this will likely be offset by better margins for banks as interest rates rise. (we’ve seen banks increase rates out of cycle to help margins and offset weak loan growth)

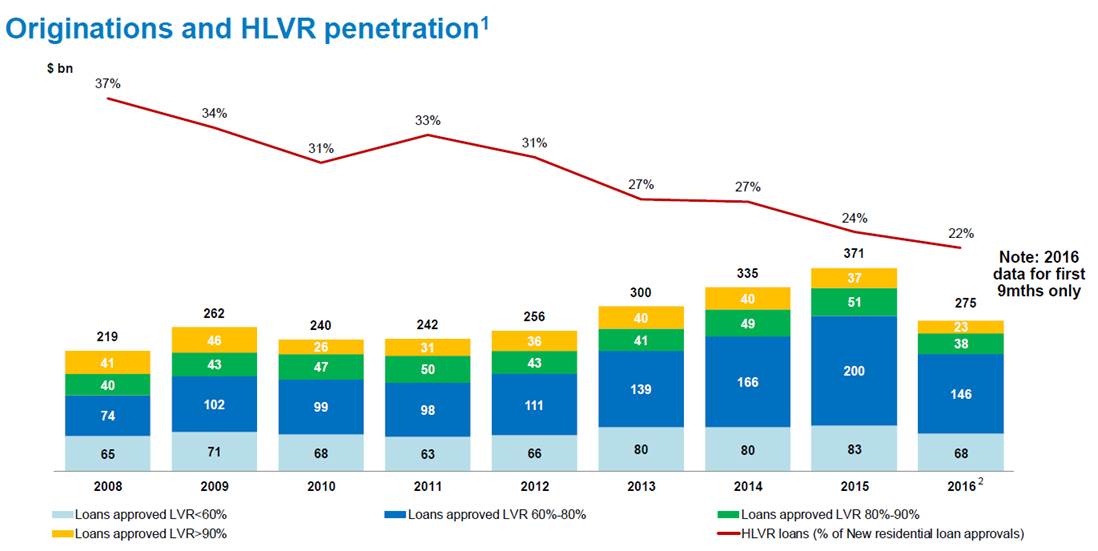

Note if property falls badly the worst positioned bank is Bendigo Bank (BEN) while CBA is likely to outperform due to its big and safe perception. Overall in simple terms we believe CBA will range trade for a few more years, and we should again be able an buy under $70 in coming years so hence do not be afraid to sell CBA ~$90.

AS51 Banking Index Monthly Chart

Moving on to questions 2 and 3, one of our concerns for our economy is the strong optimism that has returned with a vengeance to our resources sector, if China slows down or we see a global trade war for example this will vanish in a flash - investors must remain open-minded for 2017-9. If Donald Trump fails to deliver as US President investors who are chasing resource stocks at the current levels, after their big rally, are likely to be big losers - note we are short Fortescue Metals (FMG) targeting a decent correction before mid-May.

Overall investors need to look at least 6-moinths in advance to enjoy the decent swings in markets hence the current wave of euphoria for the resources sector maybe rapidly becoming long in the tooth.

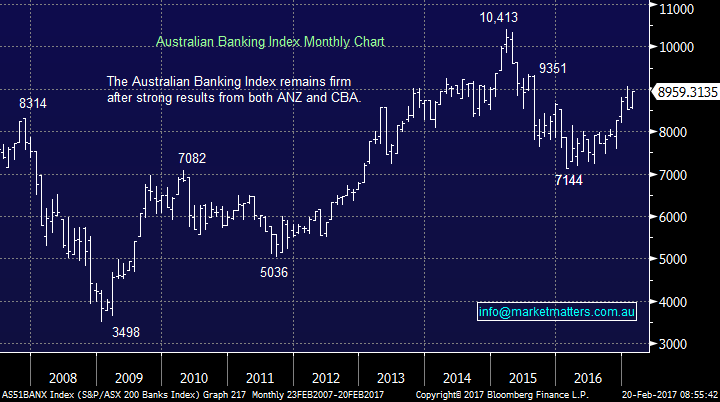

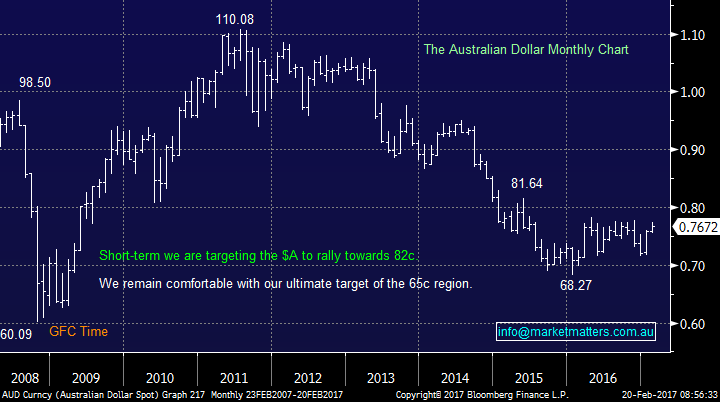

For the $A to fall towards 60c we are very likely to need this slowdown in China and we would note that our view that the $US heading towards tough times does contradict our thought that the $A will test 60c - a crowded view which also concerns us. The Australian economy is a tough one at present as our government fights with an increasing debt burden and concerns around losing our AAA rating BUT we must also find ways to be competitive on a global scale in areas other than just digging stuff out of the ground.

The Australian Dollar Monthly Chart

Conclusion

Probably the most important part of this comprehensive question is how do MM customers make money - be open-minded and later in the year be happy to hold one of the highest cash positions you have in years while probably holding a relatively large exposure to the gold sector, and be open to other investments that benefit from a fall in stock prices

Overnight Market Matters Wrap

- The US markets closed with little change overnight, ahead of their public holiday tonight – Presidents Day.

- The VIX (Volatility) index dissipated by 2.3%, while Iron Ore rallied 0.34%.

- BHP is expected to underperform the broader market, after closing an equivalent -1.49% in the US from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open slightly higher, above the 5,810 level this morning, with Wesfarmers (WES) trading ex-dividend today.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/02/2017. 9.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here